Bill Gates' Stock Portfolio

- By Ben Reynolds

(Published Jan. 20 by Bob Ciura)

Bill Gates (Trades, Portfolio) is the richest man in the world. The Bill & Melinda Gates Foundation has a massive $18.5 billion endowment.

Warning! GuruFocus has detected 4 Warning Sign with BRK.A. Click here to check it out.

The intrinsic value of BRK.A

That kind of wealth is something of which the vast majority of us can only dream. However, there is one similarity between the everyday investor and the wealthiest person on the planet: We're all looking for good stocks to buy and hold for the long term.

Gates is a personal friend of Warren Buffett (Trades, Portfolio) so it's no surprise to see the Bill & Melinda Gates Foundation take a similar approach to investing as the Oracle of Omaha.

You can see Buffett's top 20 high-yield dividend stocks analyzed here.

The Bill & Melinda Gates Foundation owns several highly profitable companies with sustainable competitive advantages. Many of the stocks also pay dividends to shareholders and grow their dividend payouts over time.

Without further ado, here are the top 16 stocks held by the Bill & Melinda Gates Foundation.

No. 1: Berkshire Hathaway

Dividend yield: N/A.

Percentage of Gates' portfolio: 58%.

Price-earnings (P/E) ratio: 17.

Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) stock takes up the majority of Gates' investment portfolio, and it is easy to see why. It's safe to say the money is in good hands.

Berkshire, under Buffett's stewardship, grew from a struggling textile manufacturer into one of the largest conglomerates in the world.

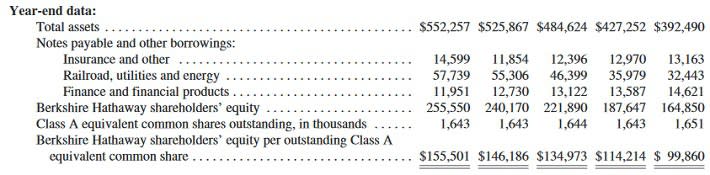

Since Berkshire's current management team took the helm 51 years ago, the company's per-share book value rose from $19 to $155,501, a rate of 19.2% compounded annually.

Today, Berkshire is a global giant. It owns and operates dozens of businesses with a hand in nearly every major industry including insurance, railroads, energy, finance, manufacturing and retailing.

A breakdown of Berkshire's various operating segments is as follows:

Sales and Services (51% of revenue).

Insurance Premiums (20% of revenue).

Railroad, Utilities, and Energy (19% of revenue).

Interest, Dividend, and Other Investment Income (2% of revenue).

Financial Product Sales (3% of revenue).

Investment and Derivatives (5% of revenue).

In Berkshire's annual letters to shareholders, Buffett typically evaluates the company's performance in terms of book value. Book value is an accounting metric that measures a company's assets minus its liabilities.

The resulting difference is a company's book value. This is a proxy for the intrinsic value of a firm, which Buffett believes to be the most important financial metric.

Over the past five years, Berkshire has done a great job growing assets faster than liabilities, which builds shareholder wealth.

Source: 2015 Annual Report, page 36

Berkshire doesn't pay a dividend to shareholders. Buffett and his partner Charlie Munger (Trades, Portfolio) have always contended that they can create wealth at a higher rate than the dividend would provide to shareholders.

There are few managers who can say that and get away with it, but Buffett and Munger might be the only two who can.

While Berkshire stock may not be attractive for investors who want dividend income, there are few companies that have a track record nearly as successful as Berkshire.

No. 2: Waste Management

Dividend yield: 2.4%.

Percentage of Gates' portfolio: 6.5%.

P/E ratio: 27.

Waste Management Inc. (WM) is the embodiment of a company with a wide economic moat. It operates in waste removal and recycling services.

This is a highly concentrated industry with only a few companies controlling the majority of the market.

Waste Management services many different industry groups, which are organized as follows:

Collection (55% of revenue).

Landfill (19% of revenue).

Transfer (9% of revenue).

Recycling (8% of revenue).

Other (9% of revenue).

The company is performing well. Over the first three quarters of 2016, revenue and earnings per share increased 3.6% and 8.8%.

Waste Management operates in a stable and necessary industry. Waste removal is extremely capital intensive and is subject to significant regulatory oversight.

These competitive advantages allow Waste Management to generate steady profits even when the U.S. economy enters recession.

Source: JPMorgan Industrials Conference presentation, page 14

Waste Management's high margins and consistent cash flow put the company in a strong financial position. It has reduced its debt significantly in the past several years.

Source: JPMorgan Industrials Conference presentation, page 17

With less debt to worry about, there is more cash flow left over each year. It uses this cash flow to invest in the business and for shareholder cash returns.

Source: JP Morgan Industrials Conference presentation, page

On Dec. 15, the company raised its dividend by 4% and added $750 million to its share repurchase program.

Waste Management is a Dividend Achiever. Dividend Achievers are companies that have raised dividends for 10 years or more.

You can see the entire list of all 272 Dividend Achievers here.

For its part, Waste Management has increased its dividend for 14 consecutive years. The stock currently has a 2.5% dividend yield.

Waste Management isn't a cheap stock. Its share price has soared over the past several years. But it still has an above-average dividend yield, and the company is growing.

No. 3: Canadian National Railway

Dividend yield: 1.6%.

Percentage of Gates' portfolio: 6.1%.

P/E ratio: 20.

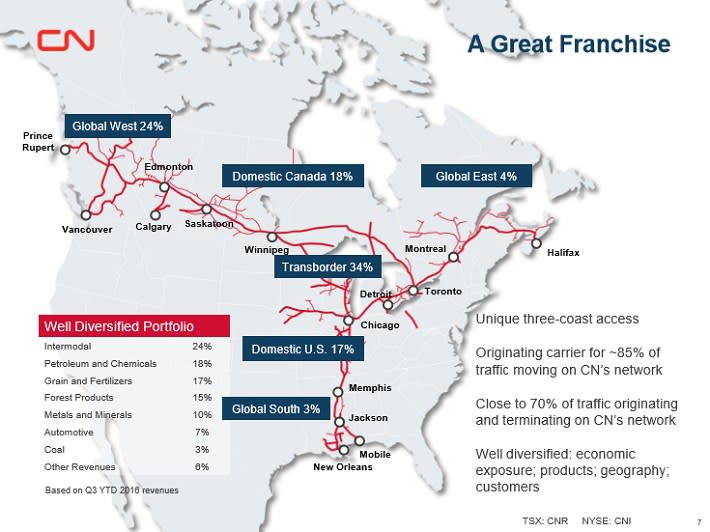

Canadian National Railway (CNI) is the only transcontinental railway in North America. It has a massive network, which includes more than 19,000 miles that spans Canada and the U.S.

Source: Investor Presentation, page 7

The company offers a full range of services including rail, intermodal, trucking, warehousing and distribution.

Canadian National has an excellent business. From 2011 to 2015, it grew revenue and adjusted earnings per share at a 9% and 16% compound annual rate.

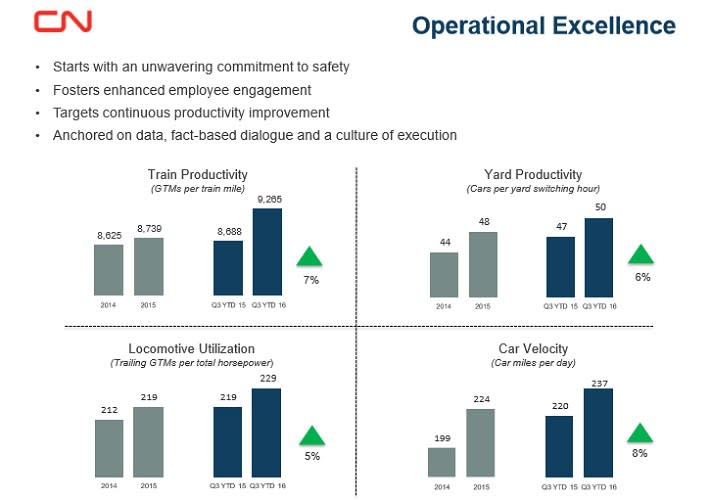

It generated this growth from executing a number of operational strategies. First, it placed focus on improving productivity.

Source: Investor Presentation, page 9

This has allowed the company to boost volumes and revenue.

Furthermore, Canadian National produces industry-leading margins, thanks to its lean cost structure.

Source: Investor Presentation, page 12

One factor negatively impacting the company right now is that it is exposed to commodities, specifically coal. Coal revenue declined 32% in the third quarter, year over year.

Moreover, revenue for energy and mining fell 13% and 20% last quarter.

That being said, the company's diverse customer base and operational excellence more than offset the declines in its commodity-based segments.

Canadian National's operating expenses declined 7% last quarter. Operating ratio reached a record 53.3% last quarter.

Free cash flow over the first three quarters of 2016 remained steady with the same nine-month period in 2015. The company expects to post flat adjusted earnings per share in 2016.

This in itself would be a notable accomplishment given the steep declines in oil and coal shipments.

With its hefty margins, Canadian National generates significant cash flow, and its shareholder-friendly management actively deploys this cash flow to investors.

Dividends per share have nearly doubled in that same five-year period. The company is one of the best dividend growth stocks in Canada.

Canadian National certainly isn't a flashy business. Railroads may be overlooked by many investors for being boring, but Canadian National's shareholder returns prove that boring can be beautiful.

No. 4: Caterpillar

Dividend yield: 3.3%.

Percentage of Gates' portfolio: 5.4%.

P/E ratio: 31 (forward P/E ratio).

Caterpillar (CAT) is a strong brand with a dominant industry position. It manufactures heavy machinery, mostly to the construction and mining sectors.

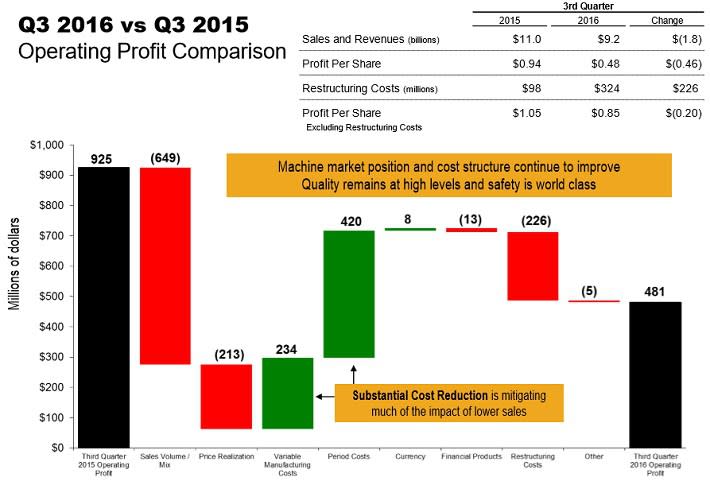

2016 was a year to forget for Caterpillar. The sharp downturn in precious metals prices weighed heavily on demand for heavy machinery. For example, Caterpillar's earnings per share fell by nearly half in the third quarter.

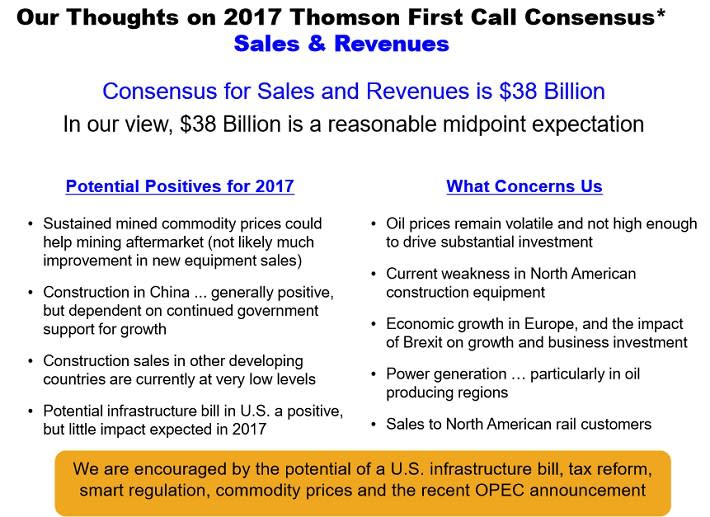

Source: Credit Suisse Industrials Conference presentation, page 4

Separately Caterpillar is being negatively impacted by slowing growth in emerging markets and the strong U.S. dollar. As a result, full-year revenue is expected to decline 29% in 2016.

These headwinds are expected to persist in 2017 although there is potential for a recovery.

Source: Credit Suisse Industrials Conference presentation, page 7

Fortunately, there may be a light at the end of the tunnel.

There are hopes that Caterpillar will return to growth in 2017. One catalyst could be a renewed emphasis on fiscal stimulus in the U.S.

The incoming administration may pursue policies to stimulate the U.S. economy. This could include more infrastructure spending and perhaps a push for more lax regulations on the energy and mining industries, which are among Caterpillar's biggest customers.

Separately higher commodity prices would be a major boost.

In the meantime, investors are paid well to wait for Caterpillar's turnaround to materialize, and the company enjoys economies of scale. This provides it with the financial flexibility to cut costs so that it can maintain its dividend.

Caterpillar forecasts over $1 billion in cost savings this year alone, mostly in manufacturing and headcount reductions.

The company may not raise its dividend until economic conditions improve, but its solid 3.3% dividend yield is secure.

No. 5: Walmart Stores

Dividend yield: 3%.

Percentage of Gates' portfolio: 4.5%.

P/E ratio: 15.

Walmart is another great example of a company with durable competitive advantages. It is the largest retailer in the world with annual revenue of approximately $500 billion.

The company came to dominate the retail industry by keeping a laserlike focus on reducing costs everywhere, particularly in supply chain and distribution.

This allowed Walmart to offer consistently lower prices than its competitors ever could. In turn, it steadily devoured market share until it became the giant it is today.

Walmart's growth has slowed over the past year. The company is investing billions to pay higher wages, and renovate its stores.

This will limit Walmart's earnings growth. As a result, some might assume Walmart's best days are behind it. After all, a behemoth as large as Walmart will naturally have difficulty continuing to grow at a rapid pace.

But there are still growth catalysts for the company to look forward to, specifically in e-commerce and small stores.

Walmart acquired Jet.com for $3 billion to boost its e-commerce business, especially in emerging markets like China.

Source: Investor Community Meeting presentation, page 4

E-commerce revenue growth accelerated throughout the year. In the third fiscal quarter, e-commerce sales increased 20.6% year over year.

Domestic growth is starting to pick up again, thanks to e-commerce and also Walmart's small-store franchise.

The company's Neighborhood Markets small-store banner grew comparable sales by 5.2% last quarter, well above the 1.2% companywide growth rate.

Walmart remains highly profitable and very resistant to recessions.

Consumers tend to scale down to discount retail when times are tight, which is why Walmart continued to grow, even during the Great Recession.

This allows Walmart to pay a solid 3% dividend yield and raise its dividend each year like clockwork. Walmart has raised its dividend for 43 years in a row.

Its long history of dividend growth qualifies Walmart as a Dividend Aristocrat, a group of companies in the Standard & Poor's 500 that have raised dividends for at least 25 consecutive years.

You can see the entire list of all 50 Dividend Aristocrats here.

The stock has an appealing P/E ratio of 14.

No. 6: Ecolab

Dividend yield: 1.3%.

Percentage of Gates' portfolio: 2.9%.

P/E ratio: 32.

Ecolab (ECL) is a commercial cleaning products firm. It operates in three segments:

Global Industrial (36% of revenue).

Global Institutional (35% of revenue).

Global Energy (23% of revenue).

Other (6% of revenue).

The Other category includes pest elimination and equipment care.

The Global Industrial group provides water treatment, cleaning and sanitation services to large industrial firms. The industrial customer base is made up primarily of food and beverage, manufacturing, chemical and mining companies.

The Global Institutional business services specialized products and services to the foodservice, hospitality, lodging, health care and retail industries. This segment manufactures products for things like laundry and housekeeping.

The Global Energy segment holds the company's Nalco brand. Nalco provides chemical and water treatment services to the oil and gas industry.

Going forward, Ecolab is focusing on international growth. Expanding in new markets has been a core priority for the company in recent years. Nearly half the company's revenue comes from outside the U.S.

One of the best aspects of Ecolab's business is its consistency. Providing cleaning products and services is a steady business. Customers need Ecolab's services, regardless of the condition of the U.S. economy.

This means Ecolab is a recession-resistant business. In fact, the company grew earnings per share each year from 2007 to 2010. It didn't skip a beat, even during the worst recession since the Great Depression.

Its reliable earnings growth allows the company to raise its dividend each year. In fact, Ecolab has paid a dividend for 80 years without interruption.

It raises its dividend regularly. The company recently passed along a 6% dividend increase, marking its 25th consecutive year of dividend increases.

Ecolab qualifies as a Dividend Aristocrat.

The stock has a dividend yield of just 1.2%, which is on the low side. Its valuation is a bit high with a P/E ratio above 30.

Investors may want to wait for a better buying opportunity, but Ecolab is a high-quality company. It is the largest operator in its industry, which provides competitive advantages.

No. 7: FedEx

Dividend yield: 0.9%.

Percentage of Gates' portfolio: 2.9%.

P/E ratio: 27.

FedEx (FDX) is yet another example of a company with a strong economic moat. It operates in global logistics, essentially an oligopoly.

It would be extremely difficult financially for a company to build out a fleet large enough to compete on the scale of FedEx.

FedEx generates more than $50 billion in annual revenue. It has more than 400,000 employees and services more than 220 nations and territories around the world.

The company has a diversified business model. It operates the following four segments:

Express (52% of revenue).

Ground (33% of revenue).

Freight (12% of revenue).

Services (3% of revenue).

FedEx maintains a modest outlook for the global economy going forward. Economic growth is expected to be weak but remain positive.

One growth catalyst that will help fuel future growth is FedEx's booming ground business, thanks to e-commerce.

Source: Roadshow Presentation, page 8

FedEx notes the e-commerce market is growing at a 16% annual rate. Plus the company has captured additional revenue market share gains in ground shipping for 17 consecutive years.

In addition, the company is countering sluggish global economic growth by cutting costs. Margins are up consistently over the past several years.

Source: Roadshow Presentation, page 5

One downside for FedEx is that it has a very low dividend yield of less than 1%. It yields less than half the 2% average yield in the S&P 500.

The company helps make up for this with dividend growth. For example, it raised its dividend by 60% in 2016.

While FedEx might not be an appealing stock to income investors, it is a high-quality company with a strong business model.

Earnings per share are expected to rise 21% in fiscal 2016. With this kind of earnings growth, FedEx stock can generate more than satisfactory returns, even without a significant dividend yield.

No. 8: Crown Castle International

Dividend yield: 4.3%.

Percentage of Gates' portfolio: 2.7%.

P/E ratio: 17.

Crown Castle International Corp. (CCI) is a real estate investment trust (REIT). It provides infrastructure assets to wireless communications carriers. It has approximately 40,000 towers and 26,500 route miles of fiber supporting small cells.

The company operates in an appealing area because wireless communications is a growth industry. U.S. consumers can't do without their smartphones, and Crown Castle is one of the companies reaping the benefits.

Crown Castle has been investing additional capital in its infrastructure in several major U.S. markets. One example is Chicago.

Source: 3Q Earnings presentation, page 4

This investment across the U.S. was done to accommodate higher demand for wireless services, and the investment has paid off with strong growth rates.

It is enjoying higher occupancy and rising rents as well. Revenue and adjusted funds from operation (FFO) increased 6% and 17% in the third quarter.

Management has an optimistic forecast for the next two years based on strong growth for the wireless industry. Higher leasing rates and price increases should fuel solid growth in 2016 and 2017.

Revenue is expected to increase 7% in 2016 and 3% in 2017. Adjusted FFO is expected to grow 10% this year and 6% in 2017.

One consideration for investors going forward is the risk of rising interest rates. REITs like Crown Castle rely heavily on debt financing.

When interest rates rise, so too does the cost of capital. This could inhibit the company's growth in future quarters.

Still, the company operates in an industry with healthy fundamentals. It should be able to continue growing above its cost of capital and create wealth for shareholders.

Crown Castle is a strong stock for dividends and dividend growth. Its current yield exceeds 4%, and it recently raised its dividend by 7%.

No. 9: United Parcel Service

Dividend yield: 2.7%.

Percentage of Gates' portfolio: 2.7%.

P/E ratio: 21.

The global logistics industry is dominated by three companies. FedEx is one, and so is UPS.

In fact, UPS is the industry leader; its market capitalization is $100 billion, which is double FedEx's market cap.

Like FedEx, UPS is benefiting from e-commerce. UPS' domestic package revenue increased 4.8% in the third quarter year over year. This drove 3.6% earnings per share growth for the period.

Another emerging growth catalyst for UPS is international growth.

Source: R.W. Baird 2016 Industrials Conference, page 9

UPS is growing international revenue and a rapid pace, and it has significantly improved margins in its overseas operations.

For example, UPS' international segment now represents 28% of its operating profit, up from just 6% in 2000.

Lastly, UPS plans to grow through acquisitions. The company recently acquired Marken, a supply chain solutions provider to the life sciences industry.

Source: R.W. Baird 2016 Industrials Conference, page 5

The acquisition further diversifies UPS' customer base by expanding its presence in health care and pharmaceutical logistics.

One concern for investors in 2017 is the risk of global recession. UPS is widely viewed as an economic bellwether.

Global uncertainty levels rose as 2016 drew to a close. If the economy enters recession in 2017 or beyond, it would significant affect UPS.

Barring a global recession, UPS has a positive outlook.

UPS stock is reasonably valued and has a solid dividend. The stock has a P/E ratio of 20. It is cheaper than the S&P 500, which has an average P/E ratio of 26.

UPS stock has a 2.7% dividend yield. This is a big advantage over main rival FedEx, which has a much smaller dividend yield.

UPS has a long history of paying consistent dividends. It has either increased or maintained its cash dividend for 47 years. Its dividend has risen more than fourfold since 2000.

No. 10: Coca-Cola FEMSA SAB

Dividend yield: 3%.

Percentage of Gates' portfolio: 2.5%.

P/E ratio: 28.

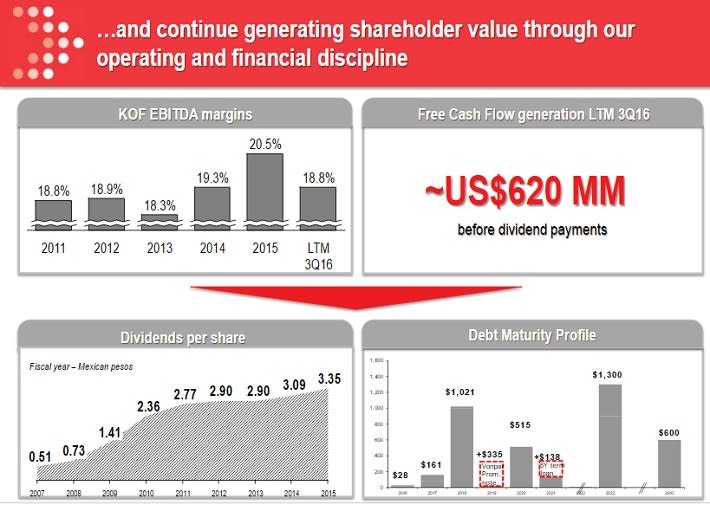

Coca-Cola FEMSA (KOF) produces, markets and distributes Coca-Cola (KO) beverages. It offers the full line of sparkling and still beverages.

It sells its products through distribution centers and retailers in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela, Brazil, Argentina and the Philippines.

Coca-Cola FEMSA is the largest franchise bottler in the world. The stock is an excellent way to gain exposure to two appealing emerging markets: Latin America and South Asia.

Source: Investor Kit presentation, page 2

These markets are growing at high rates for the company. Over the first nine months of 2016, total revenue and operating cash flow rose 7.8% and 6.6%.

Revenue growth was driven largely by price increases.

Coca-Cola FEMSA is in a strong financial position with low levels of debt and positive free cash flow. In addition, carrying the Coca-Cola brand allows it to generate high margins and enjoy pricing power.

Source: Investor Kit presentation, page 23

This allows the company to consistently raise its dividend each year.

One risk factor on which investors should keep an eye going forward is a potential change in consumer preferences. Coca-Cola FEMSA sells and distributes water and noncarbonated beverages, but more than 75% of the company's annual sales come from carbonated soft drinks.

The emerging markets are high-growth economies with expanding middle classes. Citizens are enjoying rising standards of living.

Once these markets become more mature, there could be a risk of consumers changing their dietary habits. Soda sales have declined in the U.S. for more than a decade.

Coca-Cola's growth is struggling from this trend, which could become a challenge for Coca-Cola FEMSA moving forward.

That being said, Coca-Cola FEMSA is still firmly in high-growth mode.

No. 11: Grupo Televisa SAB

Dividend Yield: 0.5%.

Percentage of Bill Gates (Trades, Portfolio)' Portfolio: 2.3%.

P/E ratio: 31 (Forward P/E).

Grupo Televisa SAB (TV) is a diversified media conglomerate. In all, Televisa operates 26 pay-TV brands and television networks, cable operators and over-the-top services in over 50 countries.

In the U.S., it operates Univision. In addition, Televisa owns a majority interest in Sky, a satellite television provider in Mexico, the Dominican Republic and Central America.

Televisa also has operations in magazine publishing, radio broadcasting, professional sports, live entertainment, film production and gaming.

It operates four business segments:

Content (36% of revenue).

Sky (22% of revenue).

Cable (33% of revenue).

Other (9% of revenue).

The company is enjoying strong growth, thanks largely to high economic growth in Mexico and several Latin American markets.

In 2015, net sales and segment operating income increased 9.9% and 10.6%.

Growth has continued in 2016. Net sales and segment operating income rose 6.6% and 4.1% in the third quarter.

The company's strongest businesses are Sky, Cable and Other, each of which posted double-digit revenue growth in the third quarter.

Content segment revenue was flat in the third quarter although it did see 20% growth in network subscription revenue. However, this was offset by declines in advertising and licensing.

The licensing business was affected by difficult comparisons. For example, licensing revenue fell 10% last quarter for Univision, since the comparable 2015 quarter included a major soccer tournament in Mexico.

Televisa is a strong brand and has a fundamental advantage, thanks to its geographic focus. As a result, it is a compelling growth stock, for investors interested in international diversification.

While it does not pay much of a dividend to shareholders, Televisa's return potential is still significant, thanks to its rapid growth.

No. 12: Walgreens Boots Alliance

Dividend yield: 1.8%.

Percentage of Gates' portfolio: 1.5%.

P/E ratio: 22.

It is no surprise to see Walgreens Boots Alliance (WBA) on the list of Gates' holdings because it is an industry giant.

Walgreens Boots Alliance came together in the $9 billion merger of Walgreens and Alliance Boots in 2014.

The merger was a great move for the two companies. Walgreens is the biggest pharmacy operator in the U.S., and Alliance Boots was a top European pharmacy and distributor.

When the two joined forces, it allowed the combined company to reach a global scale. Walgreens Boots now has three separate businesses, each of which are very large:

Retail Pharmacy USA ($83.8 billion in annual sales, 70% of revenue).

Retail Pharmacy International ($13.3 billion in annual sales, 11% of revenue).

Pharmaceutical Wholesale ($22.6 billion in annual sales, 19% of revenue).

The company performed well in fiscal 2016. Revenue and earnings per share, adjusted for currency and non-recurring costs, increased 16% and 18%.

It is off to a good start in fiscal 2017 as well, thanks largely to the U.S. retail pharmacy operation. That segment posted 2.5% growth in pharmacy sales and 3% prescription growth in the 2017 first fiscal quarter.

Going forward, Walgreens Boots intends to invest more in its beauty departments to help drive higher traffic.

Source: Q1 2017 Earnings presentation, page 8

There could be more transformational deals in the near future. The company has a pending deal to acquire fierce competitor Rite Aid Corp. (RAD) for $17 billion.

Walgreens Boots has a below-average dividend yield, and the P/E ratio significantly exceeds the retail industry average.

One of Buffett's favorite sayings is that price is what you pay, value is what you get. Walgreens Boots enjoys several competitive advantages, high profit margins and a strong brand.

These qualities make it a valuable stock to own as part of a dividend growth portfolio.

No. 13: Liberty Global Group

Dividend yield: N/A.

Percentage of Gates' portfolio: 1%.

P/E ratio: 23.

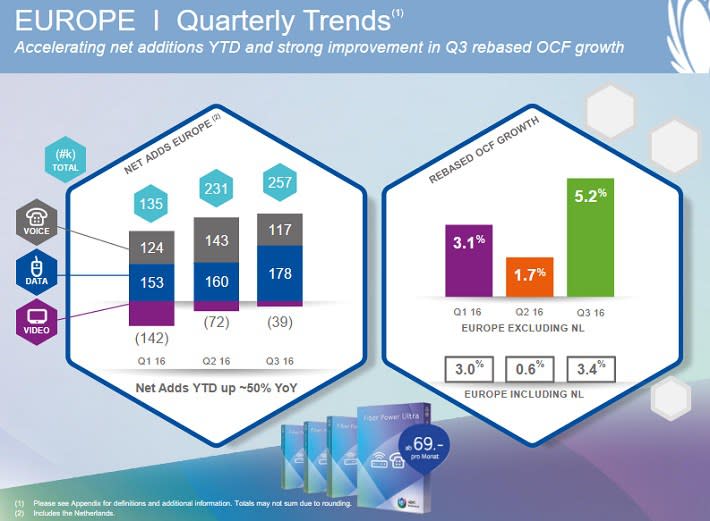

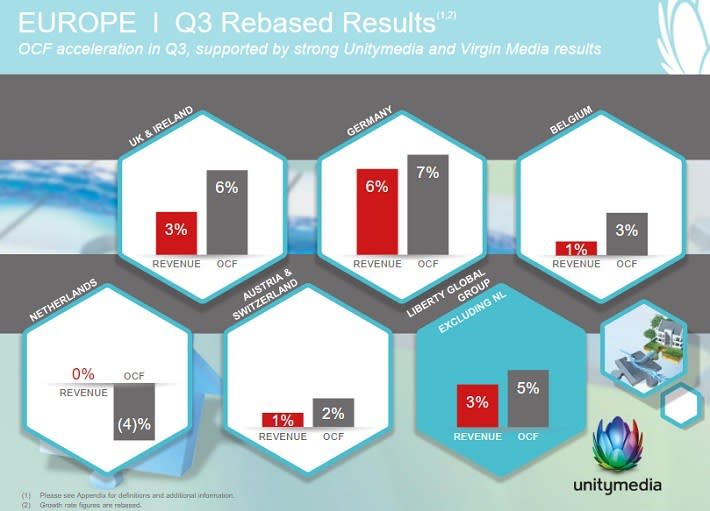

Liberty Global (LBTYA) is the largest international television and Internet provider. In all, the company operates in 30 countries and generates more than $20 billion in annual revenue.

The company and its various subsidiaries provide service to 29 million customers.

Its core brand in Europe is Virgin Media. It also has the Ziggo, Unitymedia, Telenet and UPC brands.

Liberty Global is split up into two businesses, which are Liberty Global Group and LiLAC. Liberty Global includes its European operations, and LiLAC houses its Latin America and Caribbean business.

Each segment - Liberty Global Group and LiLAC - have three share classes each. This share class corresponds to the Liberty Global Group.

The European economy is on shaky ground broadly speaking with weak economic growth and the uncertainty presented by the Brexit vote.

But television and Internet is a growth industry because of the low levels of market penetration. There are still many parts of Europe with untapped growth potential.

In turn, Liberty Global is rapidly adding customers.

Source: Q3 Earnings Presentation, page 5

Year-to-date additions rose 50% through the third quarter.

As far as future growth is concerned, there is plenty of runway left. Liberty expects to add more than 5 million new households from 2016 to 2018.

This aggressive expansion will require significant capital investment. The company plans to spend $2 billion over the next two years to build up its customer base, but the payoff is growth.

Source: Q3 Earnings Presentation, page 15

Liberty Global realized growth in revenue and cash flow over the first three quarters of 2016. Growth accelerated as the year went by with the fourth quarter expected to be the highest-growth period for the year.

The company is investing large amounts of capital. There will be little cash flow to spare over the next two years, which is why the stock does not pay a dividend.

Investors looking for income may want to select a different telecom stock that pays dividends, and there are many to choose from.

But Liberty Global could conceivably start paying a dividend at some point in the not-too-distant future, once its aggressive expansion period ends.

In the meantime, the stock is reasonably valued and could generate double-digit earnings growth. Revenue is growing at a high rate, and Liberty Global will use more than $2 billion to buy back stock next year.

This earnings growth means investors can earn satisfactory returns moving forward even without the benefit of a dividend.

No. 14: AutoNation

Dividend yield: N/A.

Percentage of Gates' portfolio: 0.5%.

P/E ratio: 13.

AutoNation Inc. (AN) is America's largest automotive retailer. It owns and operates over 360 new vehicle franchises in 16 states.

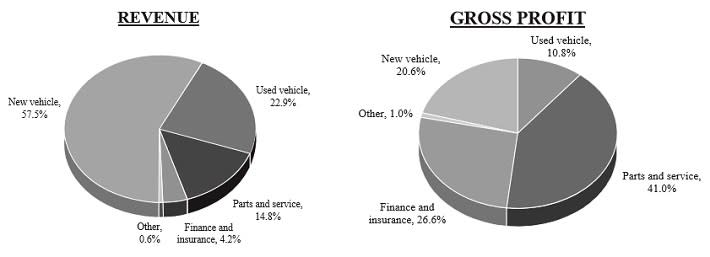

The company operates five segments:

Source: 2015 Annual Report, page 5

AutoNation has been successful growing the business over the past five years. From 2011 to 2015, sales and earnings per share increased by 8.5% and 15% per year.

The company has benefited greatly from a strong operating environment. Auto sales are near a record, driven by attractive product offerings, access to affordable credit thanks to low interest rates and lower fuel prices.

The market climate is supportive of auto sales, which is why new and used vehicle sales both increased 9% for AutoNation in 2015.

Going forward, the company is in the process of rolling out its Brand Extension strategy. This involves further expanding its stand-alone preowned vehicle sales and service centers, branded parts and accessories, branded collision centers and its auto auction businesses.

To help accomplish this, AutoNation recently announced the acquisition of three Premium Luxury franchises, one collision center and three Premium Luxury franchise add points.

The assets acquired hold combined annual revenue potential of at least $430 million.

Separately, the company is building its digital channel platform AutoNation Express. Digital channel sales now account for nearly 30% of vehicle sales.

AutoNation does not pay a dividend, but it does return cash to shareholders through stock buybacks. The company has $316 million left on its current share price authorization, which amounts to approximately 6% of its market capitalization.

All things being equal, AutoNation's buybacks will boost earnings per share by an additional 6% over the next year.

The stock is cheap at a P/E ratio of 13.

As a result, the combination of earnings growth and expansion of the valuation multiple, could lead to double-digit annualized returns going forward.

No. 15: Liberty LiLAC Group

Dividend yield: N/A.

Percentage of Gates' portfolio: 0.16%.

P/E ratio: 23.

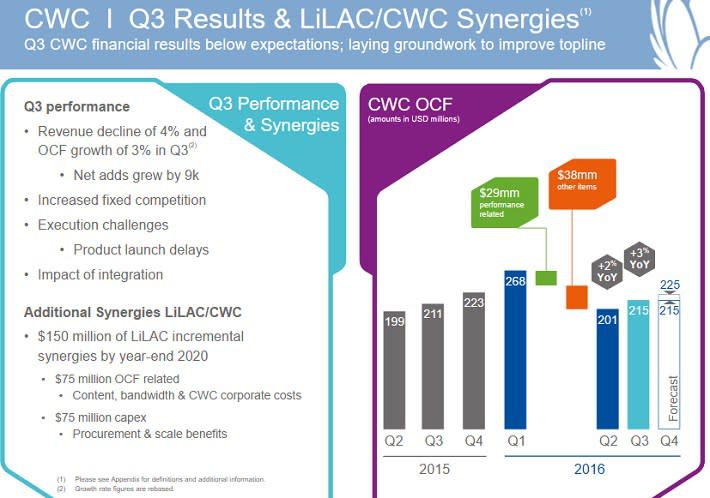

This share class corresponds to Liberty Global's LiLAC (LILAK) operating segment. LiLAC includes Liberty Global's Latin America and Caribbean businesses under the brands VTR, Flow, Liberty, Mas Movil and BTC.

These are currently a small part of the overall business. LiLAC represents approximately 13% of Liberty Global's total annual revenue, but there is a lot of growth potential up ahead.

LiLAC is poised to become a much bigger part of the company going forward as a result of the 2016 acquisition of Cable & Wireless Communications. The $7.4 billion deal added more than 10 million new customers in Latin America and the Caribbean.

The CWC acquisition presents cost synergy opportunities.

Source: Q3 Earnings Presentation, page 12

As a result, LiLAC's year-to-date revenue and operating cash flow doubled year over year through the third quarter.

Another growth catalyst for LiLAC is to increase bundling of services. Nearly half of LiLAC's customers purchase only one service. The company will seek to expand on this moving forward.

Source: Investor relations

Bundling services is lucrative for telecommunications providers, which is why the practice is so common in the U.S.

Liberty Global has a much higher percentage of triple-play customers in Europe, and it has served the company well.

Like Liberty Global, LiLAC uses its cash flow to reinvest in the business and support its balance sheet. It does not pay a dividend.

That being said, LiLAC also offers investors attractive return potential, from its future revenue and earnings growth.

The company expects to increase operating cash flow by 7% to 9% each year over the next few years.

No. 16: Arcos Dorados Holdings

Dividend yield: N/A.

Percentage of Gates' portfolio: 0.1%.

P/E ratio: 18.

Last but not least is Arcos Dorados (ARCO). Investors might not immediately recognize Arcos Dorados by its name, but they will certainly understand its business.

Arcos Dorados is a holding company. Collectively, it is the largest McDonald's (MCD) franchisee in the world in terms of number of restaurants.

It has the exclusive right to own and operate McDonald's restaurants in 20 Latin American and Caribbean countries and territories. In all, it operates or franchises over 2,100 McDonald's restaurants.

Its geographic split is as follows:

Brazil (45% of revenue).

South Latin America Division (28% of revenue).

Caribbean (14% of revenue).

North Latin America Division (13% of revenue).

Many of the countries in which Arcos Dorados operates are emerging markets. For example, sales in South Latin America and the Caribbean rose 24% and 27.6% through the first nine months of 2016.

One downside for Arcos Dorados investors is that the stock does not pay a dividend. This might seem like a deal breaker since McDonald's itself is a legendary dividend stock.

The upside for Arcos Dorados is that it is growing much faster than McDonald's. For example, on a constant-currency basis, revenue rose 15.3% in the third quarter.

Some of this growth was due to aggressive new restaurant openings. In the past four reported quarters, Arcos Dorados opened 33 new restaurants and 133 Dessert Centers.

Comparable-restaurant sales, a key metric for restaurant chains that measures growth at locations open at least one year, increased 11.3% last quarter.

Double-digit comparable sales growth is virtually unheard of in the U.S.

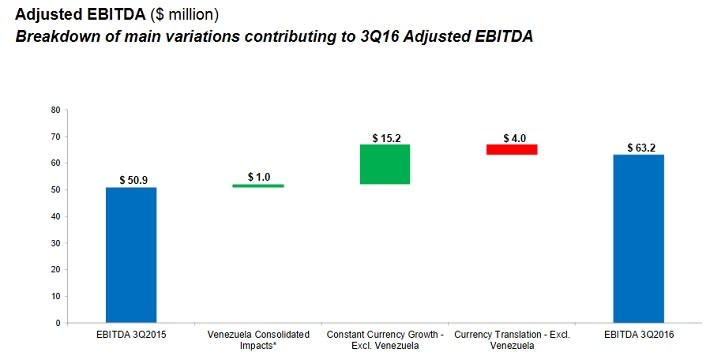

Overall adjusted EBITDA grew 24% last quarter.

Source: Q3 Results, page 3

A key factor boosting EBITDA is that, even with sales growing at a rapid pace, Arcos Dorados kept general and administrative costs flat. This indicates the company is doing a very good job boosting productivity.

Disclosure: I am not long any of the stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Sign with BRK.A. Click here to check it out.

The intrinsic value of BRK.A

Yahoo Finance

Yahoo Finance