Big Lots (BIG) Tanks on Q4 Earnings Miss, Coronavirus-Hit View

Shares of Big Lots, Inc. BIG slumped 27.9% in after-hour trading session on Feb 27. The decline can primarily be attributed to lower-than-expected fiscal fourth-quarter results and apprehensions regarding the impact of coronavirus outbreak on its first-quarter 2020 performance. Moreover, both earnings and revenues missed the consensus mark after beating the same in the trailing three quarters.

The global stock market is currently grappling with the coronavirus outbreak and Big Lots isn’t immune to the trend. Supply chain disturbance owing to the outbreak and slow start to the first quarter remain major concerns. The company’s first-quarter fiscal 2020 will also be impacted by upfront investments and growth efforts, which will primarily benefit the company in the second quarter and beyond.

However, the company is confident that Operation North Star strategies will help it drive growth in the long haul.

Q4 in Details

This Columbus, OH-based company reported adjusted earnings of $2.39 a share, missing the Zacks Consensus Estimate of $2.53. The bottom line came within management’s guidance of $2.40 to $2.55. Moreover, the company’s adjusted earnings declined 10.8% year over year.

Net sales inched up 0.5% to $1,607 million but lagged the Zacks Consensus Estimate of $1,626 million. The upside can be attributed to sales growth in high volume new stores and relocated non-comp stores, and increased store count. The gain was marginally offset by comparable sales decline. Notably, furniture was the top performing category that registered a low-double digits comps growth in the quarter.

Comps declined 0.9% against the company’s expectations of marginally positive comps. While sales were above the company’s expectation in November, it declined significantly in December. In January, sales were in line with expectations.

Gross profit decreased 3.8% year over year to $634 million, while gross margin contracted 170 basis points (bps) to 39.5%. The downside can be attributed to higher markdown from promotional selling and rise in shrink expense. The company expects gross margin for the fiscal first quarter to be under pressure due to higher promotion expenses and adverse impact of tariffs.

In the reported quarter, S&A expenses came in at $471.1 million, down 1.2% year over year. Moreover, the metric (as a percentage of net sales) declined 50 bps from the prior-year quarter to 29.3%.

Operating profit came in at $125.5 million, down 15.4% year over year.

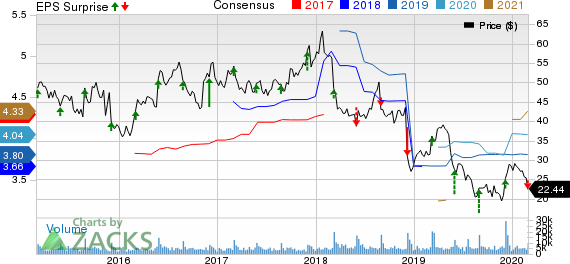

Big Lots, Inc. Price, Consensus and EPS Surprise

Big Lots, Inc. price-consensus-eps-surprise-chart | Big Lots, Inc. Quote

Other Financial Details

This Zacks Rank #2 (Buy) company ended the quarter with cash and cash equivalents of $52.7 million. Inventories decreased 5% to $921.3 million. Management stated that inventory levels were up at the end of fiscal 2018 due to tariff mitigation activities. Long-term debt totaled $279.5 million, up from $374.1 million in the prior-year quarter. Total shareholders’ equity was $845.5 million.

In fiscal 2019, the company has returned about $98 million to its shareholders in the form of share repurchases and dividends.

Guidance

Big Lots’ projects comps to decline in the range of low to mid-single digit range in first-quarter fiscal 2020, which comprises of effect of supply chain disruption on account of the coronavirus outbreak. Based on comps expectations, the company envisions first-quarter earnings per share (EPS) in the range of 30-45 cents, which suggests a decline from 92 cents in the year-ago quarter. The Zacks Consensus Estimate for the bottom line is pegged at 96 cents per share.

For fiscal 2020, the company expects adjusted earnings in the range of $3.20-$3.40 per share. However, the guidance indicates a decline from the prior-year reported figure of $3.67. The Zacks Consensus Estimate for earnings in the fiscal year is pegged at $4.05.

Don’t Miss These Solid Bets

Chico's FAS CHS has a long-term earnings growth rate of 15% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Zumiez ZUMZ has a long-term earnings growth rate of 12% and a Zacks Rank #1.

Stitch Fix SFIX has a long-term earnings growth rate of 15% and a Zacks Rank #1.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Big Lots, Inc. (BIG) : Free Stock Analysis Report

Chico's FAS, Inc. (CHS) : Free Stock Analysis Report

Zumiez Inc. (ZUMZ) : Free Stock Analysis Report

Stitch Fix, Inc. (SFIX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance