Best NasdaqGS Growth Companies

Most investors find it challenging to find companies with prospective double-digit growth rates that are also financially robust. These hidden gems also add meaningful upside to a portfolio, should the companies meet expectations. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

Triumph Bancorp, Inc. (NASDAQ:TBK)

Triumph Bancorp, Inc. operates as a financial holding company for TBK Bank, SSB that provides banking and commercial finance products and services to retail customers and small-to-mid-sized businesses in the United States. The company size now stands at 820 people and with the stock’s market cap sitting at USD $1.03B, it comes under the small-cap stocks category.

Thinking of investing in TBK? Take a look at its other fundamentals here.

National Commerce Corporation (NASDAQ:NCOM)

National Commerce Corporation operates as the bank holding company for National Bank of Commerce that provides various financial services to businesses, business owners, and professionals. Started in 2004, and headed by CEO Richard Murray, the company employs 433 people and with the company’s market cap sitting at USD $792.55M, it falls under the small-cap category.

Interested to learn more about NCOM? Take a look at its other fundamentals here.

Celsion Corporation (NASDAQ:CLSN)

Celsion Corporation, a development stage oncology drug company, focuses on the development and commercialization of directed chemotherapy, DNA-mediated immunotherapy, and RNA based therapy products for the treatment of cancer. Formed in 1982, and run by CEO Michael Tardugno, the company now has 21 employees and with the stock’s market cap sitting at USD $43.95M, it comes under the small-cap category.

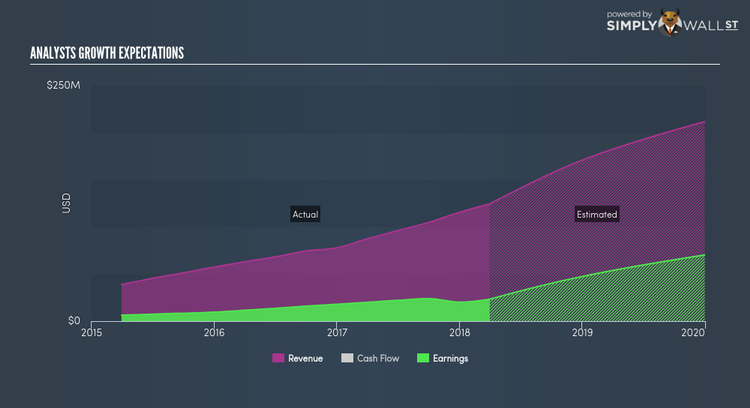

CLSN’s forecasted bottom line growth is an optimistic double-digit 40.07%, driven by underlying sales, which is expected to more than double, over the next few years. It appears that CLSN’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. CLSN ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Thinking of investing in CLSN? Take a look at its other fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance