Beyond Meat's (NASDAQ:BYND) Profitability is Not Beyond the Corner Yet

This article first appeared on Simply Wall St News.

Switching the population's dietary habits to healthier and more sustainable options remains one of the issues of the 21st century.

Beyond Meat, Inc.'s (NASDAQ: BYND) rose as one of the companies tackling this problem, yet since its public debut in 2019, its performance on the market has been underwhelming but volatile. Since the company remains unprofitable, in this article, we will look at the estimates that show when that might change.

Check out our latest analysis for Beyond Meat

Downgrade and COO loss

Beyond Meat just got hit with a downgrade after Piper Sandler lowered the outlook to Underweight from Neutral. The company believes that the current retail momentum lags the consensus expectations and might result in an earnings miss. Furthermore, a new price target has been set at US$95.

Meanwhile, the company is teaming up with Pepsi to launch a joint venture branded as "The PLANeT Partnership“ in early 2022. This fits the current Pepsi goal to become sustainable, with the CEO Ramon Laguarta calling the venture “game-changing. “

On the other hand, BYND lost its COO, as Sanjay Shah stepped down at the beginning of this month. Interestingly enough, our platform took note of him significantly reducing his stake in the company as early as November. You can find all the insider transactions here.

Profitability Projections

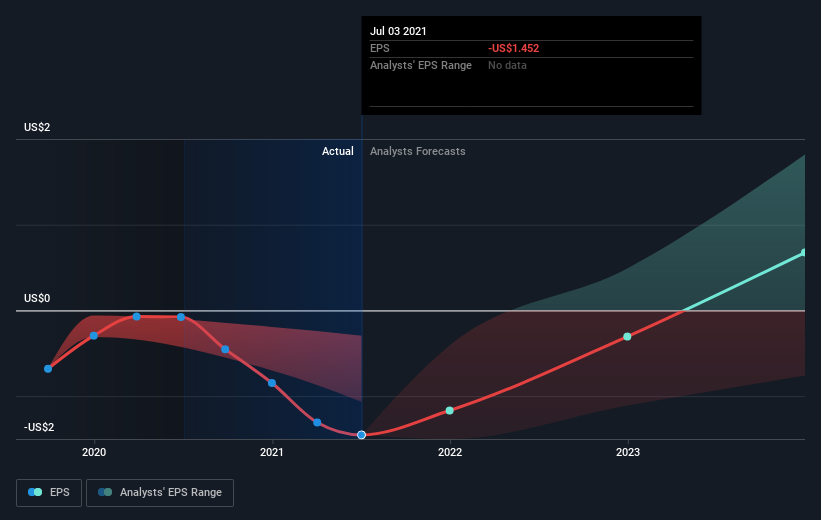

The consensus from 18 of the American Food analysts is that Beyond Meat is that the company will post a final loss in 2022 before turning a profit of US$27m in 2023.

So, the company is predicted to break even approximately 2 years from now. What rate will the company have to grow year-on-year to break even on this date?

Using a line of best fit, we calculated an average annual growth rate of 70%, which is somewhat optimistic. Should the business grow at a slower pace, it will become profitable later than expected.

Given this is a high-level overview, we won't go into details of Beyond Meat's upcoming projects but take into account that, by and large, a high growth rate is not out of the ordinary, mainly when a company is in a period of investment.

One thing to keep an eye on is Beyond Meat's debt-to-equity ratio of over 2x. Typically, debt shouldn't exceed 40% of your equity, which in this case, the company has significantly overshot. A higher debt obligation increases the risk of investing in the loss-making company.

Next Steps:

Beyond Meat's key fundamentals are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Beyond Meat, take a look at Beyond Meat's company page on Simply Wall St.

We've also put together a list of relevant aspects you should further research:

Historical Track Record: What has Beyond Meat's performance been like over the past? Go into more detail in the past track record analysis and look at the free visual representations of our research for more clarity.

Management Team: An experienced management team at the helm increases our confidence in the business - take a look at who sits on Beyond Meat's board and the CEO's background.

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance