Big 5 Sporting (BGFV) Rallies Despite Sales Woes: Here's Why

Big 5 Sporting Goods Inc. BGFV stock continues its bull run despite reporting lower-than-anticipated sales results for fourth-quarter fiscal 2017 while providing a soft outlook. The sales decline stemmed from an extremely challenging performance in December. Sales in December were largely hurt by nearly 50% decrease in core winter-product categories due to warmer-than-normal and dry weather conditions in most of its markets. Lower demand for firearm-related products also hurt the quarterly sales.

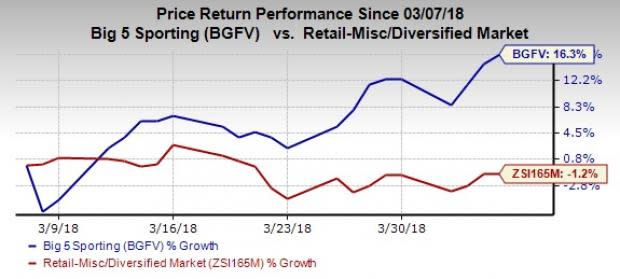

However, the company’s upside story mainly relates to the positive earnings surprise trend and commitment to enhancing customer experience through store expansion and effective merchandising strategies. Consequently, shares of Big 5 Sporting rallied 16.3% in the past month, against the industry’s decline of 1.2%.

Let’s find out more about the growth drivers for this Zacks Rank #3 (Hold) stock.

Store Growth & Technological Advancement

Big 5 Sporting leverages an extensive network of stores to effectively penetrate into target markets, directed toward generating healthy sales and capturing market shares. The company has been focusing on expanding its store base and introducing technological advancements to enhance services for its patrons. Big 5 Sporting expects to open eight new stores and close three in 2018. We believe these moves will place it well for future growth.

Effective Merchandising Aid Margins

Big 5 Sporting’s unique strategy of offering exclusive branded merchandise, sourced from leading manufacturers provides it with a competitive edge over its rivals in a cut-throat specialty retailing industry. Further, the company leverages strong vendor relationships to source overstock and closeout merchandise at substantial discounts. This helps it achieve the dual objectives of boosting gross margin while offering compelling value to customers.

Inventories Look Good

Additionally, the company’s merchandise strategy helped it retain solid inventory position. At the end of fiscal 2017, inventories remained in good shape despite soft sales of winter-related products in the fiscal fourth quarter. Inventories improved 6.7% in the quarter. However, the excess inventory is not likely to impact the transition to the next season as the company deals with non-fashion products, which should play well next year.

Shareholder Rewards

Big 5 Sporting remains committed toward enhancing shareholder returns, as evident from its regular practice of returning value to stockholders in forms of dividends and share buybacks. It recently announced a quarterly cash dividend of 15 cents per share that was paid on Mar 23. Moreover, the company repurchased 795,718 shares for nearly $7.7 million in 2017. As of Dec 31, 2017, it had about $15.7 million remaining to be repurchased under its $25-million share buyback program.

Looking for Trending Retail Picks? Check These

Investors interested in the space may consider KAR Auction Services, Inc. KAR, Sally Beauty Holdings Inc. SBH and The Gap Inc. GPS, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

KAR Auction delivered a positive earnings surprise of 14.1% in the trailing four quarters and has long-term growth rate of 11%.

Sally Beauty pulled off an average positive earnings surprise of 2.8% in the trailing four quarters. Additionally, it has long-term earnings growth rate of 6.8%

Gap delivered an average positive earnings surprise of 11.1% in the trailing four quarters. It has long-term earnings growth rate of 8%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Big 5 Sporting Goods Corporation (BGFV) : Free Stock Analysis Report

Sally Beauty Holdings, Inc. (SBH) : Free Stock Analysis Report

KAR Auction Services, Inc (KAR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance