Best Income Stocks to Buy for February 22nd

Here are three stocks with buy rank and strong income characteristics for investors to consider today, February 22nd:

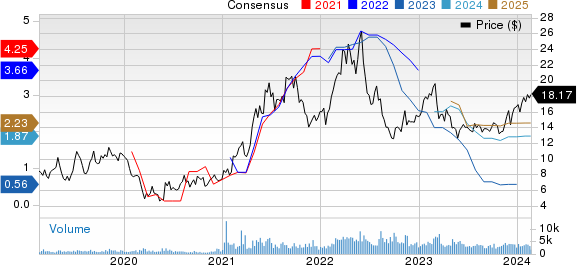

Artisan Partners Asset Management APAM: This investment management firm which is focused on providing high-value added, active investment strategies to clients globally, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 12.0% over the last 60 days.

Artisan Partners Asset Management Inc. Price and Consensus

Artisan Partners Asset Management Inc. price-consensus-chart | Artisan Partners Asset Management Inc. Quote

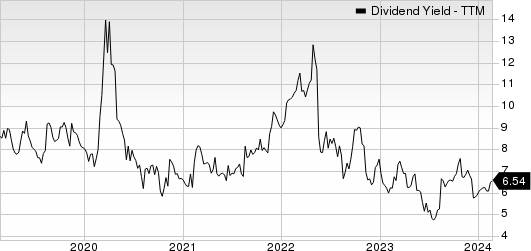

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 6.5%, compared with the industry average of 3.1%.

Artisan Partners Asset Management Inc. Dividend Yield (TTM)

Artisan Partners Asset Management Inc. dividend-yield-ttm | Artisan Partners Asset Management Inc. Quote

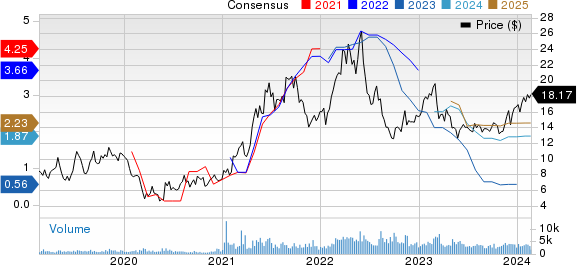

Genco Shipping & Trading Limited GNK: This ship owning company which, transport iron ore, coal, grain, steel products and other drybulk cargoes along shipping routes, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 8.9% over the last 60 days.

Genco Shipping & Trading Limited Price and Consensus

Genco Shipping & Trading Limited price-consensus-chart | Genco Shipping & Trading Limited Quote

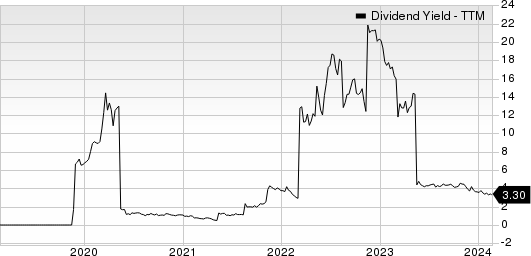

This Zacks Rank #1 company has a dividend yield of 3.3%, compared with the industry average of 2.0%.

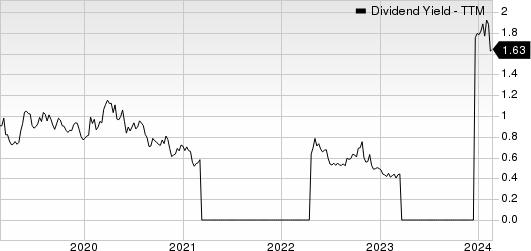

Genco Shipping & Trading Limited Dividend Yield (TTM)

Genco Shipping & Trading Limited dividend-yield-ttm | Genco Shipping & Trading Limited Quote

H World Group Limited Sponsored ADR HTHT: This company which, is involved in hotel industry, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 1.7% over the last 60 days.

H World Group Limited Sponsored ADR Price and Consensus

H World Group Limited Sponsored ADR price-consensus-chart | H World Group Limited Sponsored ADR Quote

This Zacks Rank #1 company has a dividend yield of 1.6%, compared with the industry average of 0.2%.

H World Group Limited Sponsored ADR Dividend Yield (TTM)

H World Group Limited Sponsored ADR dividend-yield-ttm | H World Group Limited Sponsored ADR Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genco Shipping & Trading Limited (GNK) : Free Stock Analysis Report

H World Group Limited Sponsored ADR (HTHT) : Free Stock Analysis Report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report