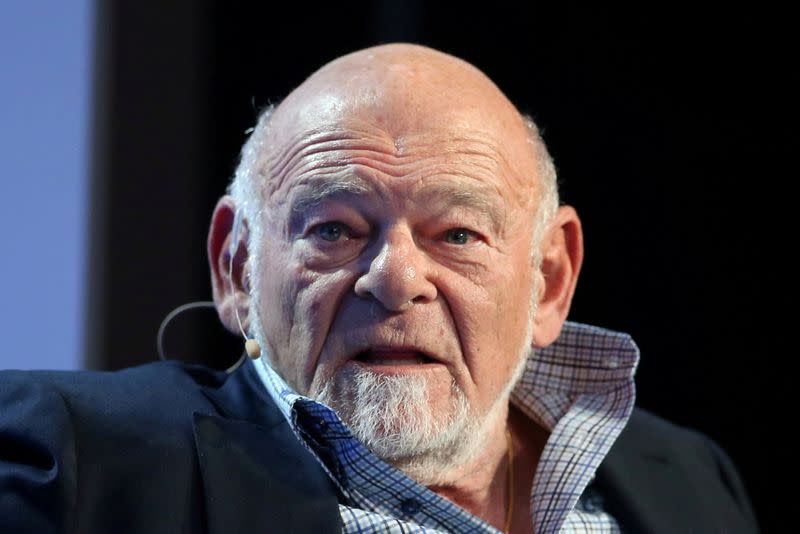

Sam Zell, billionaire real estate investor, dies at 81

By Niket Nishant

(Reuters) -Billionaire Sam Zell, who built a real estate empire and was known for his bets on distressed assets, died at the age of 81 due to complications from a recent illness, a statement from his private investment firm said on Thursday.

Born in 1941 to Polish parents who escaped to the United States during the German invasion of Poland, Zell took a deep interest in real estate very early on.

He began his career managing student housing apartments as an undergraduate at the University of Michigan and founded his chief investment vehicle, Equity Group Investments, in 1968.

Besides real estate, his firm also invested in manufacturing, travel, retail, healthcare and energy businesses.

Zell played a key role in popularizing the structure of real estate investment trusts (REITs) that involved leasing and collecting rent on properties and distributing profit to investors as dividend in the 1990s.

One of his REITs, Equity Office Properties Trust, was the first to be a part of the benchmark S&P 500 index. It was later sold to asset management giant Blackstone Inc for $39 billion in one of the largest real estate deals ever.

Another of his ambitious ventures, however, went belly up. He took media giant Tribune Co private in an $8.2 billion highly-leveraged deal that saddled the company with too much debt.

Tribune filed for bankruptcy protection a year later during the global financial crisis after advertising revenue tumbled as more readers began getting their news online. Zell famously dubbed the acquisition a "deal from hell".

The Chicago property czar had a net worth of $5.2 billion, according to Forbes.

An outspoken businessman, Zell had a passion for motorcycles, which led him to form a group called Zell's Angels with whom he would take annual motorcycle rides.

In 2017, he published a book titled "Am I Being Too Subtle? Straight Talk From a Business Rebel", in which he talked about his experiences.

(Reporting by Niket Nishant and Mehnaz Yasmin in Bengaluru; Editing by Pooja Desai and Arun Koyyur)

Yahoo Finance

Yahoo Finance