BHP Billiton warns unification plan could force FTSE 100 exit

BHP Billiton has shot down calls from an activist investor to end its dual corporate structure, warning it could fall out of the FTSE 100.

Andrew Mackenzie, chief executive of BHP, said that folding its London-listed plc into its Sydney-listed company would mean it struggles to qualify for the blue-chip index.

“The big issue is our ability to achieve indexation - how you keep up your index listing without being a plc?” he said. “Both sets of shareholders [in the UK and Australia] would have to have a vote on it. How would the UK investors feel? They would probably need a high probability of a value uplift in the shares.”

Mr Mackenzie pointed to the example of South32, the midcap miner that it spun off in 2015. South32 is listed in London but does not have enough UK-based shareholders to qualify for any of the FTSE indexes.

“We tried to see if we could get indexation for South32 and that was denied,” Mr Mackenzie said.

Earlier this month New York-based hedge fund Elliott Advisors, which holds 5pc of BHP’s London stock, said the miner could generate £16bn in savings if it ditched the DLC, which dates from the 2001 merger of BHP and Billiton. Elliott cited the example of other companies that had enjoyed a bounce in their share prices after unifying their structures.

Mr Mackenzie said Elliott’s calculations took a “particularly optimistic view”. He acknowledged the “potential prize” from unification and insisted “we never stop working on the DLC”, but the company had concluded the plan was currently too risky.

Last year BHP said such a move would destroy “at least $1.3bn in value”, and the DLC merited just one paragraph in the miner’s half-year results. Mr Mackenzie will meet with Elliott along with other investors later this week.

In the six months to Dec 31, BHP’s revenue climbed 13.7pc to $21.78bn, while pre-tax profits rose 8.6pc to $6bn. However after-tax profits slumped as it took a $1.8bn one-off hit from tax reforms in the US, which forced it to pay some deferred taxes.

BHP raised its interim dividend by nearly 40pc, to 55 US cents a share, well above its minimum payout level.

But City analysts zeroed in on its earnings performance, which disappointed forecasts. Underlying earnings before interest, tax and other deductions jumped 14pc to $11.2bn, 3pc below predictions.

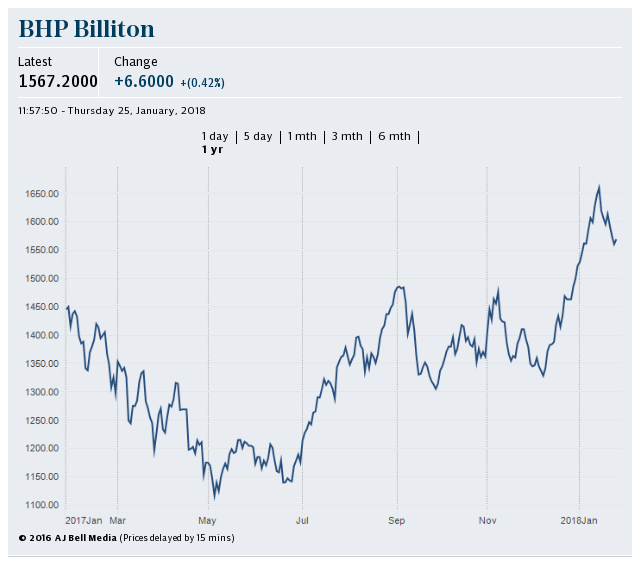

Net debt fell by $900m to $15.4bn, but this was also higher than analysts had expected, prompting investors to send its London shares down 4.4pc to £14.91 in lunchtime trade.

BHP also reported a $496m spike in costs due to maintenance projects and lower production in one of its coal and oil divisions. It said it was still on track to save $2bn over two years.

Nicholas Hyett, of Hargreaves Lansdown, said: “Profits are increasing rapidly, debt is falling, and the interim dividend is well ahead of market expectations. But investors were expecting more. BHP’s better performance is being driven by improved commodity prices, which are out of the company’s hands, while productivity, which it can control, is heading in the wrong direction.”

BHP makes much of its money digging up iron ore in Western Australia and copper in South America. It also has extensive oil operations.

Mr Mackenzie reaffirmed the company's commitment to copper, which is expected to be in high demand for the wiring in electric cars. "Copper is one area where we're prepared to look globally [for new deposits]," he said.

Elliott has also pressed BHP to sell off its US shale fields, which it bought at the top of the market earlier this decade and was then forced to write down. The miner said the process was under way but dampened expectations for a quick sale, saying any transaction was unlikely to be before the start of 2019.

Yahoo Finance

Yahoo Finance