Best LSE Dividend Picks For The Day

Devro is one of the companies that can help improve your portfolio income through large dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

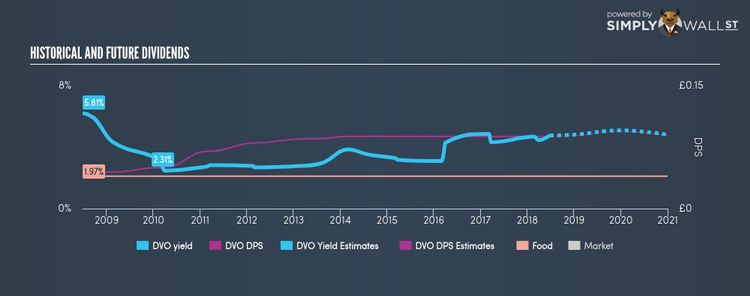

Devro plc (LSE:DVO)

Devro plc, together with its subsidiaries, manufactures and supplies collagen casings in the Americas, Europe, and the Asia-Pacific. Formed in 1991, and run by CEO Rutger Helbing, the company employs 2,166 people and with the stock’s market cap sitting at GBP £329.43M, it comes under the small-cap stocks category.

DVO has an appealing dividend yield of 4.46% and is currently distributing 94.18% of profits to shareholders . DVO has increased its dividend from UK£0.044 to UK£0.088 over the past 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Devro’s future earnings growth looks strong, with analysts expecting 83.70% EPS growth in the next three years. More detail on Devro here.

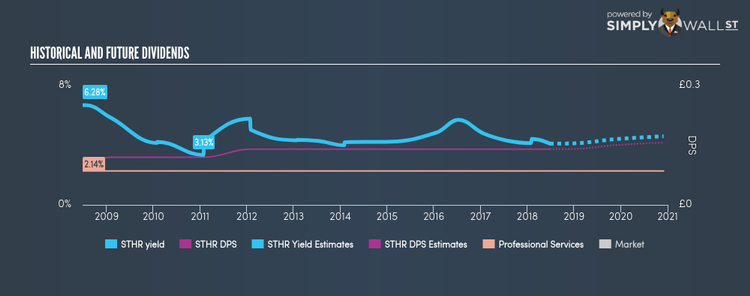

SThree plc (LSE:STHR)

SThree plc provides recruitment services for science, technology, engineering, and mathematics industries. Established in 1986, and currently run by Gary Elden, the company now has 2,866 employees and with the company’s market capitalisation at GBP £456.60M, we can put it in the small-cap group.

STHR has a solid dividend yield of 3.85% and is distributing 65.17% of earnings as dividends . Over the past 10 years, STHR has increased its dividends from UK£0.093 to UK£0.14. It should comfort existing and potential future shareholders to know that STHR hasn’t missed a payment during this time. Analysts are enthusiastic about the company’s future growth, estimating a 79.81% earnings per share increase in the next three years. More detail on SThree here.

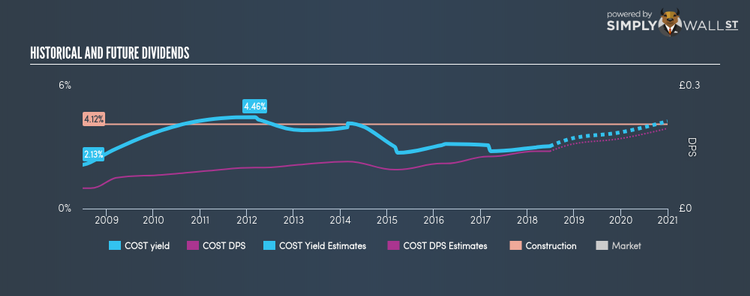

Costain Group PLC (LSE:COST)

Costain Group PLC provides engineering solutions for various energy, water, and transportation infrastructures in the United Kingdom, Spain, and internationally. Established in 1865, and now run by Andrew Wyllie, the company now has 4,008 employees and with the company’s market cap sitting at GBP £488.41M, it falls under the small-cap group.

COST has a good-sized dividend yield of 3.05% and their payout ratio stands at 44.96% , with analysts expecting a 45.93% payout in the next three years. COST has increased its dividend from UK£0.05 to UK£0.14 over the past 10 years. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. More detail on Costain Group here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance