Best LSE Dividend Paying Companies

Aggreko is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. If you’re a long term investor, these high-performing top dividend stocks can boost your monthly portfolio income.

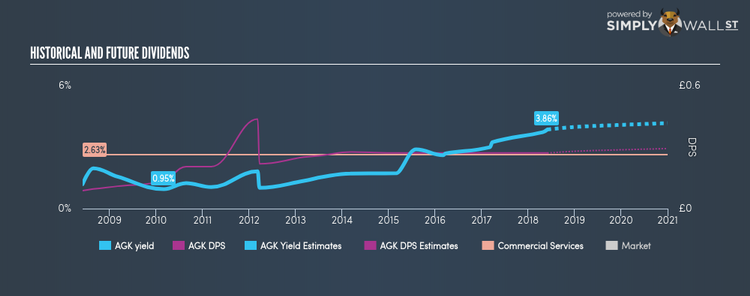

Aggreko Plc (LSE:AGK)

Aggreko Plc supplies modular, mobile power, heating, cooling, and related services worldwide. Established in 1962, and now led by CEO Chris Weston, the company now has 5,753 employees and with the company’s market capitalisation at GBP £1.83B, we can put it in the small-cap stocks category.

AGK has a wholesome dividend yield of 3.86% and is paying out 65.24% of profits as dividends . AGK’s DPS have risen to UK£0.27 from UK£0.087 over a 10 year period. They have been consistent too, not missing a payment during this 10 year period. More detail on Aggreko here.

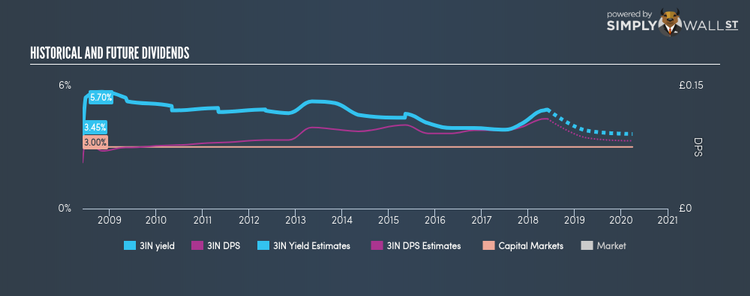

3i Infrastructure plc (LSE:3IN)

3i Infrastructure plc is an investment firm specializing in infrastructure investments. The company was established in 2007 and with the market cap of GBP £1.84B, it falls under the small-cap stocks category.

3IN has a substantial dividend yield of 4.83% and is currently distributing 19.04% of profits to shareholders , with analysts expecting a 57.70% payout in the next three years. While there’s been some level of instability in the yield, 3IN has overall increased DPS over a 10 year period from UK£0.056 to UK£0.11. The company recorded earnings growth of 227.82% in the past year, comparing favorably with the gb capital markets industry average of 31.93%. More on 3i Infrastructure here.

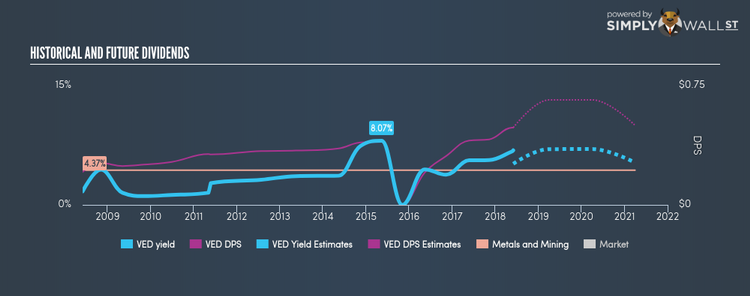

Vedanta Resources plc (LSE:VED)

Vedanta Resources plc operates as a diversified natural resources company in India, Zambia, South Africa, Namibia, the United Arab Emirates, Ireland, Australia, and Liberia. Founded in 1976, and headed by CEO Kuldip Kaura, the company currently employs 25,035 people and has a market cap of GBP £2.03B, putting it in the mid-cap category.

VED has a substantial dividend yield of 6.86% and is paying out 76.62% of profits as dividends . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from US$0.21 to US$0.49. More detail on Vedanta Resources here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance