Beyond Meat's (NASDAQ:BYND) Q1 Earnings Results: Revenue In Line With Expectations

Plant-based protein company Beyond Meat (NASDAQGS:BYND) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 18% year on year to $75.6 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $330 million at the midpoint. It made a non-GAAP loss of $0.72 per share, improving from its loss of $0.91 per share in the same quarter last year.

Is now the time to buy Beyond Meat? Find out in our full research report.

Beyond Meat (BYND) Q1 CY2024 Highlights:

Revenue: $75.6 million vs analyst estimates of $75.72 million (small miss)

Adjusted EBITDA: ($32.9) million loss vs analyst estimates of ($29.4) million loss (miss)

EPS (non-GAAP): -$0.72 vs analyst estimates of -$0.66

The company reconfirmed its revenue guidance for the full year of $330 million at the midpoint

Gross Margin (GAAP): 4.9%, down from 6.7% in the same quarter last year

Free Cash Flow was -$33 million compared to -$30.54 million in the previous quarter

Sales Volumes were down 16.1% year on year

Market Capitalization: $536.9 million

Beyond Meat President and CEO Ethan Brown commented, “In Q1, we made solid progress against our 2024 priorities, including: hitting our first quarter revenue objective; reducing operating expenses and cash consumption year-over-year; bringing production in-house to reduce costs and improve quality; and commencing shipments of Beyond IV, the fourth generation of Beyond Burger and Beyond Beef, to our customers, to the praise of nutritionists and consumers alike.”

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQGS:BYND) is a food company crafting innovative, sustainable, and delicious alternatives to traditional meat products.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

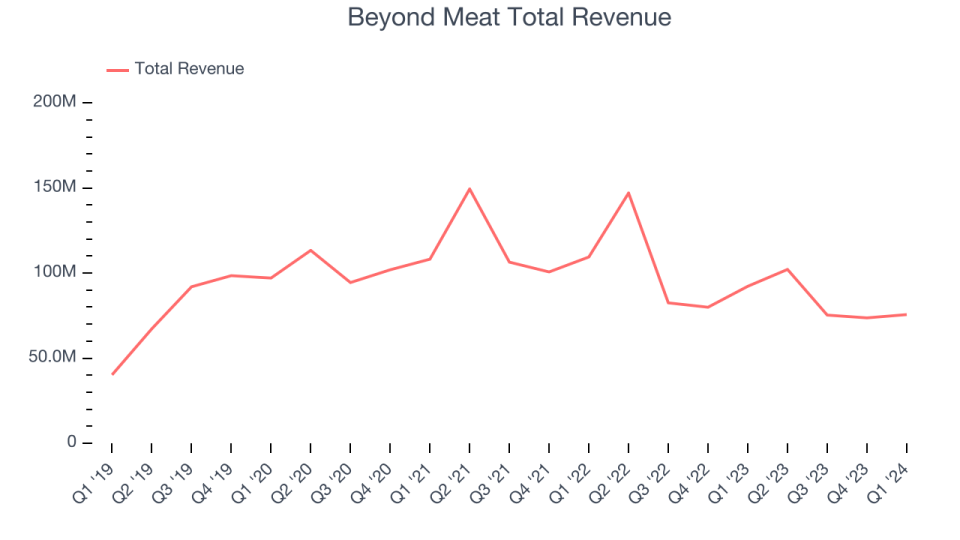

As you can see below, the company's revenue has declined over the last three years, dropping 7.9% annually. This is among the worst in the consumer staples industry, where demand is typically stable.

This quarter, Beyond Meat missed Wall Street's estimates and reported a rather uninspiring 18% year-on-year revenue decline, generating $75.6 million in revenue. Looking ahead, Wall Street expects sales to grow 4% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

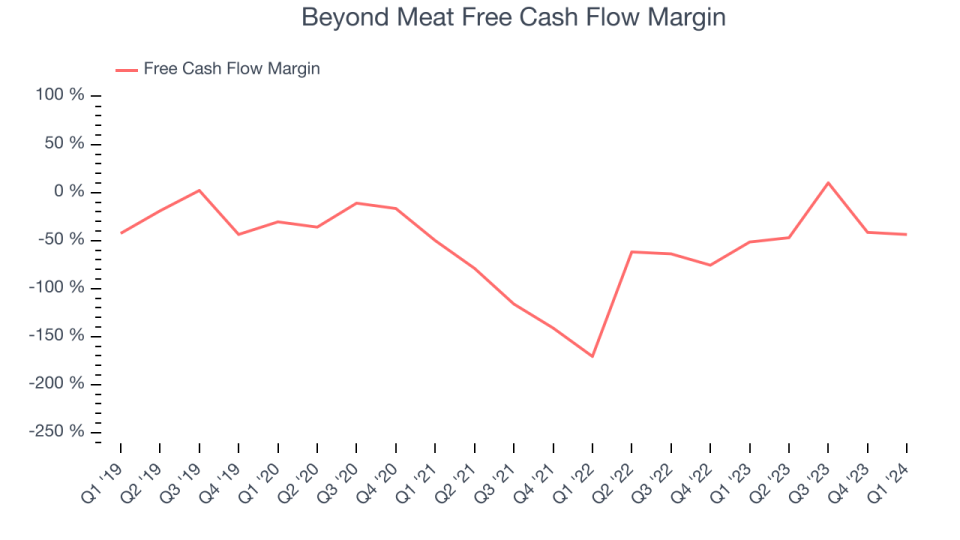

Beyond Meat burned through $33 million of cash in Q1, representing a negative 43.7% free cash flow margin. The company increased its cash burn by 30.5% year on year.

Over the last two years, Beyond Meat's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 48.8%. However, its margin has averaged year-on-year increases of 30.8 percentage points over the last 12 months, showing the company is taking action to improve its situation.

Key Takeaways from Beyond Meat's Q1 Results

We struggled to find many strong positives in these results. The company missed on revenue and adjusted EBITDA. Beyond Meat still seems to believe that its previously-provided full-year guidance can be achieved as the company reiterated that full year guidance for revenue and implied operating profit. Overall, this was a mediocre quarter for Beyond Meat. The stock is flat after reporting and currently trades at $8.2 per share.

Beyond Meat may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance