BHP Group (BHP) Sweetens Offer for OZ Minerals Limited

BHP Group BHP has raised its offer by 13% for OZ Minerals Limited to a cash price of AUD 28.25 ($18.67) per share — its final price. OZ Minerals has a high-quality portfolio of copper and nickel assets, located in a Tier-1 mining jurisdiction with long mine lives and first-quartile cost positioning.

This deal, which values OZ Minerals at AUD9.6 billion ($6.34 billion) would add to BHP’s pipeline of growth options and enhance its exposure to future-facing commodities, while adding attractive synergies.

BHP made the initial offer to acquire 100% of the issued share capital in OZ Minerals Limited for AUD25 per share on Aug 7, 2022. OZ Minerals’ Board had rejected the offer citing that it undervalues the company and was not in the best interests of shareholders.

The latest offer price of A$28.25 per share represents a 49.3% premium to OZ Minerals’ closing price of AUD18.92 per share on Aug 5, 2022 — the last trading day prior to BHP’s initial proposal. OZ Mineral’s board has confirmed to BHP that it intends to recommend the revised offer to the company’s shareholders.

OZ Minerals owns and operates Prominent Hill, a high-quality copper-gold mine, and Carrapateena, an iron-oxide-copper–gold underground mine, both located in the highly prospective Gawler Craton in South Australia. The Carajás East Hub located in Brazil is also part of its portfolio. This hub comprises the Pedra Branca underground mine, which is the beginning of a potential series of small, high-quality copper-gold mines with ore being processed at existing facilities at the nearby, now-depleted Antas mine.

The company recently announced that its board has given the go-ahead for developing the West Musgrave copper-nickel project. The project is located in the Musgrave Province of Western Australia and includes the Nebo and Babel nickel-copper deposits and the Succoth copper deposit. The area is highly prospective for nickel and copper.

West Musgrave will be one of the world’s largest, lowest cost, lowest emissions copper-nickel projects. It is expected to produce between 35,000 tons to 41,000 tons of copper annually in the first five years and then 28,000-35,000 tons per year over its 24-year operating life. The first concentrate is targeted for the second half of 2025.

This buyout thus, if it comes through, will add to BHP’s copper and nickel resources. The company’s focus on building its capabilities in commodities like copper, nickel and potash will help it ride on growing global trends such as decarbonization, electrification population growth and rising living standards in developing countries among others.

The combination will also help BHP unlock potential operational synergies in South Australia as OZ Minerals’ Carrapateena and Prominent Hill mines are in proximity to the former’s Olympic Dam and Oak Dam development resources. OZ Mineral’s West Musgrave project will add a large greenfield nickel option to BHP’s Nickel West premier nickel sulfide resource position in Western Australia.

The revised proposal is however subject to certain conditions, including BHP completing satisfactory due diligence and entering into a scheme implementation agreement on acceptable terms. It also includes a unanimous recommendation from the OZ Mineral’s board that shareholders vote in favor of the revised proposal and an independent expert affirming that the current proposal is in the best interests of the company’s shareholders. Along with the satisfaction of these conditions, completion of the transaction will be subject to other customary closing conditions.

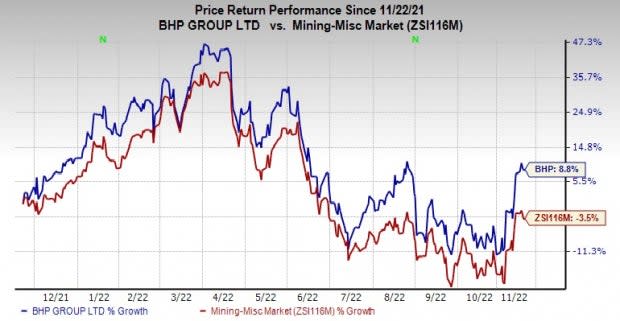

Price Performance

Image Source: Zacks Investment Research

BHP Group’s shares have gained 8.8% over the past year compared with the industry’s decline of 3.5%.

Zacks Rank & Stocks to Consider

BHP currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Sociedad Quimica y Minera de Chile S.A. SQM, Commercial Metals Company CMC and Reliance Steel & Aluminum Co. RS. While SQM and CMC sport a Zacks Rank #1 (Strong Buy), RS carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Sociedad has a projected earnings growth rate of 538.1% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 1.2% upward in the past 60 days.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied around 60% in a year.

The Zacks Consensus Estimate for CMC's current-year earnings has been revised 3.8% upward in the past 60 days. Commercial Metals’ earnings beat the Zacks Consensus Estimate in each of the last four quarters.

CMC has a trailing four-quarter earnings surprise of roughly 19.7%, on average. The company’s shares have gained around 31% in a year.

Reliance Steel has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 26% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance