There Are Better Options Than Boston Scientific

Boston Scientific Corp. (NYSE:BSX) was founded in 1979. With a market cap over $110 billion, it is one of the largest publicly traded medical device companies in the world.

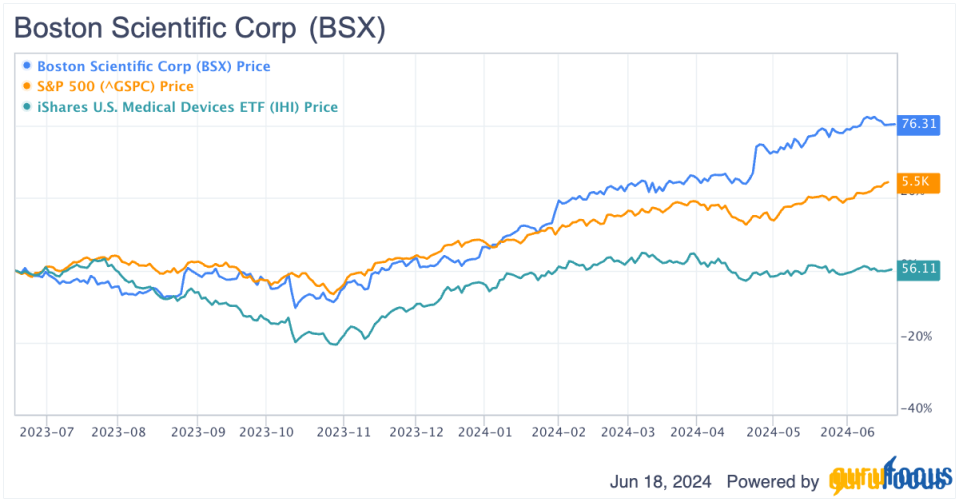

The stock has significantly outperformed its competitors and the overall market over the past year.

BSX Data by GuruFocus

Segment breakdown

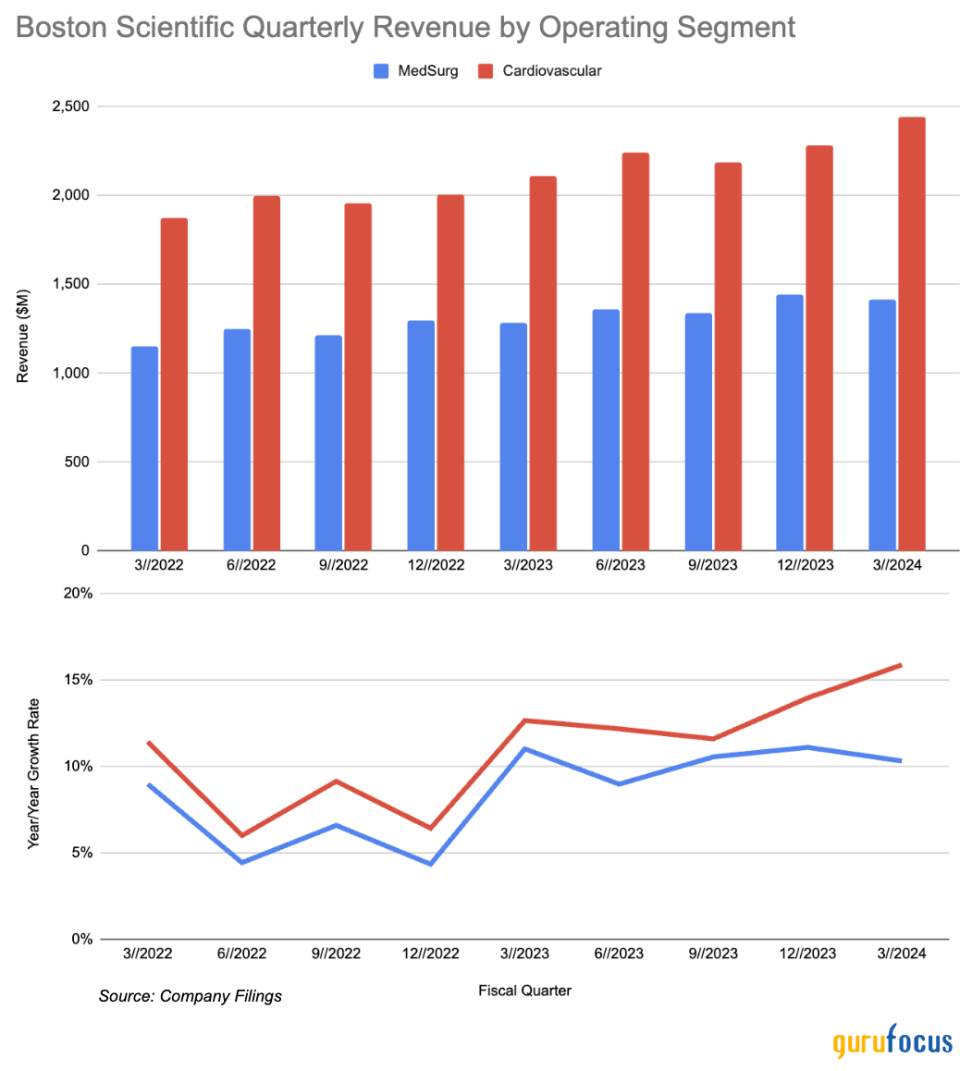

Boston Scientific operates in two segments: Cardiovascular and Medsurg.

Cardiovascular accounts for over 60% of the revenue and includes devices and treatments related to monitoring, diagnosing and treating issues related to the heart.

Medsurg accounts for the remaining 40% of revenue and includes devices and treatments related to digestion, urology and neurological disorders.

Quarterly revenue is up for both segments, though the growth rate in the Cardiovascular segment is outpacing Medsurg.

This is a great thing for Boston Scientific investors since the largest segment has the highest growth. But how will it fare going forward?

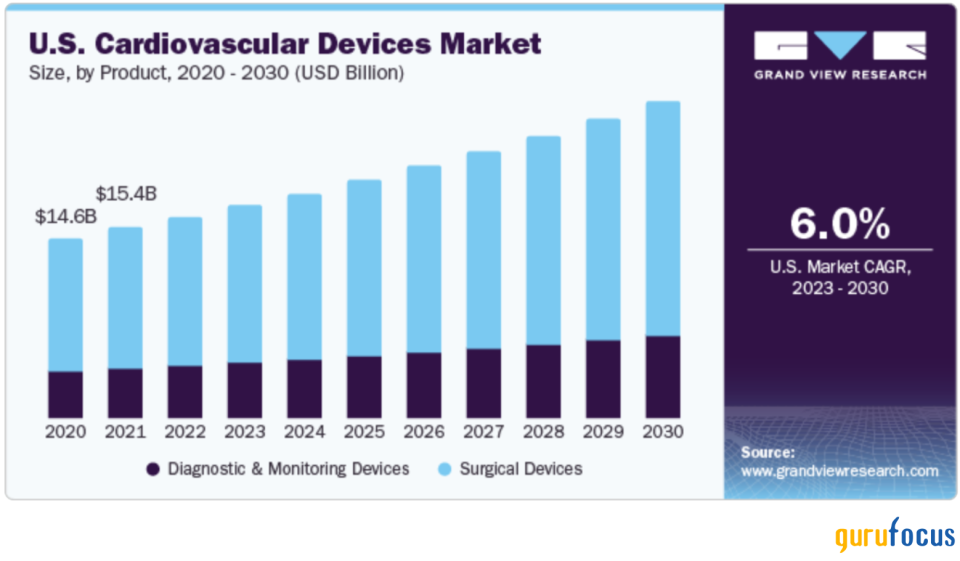

The cardiovascular market is only expected to grow about 6% moving forward, significantly less than Boston Scientific's overall recent growth.

If the company wants to maintain its elevated growth rate, it needs to be from taking share away from competitors. Fortunately, it is a smaller fish in a very large pond. Boston Scientific is big enough to be noticed, but has plenty of room to grow and steal some share from larger competitors.

Earnings and guidance have been fantastic

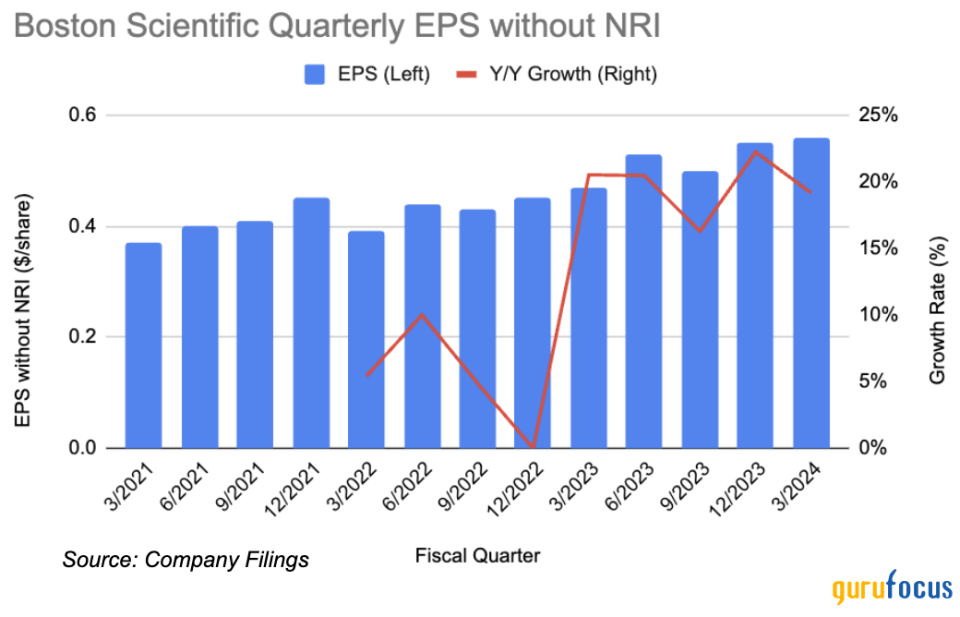

Boston Scientific turned it up a notch starting in March 2023 with earnings per share growing around 20% per year for each quarter.

Further, earnings per share figures have been consistently beating Wall Street analyst expectations for these quarters by about 8% on average.

Company guidance has also been improving. When Boston Scientific reported 2023 annual figures in January, it forecasted sales to grow around 9% and earnings to be near $2.25 per share for fiscal year 2024. Just three months later, the company increased its expected sales growth to 12% and earnings to nearly $2.31 when it released first-quarter 2024 results.

This updated guidance would yield 13% growth in 2024 earnings per share compared to 2023.

Wall Street analysts are optimistic for the future. The average price target is over $80, which is about 8% higher than current price levels.

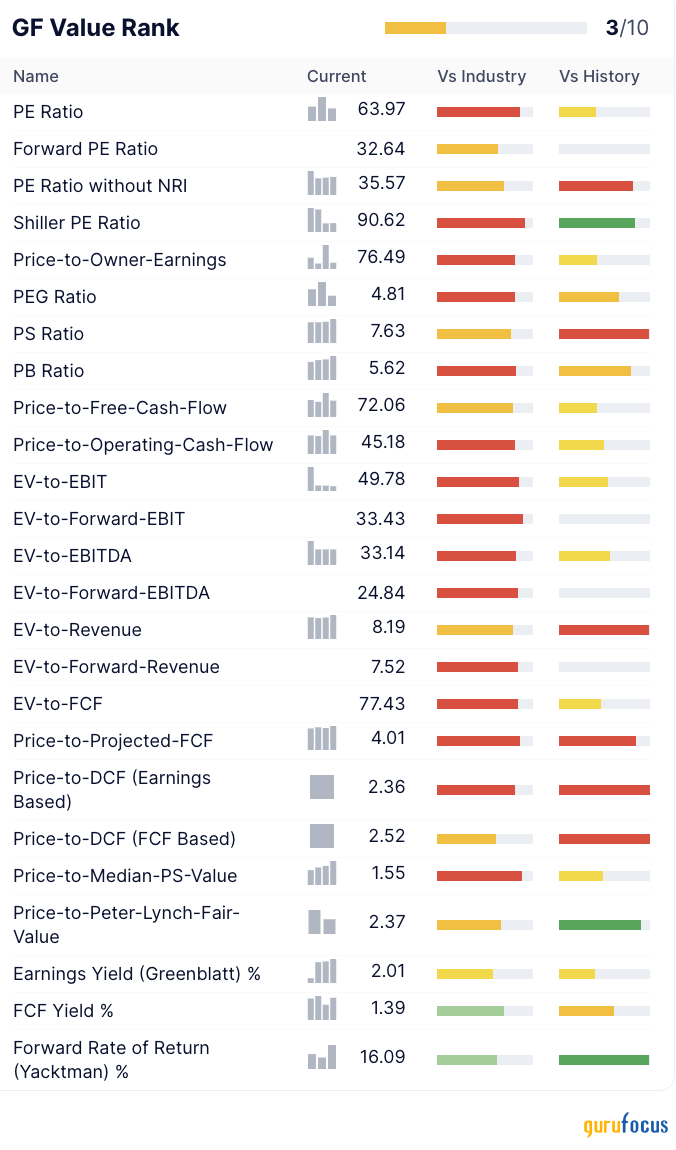

Valuation ratios are screaming overvalued

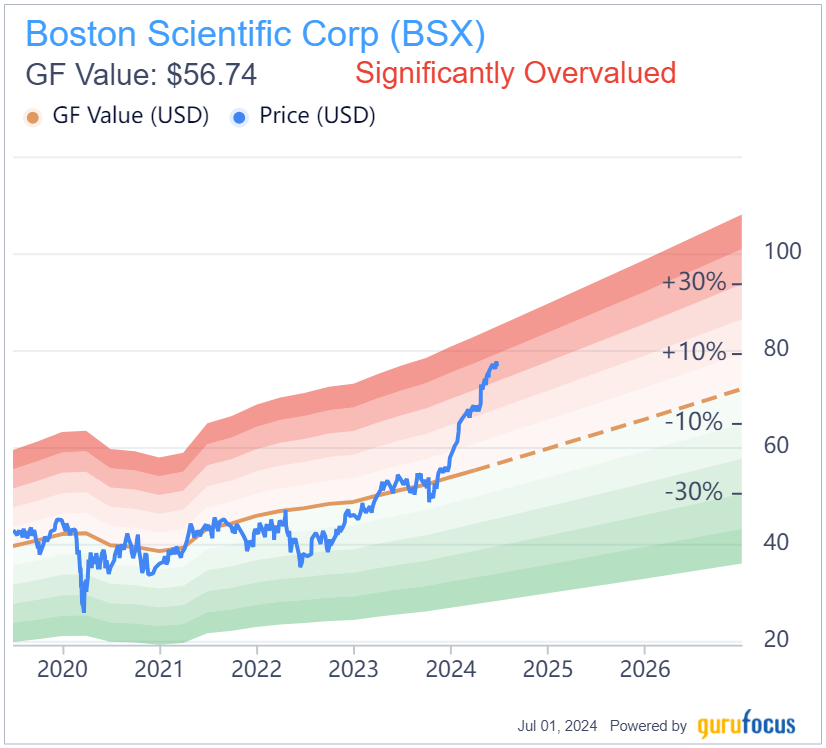

Unfortunately, the valuation ratios for Boston Scientific are raising many red flags. Speaking of red, here is the GF Value Rank section:

Let's discuss a few of these ratios in more detail.

First, the current price-earnings ratio, which is in the mid-60s, is high and above historical values. The price-earnings without nonrecurring items ratio is a lot lower in the mid-30s. Earnings per share without NRI is the company's EPS after removing non-recurring items and is a better measure of a company's true EPS.

For Boston Scientific, the non-recurring items are primarily amortization expenses, acquisition and divestment charges and restructuring expenses. Amortization expense is largely related to intangible assets. It is recurring, but not really considered operating, so it is removed from EPS without NRI.

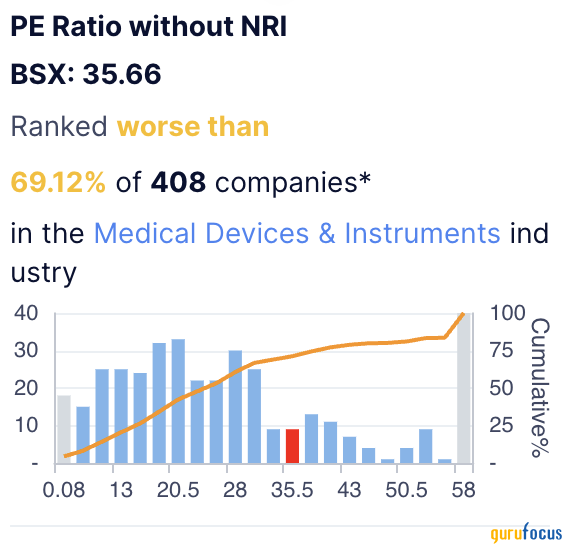

Last year, the price-earnings ratio without NRI was near 27, so current values are about 25% higher. Boston Scientific's ratio is also worse than its peers. Comparably, the multiple is higher than almost 70% of other medical device companies and 25% higher than the industry median.

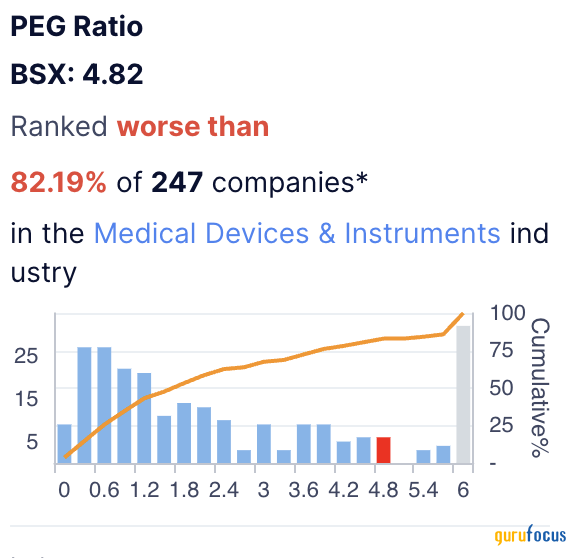

The PEG ratio is even worse. The major drawback to the price-earnings ratio is that it does not account for growth. This is where the PEG ratio can be more helpful because it divides the ratio by the expected long-term growth rate. For Boston Scientific, the PEG ratio is just below 5, which is really bad. Companies with PEG ratios above 2 are considered overvalued and Boston Scientific is more than double that.

Comparison to its peers does not help. Boston Scientific's PEG ratio is higher than 80% of its competitors and more than double the industry median of 1.97.

The GF Value for Boston Scientific is around $56, which is a lot lower than the current price and is thus designated as significantly overvalued.

There are better options in medical devices

The growth for Boston Scientific is definitely there, especially in the cardiovascular segment. However, I think the stock price has increased too much, especially relative to the competition, to make the stock a good investment.

Here is Boston Scientific's PEG ratio relative to some of its competitors:

Boston Scientific's PEG ratio is the highest in this comparison with a figure just below 5. Stryker Corp. (NYSE:SYK) is the only competitor with a similar PEG ratio near 4.50. Every other company is significantly lower with values near 2.

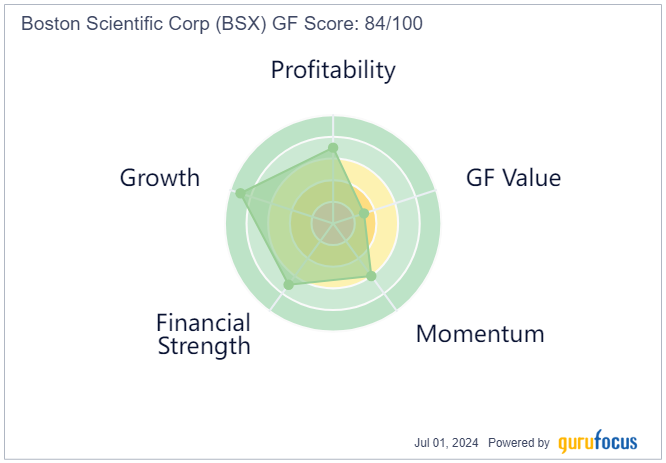

The GF Score for Boston Scientific looks high at 84 with a growth score of 9, but has a value score of only 3.

Other companies in the medical services industry have much better GF Scores. Stryker, which we just mentioned, has a higher GF score of 93. Abbott Laboratories (NYSE:ABT), a $200 billion market cap company in the medical devices industry, has a great score of 95. If you want to go smaller, Edwards Lifesciences Corp. (NYSE:EW) has a score of 98.

Overall, Boston Scientific is not a terrible investment. Management appears to have turned the company around in the last year, and the stock performance reflects that. However, I think the share price ran up too high in the past year and the stock is overvalued.

For investors interested in Boston Scientific, there are better opportunities elsewhere, especially within the medical device industry. If you already own some shares, I would significantly cut back your position (at least 50%) and move those gains somewhere else.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance