The biggest threat to Britain's North Sea oil industry has nothing to do Brexit or supply

Getty

LONDON— The North Sea oil industry is one of the jewels in the crown for Britain's economy.

But there is a ticking timebomb that could put off companies investing in the sector and prevent new projects being set up to drill for oil.

It has nothing to do with Brexit or with even falling oil prices.

It is all down to the decommissioning of infrastructure, said Dr. Dougie Youngson, research director in oil and gas for UK-based broker Finncap to Business Insider.

Decommissioning is when companies dismantle and remove structures for oil and gas operations that are no longer in use.

"The whole decommissioning situation is significant for the industry and is a huge growth area for the service sector. There are quite a few projects that are very mature and who pays for this decommissioning isn't particularly transparent," said Youngson to BI.

"But decommissioning is something the service sector is desperate for. Over the next 5-10 years a lot of infrastructure needs to be taken apart and at the moment it is a bit of a wrestling match between the government and industry."

The North Sea oil and gas industry has generated £330 billion ($407 billion) in tax revenue over almost fifty years and as Youngson notes in his quarterly report to clients, "it saved the country from an even worse recession in the 1980s and made the UK a global technology leader in the sector."

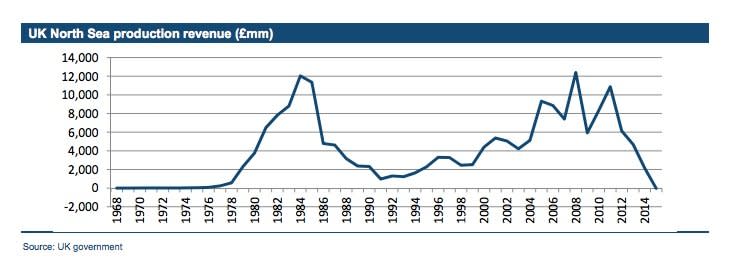

However, over the last few years, revenues have been dwindling:

Getty

The on top of that "the North Sea actually generated negative production taxes in the year 2015-16," said Youngson.

"The North Sea was seen as being uncompetitive with other regions globally. The combination of high costs, punitive fiscal terms and what was perceived as an unsupportive regulator resulted in assets being put up for sale and companies exiting the area," he added.

"When the downturn in the oil price occurred, things got unpleasant for the industry very quickly. The industry responded initially by focusing on cutting costs and discretionary capex. Headcount fell to around 330,000, a drop of 27% relative to numbers in 2014, and exploration activity largely dried up as budgets tightened."

GettyOil prices have also cratered over the last few years, falling from over $100 per barrel in June 2014, to now around $45 per barrel. At one point this year, oil crashed to nearly $20 per barrel.

Britain's vote to leave the European Union is also seen as potential upset for multinationals looking to invest in the UK.

However, Youngson told BI that decommissioning is one of the biggest issues to face companies investing in the North Sea and the lack transparency over who will foot the bill is a problem.

Youngson estimates that decommissioning will cost the industry £17 billion across five years.

"There are environmental drivers around this. You can't just leave an unused pipeline doing nothing on a sea bed. [As an operator of a project] you don't want to deal with it rotting in a path, on the way to a rig. All these remain a constant that the industry has to get a grip of," said Youngson.

When huge corporates like BP and a range of other energy giants cut jobs and said they would pull out of the market, it gave opportunities to smaller petroleum companies or foreign investors to enter the sector. In August this year, China took over Scotland's oil production and now controls two of the North Sea’s biggest oilfields.

If you pop into a field with only 5 years of life left, paying and dealing for decommissioning can be a big issue for people

Analysis of China National Offshore Oil Corporation's (CNOOC) accounts, a CNOOC-owned company Nexen extracts nearly 200,000 barrels of oil per day across those two fields. This makes it the largest producer in the area.

But since decommissioning has to happen, when BI asked Youngson if this could affect new players entering the industry, Youngson "this is exactly the issue."

"The companies coming into acquiring assets don't have the balance sheet or appetite for new costs. There is also an issue over the level of fairness. If you pop into a field with only five years of life left, paying and dealing for decommissioning can be a big issue for people.

"However, on the other side, if you sold the assets to someone and then suddenly you are being asked to send a big cheque in the post 10 years later for decommissioning, this is problem too. It is simply not transparent at the moment."

NOW WATCH: The real estate tricks billionaires use to sell their penthouses faster and for more money

See Also:

Yahoo Finance

Yahoo Finance