Better Buy: Take-Two Interactive vs. Ubisoft

The video game industry is red hot, and the leading companies in the space have been providing shareholders with fantastic returns in recent years. Activision Blizzard and Electronic Arts continue to battle it out for the top spot in the publishing space, but mid-size rivals Take-Two Interactive (NASDAQ: TTWO) and Ubisoft (NASDAQOTH: UBSFF) have been steadily growing and could offer investors greater growth potential thanks to their smaller sizes.

Both mid-size publishers trade near all-time highs and will be affected by many of the same market trends, but which is the better buy?

Company | Trailing P/E | Trailing P/S | Market Cap |

|---|---|---|---|

Take-Two Interactive | 61 | 6 | $11 billion |

Ubisoft | 72 | 6 | $8.4 billion |

Data source: Yahoo Finance.

Taking advantage of industry tailwinds

The June-ended quarter saw Ubisoft's digital sales increase 55% year over year while Take-Two's digital sales were up 56% over the stretch. Digital accounted for roughly 80% of Ubisoft's revenue compared to 64% for Take-Two, so the latter publisher seemingly has more room to benefit from the trend, but this difference is likely due to release schedules. Comparing each company's last full-year reports, digital accounted for 50% of Ubisoft's sales and 52% of Take-Two's -- suggesting that both publishers are looking at similar growth trajectories in digital sales.

Both companies also look to have similar opportunities in esports, mobile, and growing business in emerging markets like China and India. As such, neither company has a clear advantage when it comes to benefiting from the tailwinds that are lifting the industry.

Operations and balance sheets

While the two mid-size video game publishers have a good deal of similarities, there are some key differences in how their businesses are structured. Most notably, Take-Two had roughly 2,500 employees as of March 31, while France-based Ubisoft reported having nearly 12,000 workers.

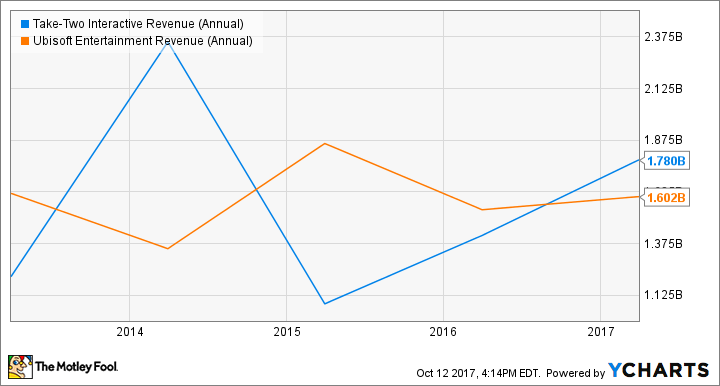

Some of Ubisoft's studios are located in markets where the cost of retaining employees is lower than in America, but this stark difference in headcount is reflected in each company's operating expenses. In its last fiscal year, Ubisoft's total operating expenses were roughly $1.1 billion, while Take-Two's came in at roughly $665 million. This difference is especially notable given that the two companies typically release close to the same number of titles on an annual basis and have generated comparable sales over the last five years.

The takeaway here is that, despite having a bigger market cap and trending toward producing more revenue, Take-Two looks to be running a smaller, tighter ship -- giving it a wider avenue for increasing earnings.

The upside for Ubisoft is that it benefits from tax subsidies that cut down on its workforce expenses and do a lot to smooth out earnings comparisons between the two companies. That said, these subsidies tend to be politically controversial and are not guaranteed over the long term, so it's a risk factor that should be kept in mind.

The company's balance sheets are another area where Take-Two has an advantage. The American-based publisher holds roughly $1.07 billion in cash and short-term investments with its debts backed out, while Ubisoft has roughly $75 million in net debt. Assuming its tax situation remains relatively consistent, Ubisoft's financial footing looks pretty sound and isn't a reason to avoid the stock on its own, but Take-Two has the edge here.

Franchise and studio strength

Success in the video game industry hinges on creating and sustaining big franchises. Take-Two and Ubisoft each own valuable intellectual properties and operate studios that have proven capable of consistently delivering high-quality titles.

Take-Two's Grand Theft Auto V is one of the most successful games ever, and it looks like the franchise will continue to be one of the gaming industry's defining properties. In addition to its most popular franchise, Take-Two also releases hits series including NBA 2K, WWE 2K, Red Dead Redemption, and Borderlands. It's worth noting that Take-Two's performance will be dramatically impacted if the next Grand Theft Auto game does not wind up being a massive hit and the company has not sufficiently built up its other properties.

Ubisoft doesn't have a franchise that's successful on the level of Grand Theft Auto, but that's also true of nearly every other of video game publisher. Between games under the Tom Clancy banner including Ghost Recon, Rainbow Six, and Splinter Cell and other big series like Assassin's Creed and Far Cry, Ubisoft's stable of viable properties is actually a bit deeper than Take-Two's. It's also had some recent success introducing new franchises.

A possible takeover for Ubisoft?

Another potential factor in choosing between the two games publishers is that Vivendi might attempt a hostile buyout of Ubisoft in the near future. Vivendi previously owned a substantial stake in Activision, and is viewed as trying to get back into the video game industry by purchasing the French publisher.

A takeover bid would likely have the effect of pushing Ubisoft's share price higher, but investing in a company with the hopes that it will be acquired can be a risky proposition, so I'll set aside the possibility of an acquisition for this comparison.

Take-Two takes the cake

Both publishers still have room for substantial growth, but Take-Two stock will be the better long-term investment. Its overall franchise portfolio is slightly stronger than Ubisoft's and I am more impressed with the output of Take-Two's studios. But the clinching factors are the company's business structure and balance sheet advantages. That's not to say that Ubisoft is a bad investment, but Take-Two looks to be the better buy.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Keith Noonan owns shares of Activision Blizzard and Take-Two Interactive. The Motley Fool owns shares of and recommends Activision Blizzard and Take-Two Interactive. The Motley Fool recommends Electronic Arts. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance