Big investors are expected to pour $40 billion into hedge funds this year

Hedge funds appear to be emerging from their “dark periods” as big investors put money to work again in anticipation of performance, according to a new study from Barclays.

Barclays’ capital solutions group surveyed 335 hedge fund investors representing approximately $6.7 trillion in total assets under management and about $874 billion in hedge fund AUM. The Barclays team also engaged in one-on-one conversation with more than 150 of those investors.

What they found was that investors are reducing their long-only exposure to stocks and fixed income and increasing their allocations to hedge funds and other alternatives such as private equity and real estate.

Money flowing in

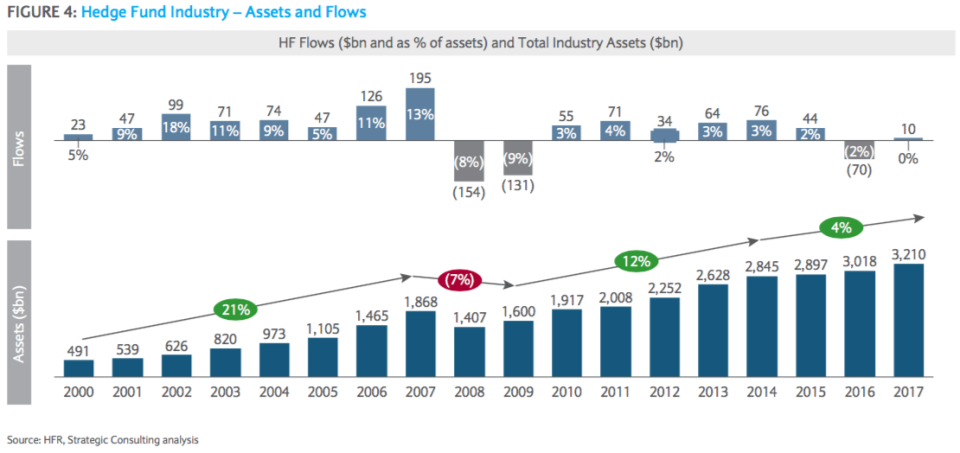

Barclays estimates that hedge fund industry inflows will be $40 billion in 2018. Barclays has a track record of being within 80% of the total inflows that are reported each year by Hedge Fund Research. Last year, they correctly estimated the exact number of inflows. Barclays also notes that investors are also anticipating fewer redemptions this year.

“Such an outcome after the redemption of 2016 and a relatively flat 2017 would signify a notable shift in investor sentiment and a renewed confidence in the industry,” Barclays wrote.

For the last five years, hedge funds, on average, have struggled to beat the broader market. The 2015 and 2016 calendar years, in particular, were especially brutal for the industry. In 2016, investors yanked $70.1 billion out of hedge funds, according to HFR data.

Back in 2016, some of the industry’s most prominent voices even shared their criticism, including Daniel Loeb of Third Point who predicted that there would be a “washout in hedge funds” and Point72’s Steve Cohen who said that there’s a “lack of talent.” And Warren Buffett of Berkshire Hathaway has long characterized the fees hedge funds charge as “unbelievable.”

The tide may be starting to turn.

“The 2015-2016 drawdown was notable in its severity, behind only the 2008 global financial crisis and 2011 Eurozone crisis in magnitude, and behind only the 2008 crisis in length (peak-to-trough),” Barclays wrote. “The recovery, however, has been brisk. The [hedge fund] industry as a whole delivered 9.2% annualized returns, or 8.1% net of the risk-free rate, significantly higher than during the recovery phase post the Eurozone crisis and above the long-term average returns for the industry.”

In 2017, the HFRI Fund Weighted Composite Index posted gains of 8.54%, with positive performance every month.

“Furthermore, the recovery has been reminiscent of the returns delivered during the pre-2008 crisis ‘golden years’, especially when considering the risk-free rate. Furthermore, 2017 was the first ‘perfect’ calendar year since 2003, with positive returns delivered every month.”

That positive performance streak continued into January, but in February the HFRI Fund Weighted Composite Index declined 1.8%.

Industry assets were at an all-time high in 2017 of $3.2 trillion. Hedge fund industry assets have grown by 43% since 2012 and Barclay expects it to grow to $3.4 trillion by the end 2018.

Fewer managers benefitting

According to the survey, investors are most interested in putting their money with sector-focused equity funds, equity market neutral funds, and systematic strategies including equity and CTA. The recent trend of quantitative strategies is also expected to continue.

That said, investors are also going to be looking to put their money with fewer managers.

“While these market conditions may create a sense of ‘a rising tide lifts all boats,’ manager selection remains a key component to investor performance, especially during bear markets,” Barclays wrote.

One of the issues plaguing the industry was that there were just too many hedge funds, with most unable to deliver the performance. Some estimates have put the number of funds at more than 10,000 and as many as 15,000.

For the last three years, there have been more hedge fund liquidations than launches. Approximately 784 hedge funds closed shop in 2017, compared to 735 that opened, according to HFR. In 2016, 1,057 called it quits, while 729 launched. In 2015, 979 closed compared to 968 that opened.

A washout in hedge funds can be seen as a good thing for those left standing as more money is put in play that’s now being allocated to fewer managers.

Barclays notes that hedge fund portfolio concentration has been a trend since 2013. Back in 2013, investors had an average of 19 hedge funds in their portfolio. In 2017, that number was 16, a decrease of 16%.

Of course, not all of the challenges are going away for hedge funds. Barclays expects that hedge fund will continue to face pressure from investors to lower their fees.

Underperformance tends to reignite the age-old debate about hedge fund fees. Historically, fund managers are paid through a compensation structure commonly known as the “2 and 20,” which means they charge investors 2% of total assets under management and 20% of any profits. The fees can vary from fund to fund, with some charging less and others charging more.

Fees have come down, though. According to the Barclays survey, investors are paying on average 1.44% in management fees and 16.8% in performance fees.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Yahoo Finance

Yahoo Finance