Best Value Stocks to Buy for May 10th

Here are two stocks with buy rank and strong value characteristics for investors to consider today, May 10th:

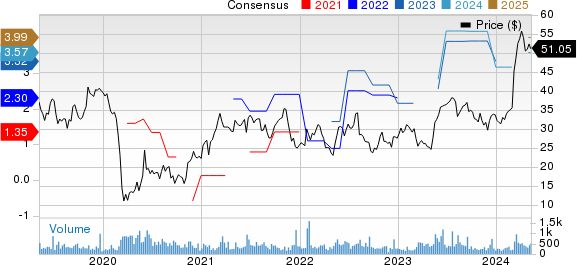

DXP Enterprises DXPE: This company which is a leading products and service distributor that adds value and total cost savings solutions to industrial customers throughout the United States, Canada, Mexico and Dubai, carries a Zacks Rank #1(Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13% over the last 60 days.

DXP Enterprises, Inc. Price and Consensus

DXP Enterprises, Inc. price-consensus-chart | DXP Enterprises, Inc. Quote

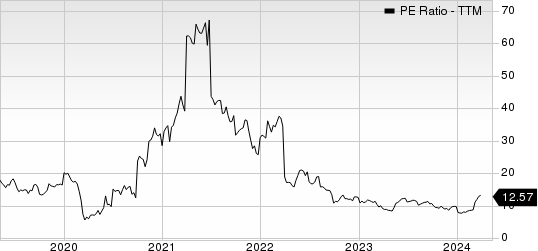

DXP Enterprises has a price-to-earnings ratio (P/E) of 14.30 compared with 17.50 for the industry. The company possesses a Value Score of A.

DXP Enterprises, Inc. PE Ratio (TTM)

DXP Enterprises, Inc. pe-ratio-ttm | DXP Enterprises, Inc. Quote

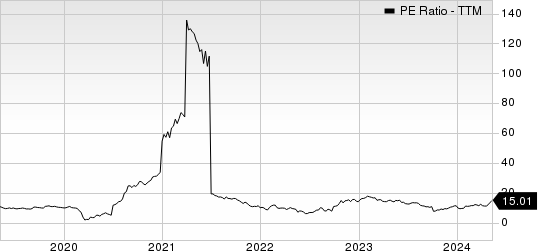

Brinker International EAT: This company which owns, operates, develops and franchises various restaurants, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6% over the last 60 days.

Brinker International, Inc. Price and Consensus

Brinker International, Inc. price-consensus-chart | Brinker International, Inc. Quote

Brinker International has a price-to-earnings ratio (P/E) of 14.97 compared with 40.70 for industry. The company possesses a Value Score of A.

Brinker International, Inc. PE Ratio (TTM)

Brinker International, Inc. pe-ratio-ttm | Brinker International, Inc. Quote

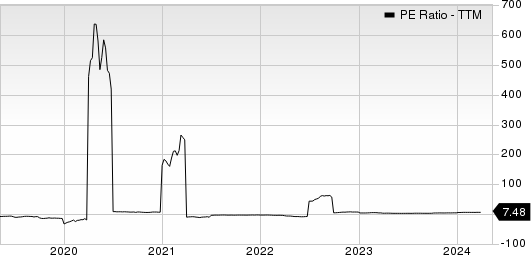

Ardmore Shipping ASC: This company which provides seaborne transportation of petroleum products and chemicals worldwide to oil majors, national oil companies, oil and chemical traders, and chemical companies, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 14.2% over the last 60 days.

Ardmore Shipping Corporation Price and Consensus

Ardmore Shipping Corporation price-consensus-chart | Ardmore Shipping Corporation Quote

Ardmore Shipping has a price-to-earnings ratio (P/E) of 6.88 compared with 12.30 for industry. The company possesses a Value Score of B.

Ardmore Shipping Corporation PE Ratio (TTM)

Ardmore Shipping Corporation pe-ratio-ttm | Ardmore Shipping Corporation Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

DXP Enterprises, Inc. (DXPE) : Free Stock Analysis Report

Ardmore Shipping Corporation (ASC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance