BGC Partners (BGCP) Divests Insurance Brokerage Business

Continuing with its efforts of boosting shareholder value, BGC Partners, Inc. BGCP successfully closed the proposed sale of its Insurance Brokerage business to The Ardonagh Group Limited.

Per the terms of the agreement, the entire equity of the entities that comprise BGC Partners’ Insurance Brokerage business has been acquired by Ardonagh, for which, Ardonagh paid $535 million in gross proceeds, subject to the limited post-closing adjustments.

The one-time gain related to the transaction will be reflected in BGC Partners’ consolidated results under U.S. Generally Accepted Accounting Principles (GAAP). However, it will be excluded from the company's results for adjusted earnings.

BGC Partners’ chairman and CEO, Howard W. Lutnick, stated, “We are pleased to have completed the sale of our Insurance Brokerage business to Ardonagh which delivers enormous value for our shareholders. The approximately $535 million in gross proceeds provides us with significant resources to continue repurchasing our shares and/or units and to accelerate Fenics growth."

As per the previous press release, BGC Partners expects to use the proceeds to boost Fenics’ growth and repurchase shares and/or units. While growth of its Insurance Brokerage business was industry-domineering, the scale and scope of the Fenics opportunity is far greater for the firm, with the potential of driving shareholder value significantly higher.

Cantor Fitzgerald & Co. and Bank of America Corporation BAC are serving as financial advisors for the deal.

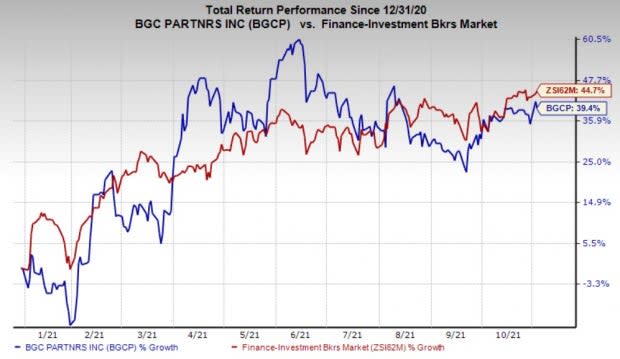

So far this year, shares of BGC Partners have gained 39.4% compared with 44.7% growth recorded by the industry.

Image Source: Zacks Investment Research

Currently, the company carries a Zacks Rank #4 (Sell).

A couple of better-ranked stocks from the same space are mentioned below.

The Zacks Consensus Estimate for Moelis & Company’s MC 2021 earnings has moved 14% north over the past 30 days. Its shares have gained 47.8% over the past six months. The company currently sportsa Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Interactive Brokers Group, Inc.’s IBKR current-year earnings has been revised 5.4% upward in the past 30 days. Shares of the company have rallied 5.8% over the past six months. It currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of America Corporation (BAC) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

BGC Partners, Inc. (BGCP) : Free Stock Analysis Report

Moelis & Company (MC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance