Big Oil Consolidation: Chevron Acquiring Hess - ConocoPhillips Acquiring Marathon Oil

Consolidation among the oil and energy sector continues as Chevron CVX will be acquiring Hess HES in a deal valued at $53 billion while ConocoPhillips COP is set to acquire Marathon Oil MRO for $22.5 billion when including debt.

This comes as crude prices are still up 10% for the year at just under $80 a barrel with big oil companies reaping massive profits.

Image Source: Yahoo Finance

Consolidation Overview

Acquiring Hess will further expand and diversify Chevron’s massive energy portfolio by giving the oil giant access to the Stabroek Block in Guyana with the large offshore oil reservoir known for its industry-leading cash margins and low carbon intensity.

While Hess shareholders approved the buyout on Tuesday, the deal still faces challenges including the final approval by the FTC and the Guyana government along with complications from Exxon Mobil's XOM 45% stake in the Stabroek Block with Hess controlling a 30% interest. The proposed acquisition stock price of $171 a share currently offers a 14% premium for Hess stock and shareholders would receive 1.025 shares of Chevron for each Hess share they own.

As for ConocoPhillips, today’s announcement of its acquisition of Marathon Oil aligns with the company’s financial framework of adding high-quality, low-cost supply inventory to its leading U.S. unconventional position. The deal is expected to be completed by the end of the year and values Marathon Oil’s stock at just over $30 and 7% above current levels with MRO spiking more than +7% on Wednesday to around $28 a share. As part of the agreement, Marathon Oil shareholders would receive 0.255 shares of ConocoPhillips for every Marthanon Oil share.

Growth Potential

Based on their fiscal 2024 top-line projections, acquiring Hess would bring in an additional $13.07 billion in sales for Chevron bringing its total sales to $220.82 billion. This would be a 10% spike from sales of $200.94 billion in 2023 and represent 133% growth over the last five years with 2020 sales at $94.69 billion.

Image Source: Zacks Investment Research

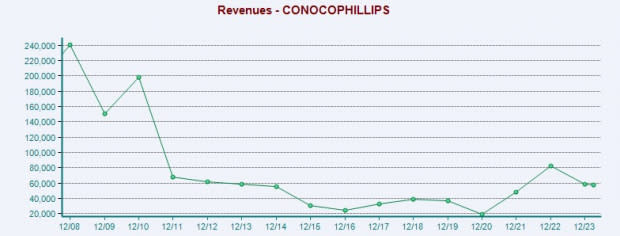

Theoretically, Marathon Oil would boost ConocoPhillips’ sales by $6.96 billion based on FY24 estimates bringing the company’s total sales to $68.17 billion which would be a 16% increase from $58.57 billion last year. More impressive, this would expand ConocoPhillips’ top line by 254% over the last five years with 2020 sales at $19.25 billion.

Image Source: Zacks Investment Research

Takeaway

Historically, large mergers in the oil and energy sector have created value for shareholders through cost reductions, and for now Chevron, ConocoPhillips, Hess, and Marathon Oil’s stock all land a Zacks Rank #3 (Hold).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Chevron Corporation (CVX) : Free Stock Analysis Report

ConocoPhillips (COP) : Free Stock Analysis Report

Marathon Oil Corporation (MRO) : Free Stock Analysis Report

Hess Corporation (HES) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report