The best investments you can make right now

Let’s cast our minds back; just for a minute.

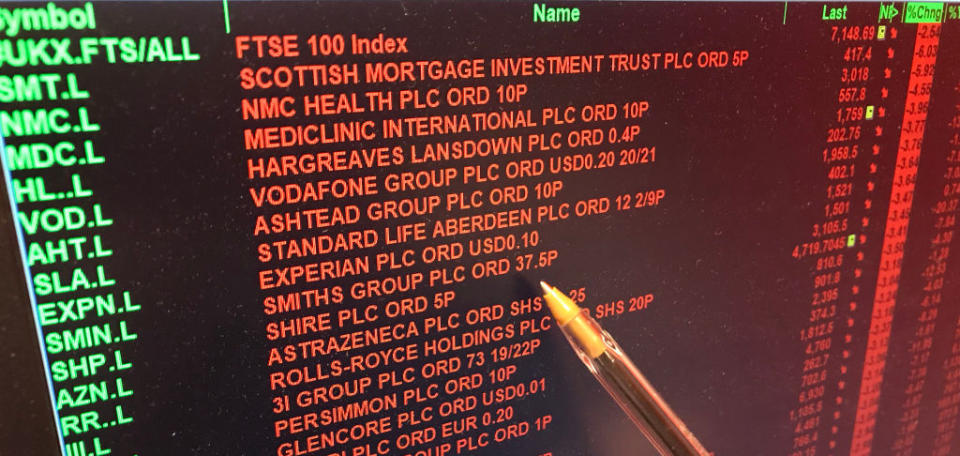

Long ago – well, in 2017, but a lot has happened since then already – the FTSE 100 superficially performed rather anaemically (+7.6% for the year) when compared to many other global indices, especially the three main US indices (DJIA +25%, NASDAQ +28%) with the Hang Seng up there and the NIKKEI (+19%) not that far behind.

There are many market observers that attach part of the disappointing performance to the uncertainties that prevailed over Brexit. I don’t really subscribe to that theory.

The FTSE 100 made much of its main gain, you will recall, following the sell-off on 24 June 2016 post the Referendum result – up 16.5% for the last 6 months of 2016. Frankly, London’s leading index has been a foreign exchange play. The Pound fell from $1.50 to $1.25 in a heartbeat. This provided a real fillip for Dollar related earnings – about 60% of the constituent FTSE 100 stocks. The Pound then made quite a measurable correction in 2017 – hence the underperformance of the FTSE.

As we all know, the FTSE 100 is not a barometer of the UK economy.

The correction arrives

With all the main indices breaking records in recent times, some with considerable comfort, unsurprisingly many of the P/E ratios became extremely frothy. A market correction was inevitable, with inflation assuming the role of standard bearer. Consequently, visceral attacks by programme traders, vagabonds and those who just wanted to take some risk off the table, felt like a tsunami right across the spectrum – breathtakingly exaggerated by algorithm trading.

Most of the main indices lost between 6.5% and 8% between 26 January 2018 and the opening on 12 February 2018. The recovery since then has varied but about 2.5%-3.5% of value has been reclaimed. Is the ‘shake-out’ all over? – it’s too early to say.

However, the earnings season has had a positive hue to it and the economic fundamentals have not changed for global growth. However, sad to relate, there is not necessarily a correlation between macro-economics and stock market performances.

Few would argue the toss that growth in the UK will emanate from small and medium sized enterprises. So, it is hardly surprising that investors will be enthusiastically looking for growth companies to invest in. There are also the imponderables surrounding BREXIT, which could persuade investors to curb their love affair with large companies devoted to trading with the EU, especially when a dangerous foreign exchange connotation is in the mix of an investment decision.

So where’s the value right now?

Enter stage left – the FTSE 250 and AIM – where it is reasonable to think the UK’s future could be very much dependent on. The FTSE 250 lost 6.8% of its value from 26 January 2018 as against FTSE 100 easing by 4.7%. Notwithstanding that anomaly, the FTSE 250 reached a record level last year and its value increased by 14.6% in 2017 – all but double FTSE 100’s achievement, excluding the foreign exchange element.

Everyone has their own ideas as to what represents value and what offers hope. It is always as well to remember that FTSE 250 and even more so AIM stocks tend not to enjoy the same level of liquidity, without the attraction and support of tracker funds; so the shareholder register is unlikely to have the same depth as larger cap companies. So as a broad rule of thumb, when markets turn bearish, investors tend to vent their spleens rather more vituperatively with smaller stocks suffering more than with larger stocks.

However, even though the prophets of doom wring their hands with fear over Brexit, the UK still has very innovative thinkers and developers in the world of technology and health. So, it’s not necessarily a question of taking advice from research departments and this is now harder to get information since the advent of Mifid2, it is just as much a case of common sense.

My old colleagues at Panmure Gordon have always had belief in Loop Up, a technological conference call and on-line meetings operation which went public just over a year ago. The share price has risen from circa 130p to 325p.

The market’s view on this company remains positive. Maxcyte, a US cell-based medicine developer, which went public in London on AIM in March 2016 courtesy of Panmure is also, I am told, one to watch out for. In the past year progress has been measured – shares up from 220-245p – However, what an exciting prospect!

It is unusual for investors to have a food company amongst its preferred investments.

Such is the case for Hilton Foods – a Huntingdon meat packing business exporting to Europe and the antipodes – popular with many stock market acolytes. Again, shares have been buoyant – up from 650 a year ago to 830p.

Finally, I was talking to a long-standing supporter of RPC Group, one of Europe’s largest plastic packaging groups. The share price has doubled in 5 years but in the past year it has dropped from 900p to 835p due to the fact many people believe the company has been too acquisitive. These acquisitions have, I am told, been digested.

Of the new challenger banks, Aldermore is much fancied by many analysts as a progressive operator. Given a fair wind there are many companies from these indices worthy of closer scrutiny.

Disclaimer: The content on this page does not constitute financial advice and is provided for general information purposes only. Nothing on this page should be regarded as an offer to conduct investment business or to buy/sell any investment.

Yahoo Finance

Yahoo Finance