Better Buy: The Walt Disney Company vs. Nike

Two of the most iconic names on the stock market are The Walt Disney Company (NYSE: DIS) and Nike (NYSE: NKE), and they've both been huge winners for investors. Since the beginning of the century, they've generated 354% and 1,450% respectively for investors, more than doubling the S&P 500's total return.

Right now, both companies face challenges from new competitors, whether it's streaming competition for Disney, or upstart apparel brands and new distribution methods like online shopping for Nike. The company better positioned to weather the competition will be the better stock of these two, so let's look at how they stack up.

Image source: Getty Images.

By the numbers

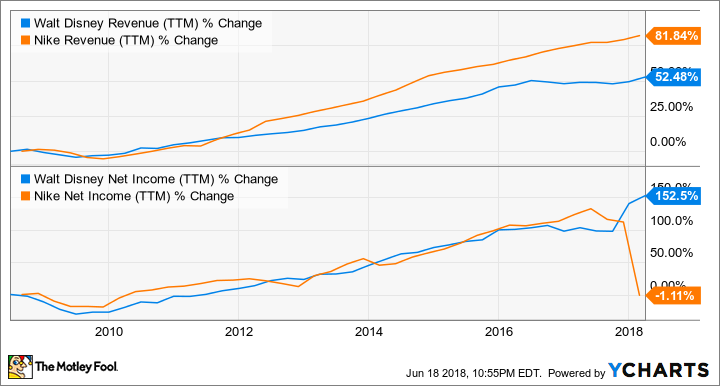

Over the past decade, Nike has beaten Disney on top-line growth. But net income grew at about the same rate until the most recent quarter, when the new tax law impacted short-term results.

DIS revenue data by YCharts. TTM = trailing 12 months.

This chart doesn't tell us anything about what these companies will do in the future, but I wanted to frame historical growth rates, which show that both companies have the ability to grow steadily long term. The more important factor for investors is strategy going forward and the value investors get from the stock today.

Disney faces disruptive competition

As big as Disney has become, it may not have built as effective a moat as investors once thought. ESPN is losing millions of subscribers per year to cord-cutting, Netflix has come to dominate the adjacent streaming business, and Disney is now in a bidding war with Comcast over Fox's media content. But amid all this, the company still has a solid foundation to build from in a digital future.

Disney arguably has the best media content assets in the world, notably in the Pixar, Marvel, and Lucasfilm studios. These assets, along with ESPN, will become the foundation of three streaming services Disney plans to have available in 2019. In the media business, content is king, and it's hard to argue that anyone has better content than Disney.

What competitors like Netflix can't match is Disney's multi-pronged business model. The company doesn't just make money from TV networks and studios. It has theme parks and consumer products as well. In the past year, these two divisions have generated $24.4 billion in revenue and $5.9 billion in operating income. That essentially gives you two times what Netflix makes in annual revenue above and beyond of the content business that's the core of Disney's long-term value.

Nike's brand continues to endure

For an apparel company like Nike, there's not the same tangible competitive advantage that Disney has in content, where a franchise can generate value for decades. Each apparel purchase is a distinct decision by consumers. That's why for Nike, brand is everything.

Nike has done a better job than most apparel brands staying relevant over the course of multiple decades. Since Michael Jordan made Nike a household name in the mid-1980s, the company has been able to grow into new markets and maintain a premium price point. According to Forbes, the brand alone is worth $29.6 billion.

Nike has built a durable competitive advantage by using its scale and financial muscle to attract the best athletes in the world through sponsorships. That's how the company signs big names like golf's Tiger Woods, USA Soccer's Alex Morgan, and NBA stars Kevin Durant and Michael Jordan. You can see below that it can simple outspend competitors in negotiations with stars if it wants to. And having stars wear your products will help fend off competition.

NKE Revenue (TTM) data by YCharts.

While Nike can maintain a strong position with scale, its size will also limit upside for investors. In the past two years, revenue is only up 1.6%. And future growth will be difficult to come by simply because the company is already so big, which is why investors shouldn't be paying growth-stock prices for Nike today.

Which is the better buy?

Disney may be facing a more disruptive threat from streaming competition, but I think the company is well positioned to withstand it, and potentially generate more value from streaming content than any other company in the world long term. Where I see the biggest difference in these two stocks is what investors have to pay, and right now Disney looks like the far better value.

DIS P/E Ratio (TTM) data by YCharts.

The chart above only shows P/E ratios to the end of 2017 because that's when net income went wild with adjustments from the tax law, but you can see that Disney has long traded at a discount to Nike.

It's the value and potential for long-term growth that has me picking Disney as the better stock between the two. The company has challenges, but with the best content in media and a plan to become a streaming giant, I think it's well positioned for success.

More From The Motley Fool

Travis Hoium owns shares of Walt Disney. The Motley Fool owns shares of and recommends Netflix, Nike, and Walt Disney. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance