Best Income Stocks to Buy for October 18th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, October 18th:

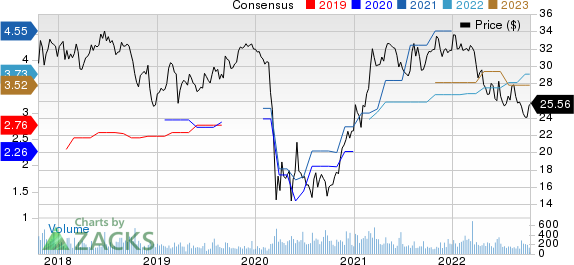

Sociedad Quimica y Minera SQM: This company which produces and distributes specialty plant nutrients, iodine and its derivatives, lithium and its derivatives, potassium chloride and sulphate, industrial chemicals, and other products and services in over 60 countries throughout the world, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 2.1% over the last 60 days.

Sociedad Quimica y Minera S.A. Price and Consensus

Sociedad Quimica y Minera S.A. price-consensus-chart | Sociedad Quimica y Minera S.A. Quote

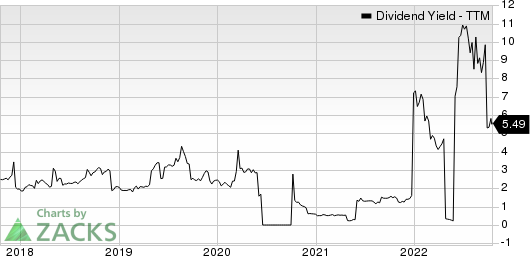

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 5.49%, compared with the industry average of 2.10%.

Sociedad Quimica y Minera S.A. Dividend Yield (TTM)

Sociedad Quimica y Minera S.A. dividend-yield-ttm | Sociedad Quimica y Minera S.A. Quote

Financial Institutions FISI: This bank holding company which provide a wide range of consumer and commercial banking services and products to individuals, municipalities and small and medium size businesses, including agribusiness, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 4.5% over the last 60 days.

Financial Institutions, Inc. Price and Consensus

Financial Institutions, Inc. price-consensus-chart | Financial Institutions, Inc. Quote

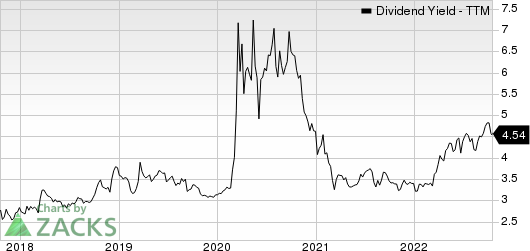

This Zacks Rank #1 company has a dividend yield of 4.54%, compared with the industry average of 2.58%.

Financial Institutions, Inc. Dividend Yield (TTM)

Financial Institutions, Inc. dividend-yield-ttm | Financial Institutions, Inc. Quote

Hanmi Financial HAFC: This leading banks providing services to the multi-ethnic communities of Southern California with full service offices, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.0% over the last 60 days.

Hanmi Financial Corporation Price and Consensus

Hanmi Financial Corporation price-consensus-chart | Hanmi Financial Corporation Quote

This Zacks Rank #1 company has a dividend yield of 3.90%, compared with the industry average of 2.67%.

Hanmi Financial Corporation Dividend Yield (TTM)

Hanmi Financial Corporation dividend-yield-ttm | Hanmi Financial Corporation Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Financial Institutions, Inc. (FISI) : Free Stock Analysis Report

Hanmi Financial Corporation (HAFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance