The best (and worst) performing international stock markets of 2018

Some of the best performing stock markets in 2018 were in places you might least expect: Russia, Saudi Arabia, Qatar and Brazil.

As US markets plunged deep into the red at the end of the year and many benchmark Asian and European indices endured bruising losses, a range of emerging markets held onto their gains.

Here’s a selection of the top performers:

Russia

Russia’s benchmark MOEX index (IMOEX.ME) – previously called the MICEX index – rallied by about 12% in 2018 following years of sanctions-induced setbacks.

Oil giant Lukoil (LKOH.ME), the largest constituent in the index, saw shares surge by roughly 50% over the year. Gazprom (GAZP.ME), another powerful constituent, rallied by about 18%.

The Russian index was supported by broad gains in various commodities, even though oil prices were weak at the end of the year, said Bruno Pannetier, chief investment officer at Old Park Capital.

“Overall, the Russian market has been a good performer compared to Western markets,” he said.

Saudi Arabia

Saudi Arabia’s Tadawul All-Share index (^TASI.SR) also posted gains of roughly 7% in 2018, but the rally wasn’t necessarily supported by a rush of international investors, said Naeem Aslam, chief market analyst at Think Markets UK.

“Disregard what happens in the Saudi market,” he told Yahoo Finance UK. “The market is completely supported by the fact that the government is trying to keep the market stabilised. That is just a plain fact. We haven’t seen any [foreign direct investment] into that country, any interest from international investors…. any inflows into ETFs.”

Qatar

Qatar’s main QE index (^GNRI.QA) also surged by nearly 21% this year, marking a comeback after the index had dropped by 18% in 2017 over a high-profile spat with its neighbours.

Saudi Arabia and its allies severed diplomatic and transport ties with the small Gulf nation in mid-2017 over the country’s alleged support of terrorism. Qatar has denied the accusations.

Qatar found workaround strategies and different trade routes after the incident, and shares in many Qatari companies have rebounded strongly.

The Qatar National Bank (QNBK.QA), for instance, saw shares surge by roughly 55% in the past year. The bank is the largest constituent in the QE index.

Brazil

Brazil’s Bovespa index (^BVSP) also saw a strong 12% run-up this year as the nation’s economic prospects improved and international investors pushed money back into stocks.

“The key message here … is that the Brazilian economy is recovering and will continue to do so next year,” said Andres Abadia, a senior economist at Pantheon Macroeconomics, in a research note.

The biggest losers

Key European and Asian stock markets experienced some of the worst selling of 2018. Tariffs and trade tensions have been blamed for spooking investors and leading to a more challenging business environment.

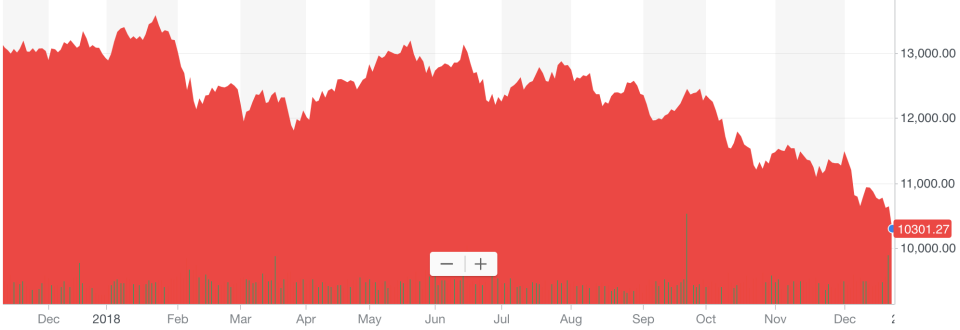

Germany’s benchmark Dax (^GDAXI) endured losses of roughly 20% as US-China trade tensions and tariffs slammed the country’s automakers and other global exporters.

The Greek ASE and Irish ISEQ endured even larger losses, with both indices down by about 25%.

In China, the all-important Shanghai Composite (000001.SS) dropped by 25%.

US stock markets also suffered, but the losses weren’t nearly as dramatic. The main indices were down by roughly 5% to 7% since the start of the year.

READ MORE: Yahoo Finance’s 2018 Company of the Year

READ MORE: The stock market’s buyers are out for the holidays

Yahoo Finance

Yahoo Finance