Better Renewable Stock to Buy: NextEra Energy vs. Xcel Energy

In 2019 -- or possibly even this year -- wind power will become America's top source of renewable energy power generation, and provide around 7% of the country's total electricity. The magnitude of that cannot be understated: It will be the first time since the late 1800s that hydroelectric power won't be the nation's most productive renewable energy source.

Many stakeholders and technologies have played a role in this changing of the guard, but two companies in particular made incredible contributions: NextEra Energy (NYSE: NEE) and Xcel Energy (NASDAQ: XEL). The pair of renewable utility holding companies ended 2017 with a combined 20.7 gigawatts of wind power in their generation mix. Throw in budding solar portfolios and their total renewable energy capacity tops 24 GW.

Their exemplary commitment to clean power over the years makes NextEra Energy and Xcel Energy two of the best renewable energy stocks on the market. Hefty dividends of around 3% help, too. But if investors could only own one, which renewable stock would be the better buy right now?

Image source: Getty Images.

By the numbers

NextEra Energy has invested tens of billions of dollars in renewable energy over the decades, and that's bought a whole lot of wind turbines and solar panels. In fact, the company owns 16% of installed wind capacity in the United States and 11% of the nation's installed solar capacity -- the largest shares of each. And it's not stopping there. By the end of 2018 it expects to add up to 4.1 GW of wind and 1.3 GW of solar, representing capacity growth of 29% and 50%, respectively.

The business got off to a great start this year thanks to steady growth from its two subsidiaries, the regulated utility Florida Power and Light and the competitive energy business NextEra Energy Resources. In the first quarter of 2018, NextEra Energy delivered adjusted EPS of $1.94, compared to $1.75 in the year-ago period. Management reiterated its full-year 2018 guidance, calling for adjusted EPS of $7.45 to $7.95 and longer-term expectations for that to grow 6% to 8% annually through 2021.

NEE Total Return Price data by YCharts

That would already rank among the best growth rates in the industry, and it's built on the continued expansion of clean (ultra-efficient natural gas) and renewable (wind and solar) assets. In late May NextEra Energy acquired Gulf Power and Florida City Gas for $6.5 billion to expand its empire in the Sunshine State. It already serves 5 million paying customers in Florida, who enjoy monthly electric bills that are 30% below the national average. The company expects to extend the same operational efficiency to its newest 600,000 customers, while adding $0.15 and $0.20 to adjusted EPS in 2020 and 2021, respectively.

Meanwhile, the core business has begun its next phase of expansion: solar power and energy storage. Florida Power and Light commissioned 600 MW of new solar capacity, including the largest solar-plus-storage operation in the United States, and filed plans for adding 3.2 GW of additional solar in the state in the coming years. NextEra Energy Resources added 667 MW of new wind projects to its backlog, in addition to 334 MW of solar. Its first solar-plus-storage project also commenced operations.

Image source: Getty Images.

On the other hand, Xcel Energy owns 6.7 GW of wind power situated along the American wind corridor, which runs down the center of the country and offers optimal potential for wind farms. That allows the company's wind assets to operate at capacity factors (the amount of time a generation asset runs at full capacity) of 45% to 50%, compared to the national average of 37%.

Turns out the same geographic position helps most of the company's 1.4 GW of solar assets top the national averages, too. The company's photovoltaic installations operate at capacity factors of 22% (in North Dakota and Minnesota) to 34%, compared to the national average of 27%.

The business turned in a solid performance in the first quarter of 2018, although investors wouldn't know it judging by the share price. The stock has struggled since the end of 2017, and is now mired in its longest and deepest rut in the last five years. At any rate, Xcel Energy delivered EPS of $0.57 in the first quarter of the year, compared to just $0.47 in the year-ago period. Management also reaffirmed its full-year 2018 guidance calling for EPS of $2.37 to $2.47.

While the year-over-year EPS gain can be explained by a lower tax bill in the first quarter of 2018, Xcel Energy has ambitious growth plans in the years ahead. It expects to grow EPS 5% to 6% annually, and tack on 5% to 7% per year to its dividend. That should be possible if the rate base increases from $24 billion in 2016 to $34.5 billion in 2022 as expected. As in the case of NextEra Energy, the company's utilities aim to accomplish that with a heavy dose of renewable energy (which will grow from providing just 5% of the rate base to 12% in that span) while keeping customer bills low.

Image source: Getty Images.

What do valuation metrics say?

All right, so both NextEra Energy and Xcel Energy are leaders in renewable energy. They got there with wind power, and are looking to cement their positions with heavy expansions of solar assets in the coming years.

But what metrics should investors focus on to begin differentiating the two renewable stocks?

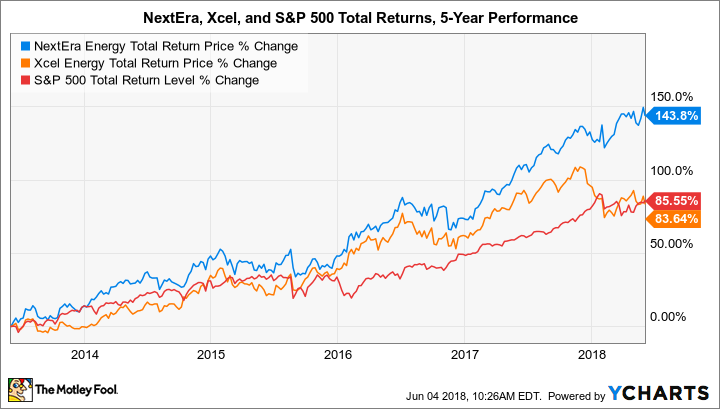

Well, as noted above, NextEra Energy expects to grow at a considerably faster annual clip than Xcel Energy for the foreseeable future -- the midpoint of their annual growth rates are 7% and 5.5%, respectively. That overshadows the latter's higher dividend and promises to help the larger renewable power company continue to extend its stock performance dominance over its smaller peer in the years ahead. While the two have graced shareholders with total returns of 244% and 220%, respectively, over the last decade, it hasn't even been close over the past five years.

In fact, given its tumble over the last six months, Xcel Energy has only matched the total returns of the S&P 500. That does make it cheaper than its larger peer in certain valuation metrics, though. Does that matter?

Metric | NextEra Energy | Xcel Energy |

|---|---|---|

Market cap | $77 billion | $23 billion |

5-Year total returns | 144% | 83% |

Dividend yield | 2.84% | 3.3% |

Forward PE | 19.4 | 17.4 |

EV to EBITDA | 12.2 | 10.2 |

Source: Yahoo! Finance.

While I think Xcel Energy stock is poised to resume its thumping of the S&P 500, especially once investors have more certainty concerning an ambitious power plan proposal in Colorado, there are legitimate questions about its rate of customer growth and its ability to speed up its historical rate of stock price growth. NextEra Energy has no such issues there: It's added 600,000 customers in Florida recently, and has a long history of nudging its shares higher.

Image source: Getty Images.

The better buy is...

Although Xcel Energy stock could resume its outperformance of the broader index in the years ahead, it may continue to lag behind the returns of NextEra Energy. It doesn't have the same capital reserves to make a $6.5 billion acquisition, nor the capital to go toe-to-toe with its larger peer in terms of renewable energy investments. Unfortunately, size really does matter when it comes to power generation and utility growth. And that's doubly true in the world of renewable energy.

Therefore NextEra Energy stock is the better buy in this matchup. It may pay a slightly lower dividend, but it has an impeccable track record of creating shareholder value and a realistic yet ambitious growth strategy. If you're looking for a great renewable energy stock, then look no further.

More From The Motley Fool

Maxx Chatsko has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance