Best Value Stocks to Buy for May 24th

Here are three stocks with buy rank and strong value characteristics for investors to consider today, May 24th:

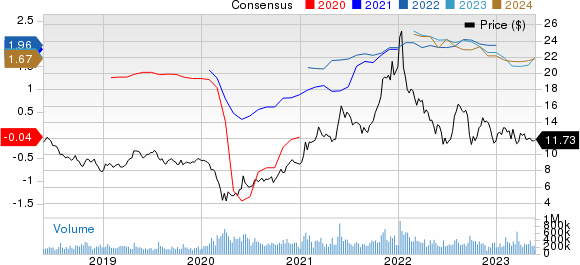

Global Ship Lease GSL: This rapidly growing containership company which owns and charters out containerships under long-term, fixed rate charters to world class container liner companies, carries a Zacks Rank #1 (Strong Buy), and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 4.2% over the last 60 days.

Global Ship Lease, Inc. Price and Consensus

Global Ship Lease, Inc. price-consensus-chart | Global Ship Lease, Inc. Quote

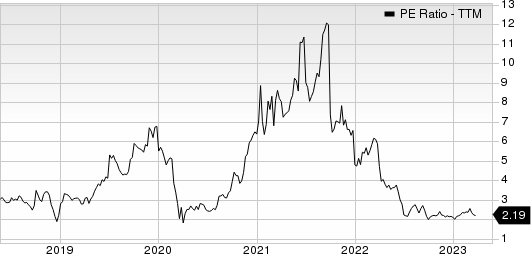

Global Ship Lease has a price-to-earnings ratio (P/E) of 2.05 compared with 2.50 for the industry. The company possesses a Value Score of A.

Global Ship Lease, Inc. PE Ratio (TTM)

Global Ship Lease, Inc. pe-ratio-ttm | Global Ship Lease, Inc. Quote

Ford Motor F: This leading automaker which manufactures, markets and services cars, trucks, sport utility vehicles, electrified vehicles, and Lincoln luxury vehicles, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.3% over the last 60 days.

Ford Motor Company Price and Consensus

Ford Motor Company price-consensus-chart | Ford Motor Company Quote

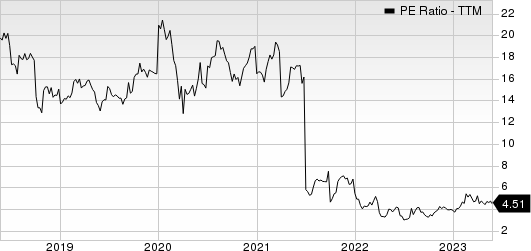

Crescent Point Energy has a price-to-earnings ratio (P/E) of 6.89 compared with 7.60 for the industry. The company possesses a Value Score of A.

Ford Motor Company PE Ratio (TTM)

Ford Motor Company pe-ratio-ttm | Ford Motor Company Quote

Encore Wire WIRE: This company which is a low-cost manufacturer of copper electrical building wire and cable, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 15.6% over the last 60 days.

Encore Wire Corporation Price and Consensus

Encore Wire Corporation price-consensus-chart | Encore Wire Corporation Quote

Encore Wire has a price-to-earnings ratio (P/E) of 7.01 compared with 8.90 for the industry. The company possesses a Value Score of A.

Encore Wire Corporation PE Ratio (TTM)

Encore Wire Corporation pe-ratio-ttm | Encore Wire Corporation Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ford Motor Company (F) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

Global Ship Lease, Inc. (GSL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance