Big changes on car tax are coming in April - here's how much more you could pay

New car tax rules come into force in a couple of months – and they will see thousands of motorists paying hundreds of pounds more.

Owners of new diesel cars are set to be hardest hit by the changes – but drivers who have bought a new hybrid car in the past year are also set to be clobbered.

And for many others who bought new in the last few months, they will also be hit in the pocket as second-year charges apply to them for the first time.

MORE: Petrol prices will keep on rising, say experts, and here’s why

The changes, which come into effect on April 1, has left the motoring industry claiming many drivers will be caught out.

How does the car tax system operate?

It’s all based on your vehicle’s CO2 emissions. Tax is charged depending on how high the level of CO2 is.

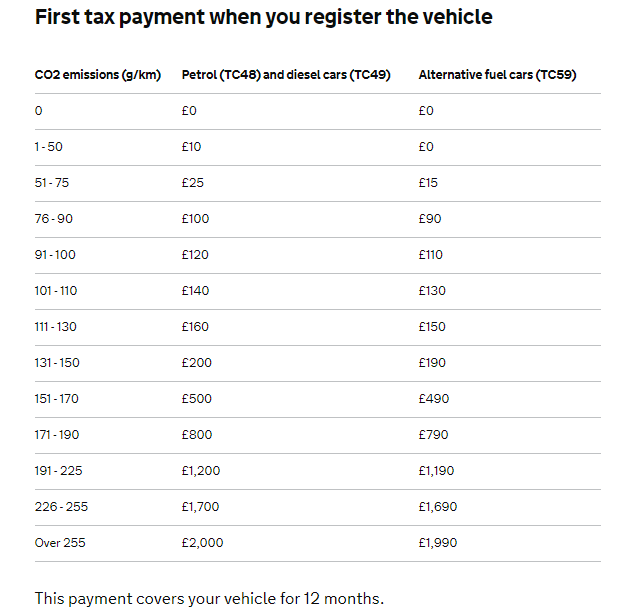

Since last April, the charge for the first year – dubbed showroom tax – is still based on CO2 emissions, with big polluters paying more.

The tax rate ranges from zero (for all-electric, zero polluters) to as high as £2,000.

For the second and subsequent years, petrol and diesel vehicles – though not diesel vans – incur a £140 tax, while it’s £130 for alternative fuel vehicles such as hybrids, bioethanol and LPG.

Second-year vehicles with zero emissions escape the tax.

But now it’s getting even more complicated

Cars costing more than £40,000 have to pay an additional rate of £310 a year for the first five years.

This will be the case even for zero emission, pure electric cars, such as Tesla’s Model S.

And, the annual cost for many popular cars is rising substantially.

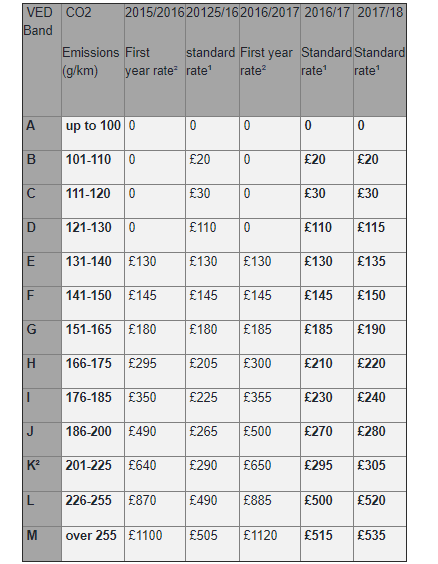

For instance, a car registered between 1 March 2001 and 31 March 2017 that emits between 111-120g/km of CO2, was incurring £30 in road tax.

MORE: Personal details of 1.7m drivers sold by DVLA at £2.50 a time to parking firms

From this April, however, the new rules mean it will cost the owner £140 to tax his or her car – up more than 350%.

‘Dirty’ diesels are in the headlights

It’s in the diesel car market that the biggest – and most painful – changes are being seen.

In the Autumn Budget, chancellor Philip Hammond announced that all new diesel cars from 1 April 2018 will face going up a VED (vehicle excise duty) band if they fail to meet the latest Euro 6 standards under real-world testing.

Experts say a new Ford Focus might see an increase of £20 in the first-year rate while a Porsche Cayenne will see a rise of £500.

The changes only apply to new diesel cars, not vans, and do not impact the subsequent £140 yearly fees all car owners have to pay after the first year.

The most efficient diesels cost no more than an additional £20 to tax for the first 12 months.

However, any model that emits between 191 and 225g/km CO2 is subject to an increase from £1,200 for the first year to £1,700 – the biggest financial leap of any of the bands.

How much does the price of your car affect how much tax you pay?

All cars that cost more than £40,000 attract an extra premium fee of £310 for years two to six of ownership, regardless of emissions, plus the £140 flat rate.

MORE: Start-up Zebra Fuel eyes rapid expansion after $2.5m funding injection

Once that five-year period is over and they revert to the £140 flat rate.

If your car is a pricey hybrid, bioethanol or LPG, then your rules are slightly different. Emissions rules still apply, but £10 is shaved both your first year rate and annual flat rate.

For example, a Toyota Prius Business Edition emits 70g/km of CO2, so owners will charged £15 for the first year, then £130 for every year after (rather than £25 for the first year and then £140 thereafter like a petrol/diesel car that emits the same amount).

Yahoo Finance

Yahoo Finance