Billionaires, showrooms and mega-deals: Inside London’s private jet scene

From glitzy Mayfair showrooms to the City’s secretive airports – Guy Taylor takes a closer look inside London’s private jet scene

Step onto the jet-black marble floor of Steve Varsano’s Mayfair showroom and you begin to get a glimpse into the parallel life of London’s super rich.

Varsano, 67, runs The Jet Business, which he says is the only place in the world where you can stroll in off the street and buy a multimillion pound private jet.

The celebrities and high-profile businessmen who venture into his Park Lane offices can quite literally sit in one as they mull their options.

Part of an Airbus A319 fuselage overlooks the street, complete with cream-coloured sofas, a smooth velvet carpet and a backgammon set. Looking out of the airplane windows, a computer generated image shows clouds gently passing by high in the sky.

“If you look at just new airplanes, the cheapest jet is probably in the $4m or $5m range and the most expensive one is $85m,” Varsano told City A.M.

“I’d say on average, when you look at the pre-owned market and what trades in the world, I’d say the average airplane is probably less than $10m.”

His showroom fits the bill of the private jet industry stereotype; the New Jersey-born businessman describes long days chatting with ultra-rich clients from the Middle East, China and the US, all looking to shave a few hours off their travel time.

The US has the biggest private jet market, but it makes sense that Varsano picked London because it is one of the world’s busiest hubs for private aviation.

Why is London so popular?

Cityfolk make use of Luton and the smaller, more secretive runways of Biggin Hill and Farnborough, which have become some of the most popular airports for private jet travel in Europe.

There have been over 200,000 private jet flights to and from London airports since 2019, according to data shared with City A.M. by Flightradar24.

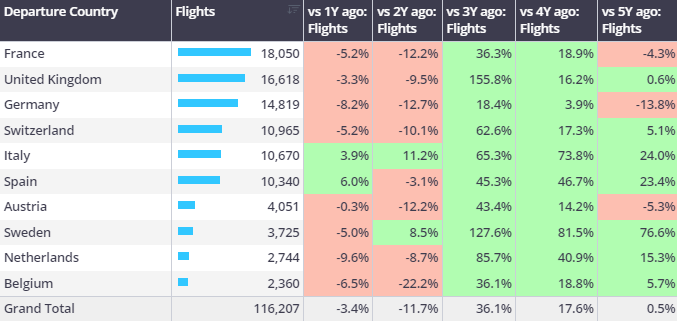

Analysis from the aviation intelligence firm WingX places the UK as a whole as the second most popular departure country in Europe.

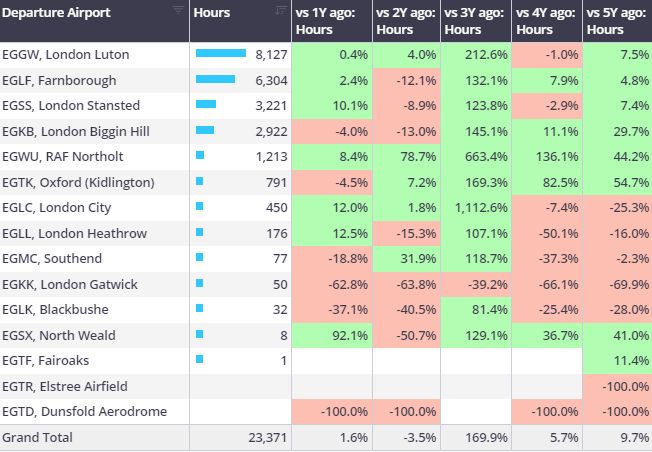

Between January and the end of March, Luton accounted for the most hours flown at 8,127, followed closely by Farnborough at 6,304, London Stansted at 3,221 and Biggin Hill, at 2,922. Flying hours at all four have increased over the last five years, with Biggin Hill rising a whopping 29.7 per cent.

“Why those two in particular are so good is because they’re dedicated to business aviation… that makes the experience and ease for private jet commuters all the more unique and better,” Rohan Mark Jayawardene, chief executive of the private jet charter firm Diamontejets, said, referring to Farnborough and Biggin Hill.

Biggin Hill airport told City A.M. that the most popular destinations for its customers were major business districts in North America and Europe. It has an air-bridge with Teterboro Airport in New Jersey, essentially a travel corridor agreed by two countries that allows visitors to travel without restrictions.

Whether it’s celebrities, C-suites, heads of state or royalty, flyers fundamentally want to remain discreet, avoiding the busier major hubs like Heathrow and Gatwick. At Luton and Stansted, private jet use is slowly being squeezed out by low-cost carriers Easyjet and Wizz Air.

The desire for luxury also plays a key role in why people splash out on jets and private flights. Jayawardene though said his clients – which range from top government officials to oil and gas firms, to famous figures in entertainment – are ultimately after a level of flexibility and efficiency that can’t be offered by commercial airlines.

“For high profiles like actors, whose schedules can change due to last minute appearances, opportunities or changes in filming locations, the ability to adapt and be flexible is crucial,” he told City A.M.

Flights from London to Paris with Diamontejets will cost anywhere from £4,000 for four passengers, to upwards of £25,000, he said.

Private jet use boomed during the Covid-19 pandemic as wealthy individuals looked to avoid crowded planes and airports.

And that boom appears to be continuing – a surprise given business travel has endured a more chequered post-Covid recovery than leisure travel.

It appears that while those lower down the corporate hierarchy may be conducting more of their international meetings on zoom, face-to-face meetings for top level c-suites are still crucial.

Christoph Kohler, an analyst at the aviation consultancy WingX, said spending on private jet flights is on the up.

He explained there has been a steady rise in so-called fractional ownership, in which passengers buy a slice of a jet in exchange for future flying hours. It is useful both for wealthy travellers looking to have more flexibility than a typical charter, and for high-profile private jet owners looking to avoid the scrutiny that comes with owning an aircraft directly.

Fractional operators, which include the likes of Netjets and Flexjet, reported a 5.2 per cent increase in flights in the first nine months of 2023, according to WingX data.

Jayawardene opted for a “cautiously optimistic” demand forecast into 2024. “I see passenger numbers stabilising now… which would still be close to 20 per cent up on pre-pandemic.”

Any tail-off in the UK would come as other regions begin to muscle in on London, particularly in the Middle East.

Dr Christopher Williams-Martin, chief executive of Flyelitejets, which has offices in London and Dubai, said the Middle East had become its “bread and butter.” His clients often include smaller fast track SMEs looking to dramatically boost efficiency, alongside big corporate blue chips.

“The Middle East at the moment, Dubai particularly, is on a real growth spurt. It’s where it’s all happening,” he told City A.M.

“I would say it’s a global hub both in terms of aviation, but also key businesses… And you can get anywhere from Dubai quite easily, in India in two hours, London and Europe in less than six hours.”

Brexit and Russia war slows London jet deals

Regardless of the competition, it is clear that demand for UK private aircraft charter firms is still strong.

But from his glitzy Mayfair showroom, Steve Varsano is strikingly downbeat on London’s market for outright jet purchases.

Annual private jet deliveries globally dropped off six per cent overall in 2023, the Telegraph reported, although this was still up around 13 per cent on pre-pandemic levels.

But in the UK, Varsano said that Brexit added more red tape in the form of changes to flight permit rules and regulations, which limited the use of European registered jets operating domestic flights in the UK, and vice versa.

The Brexit vote was followed by Russia’s war in Ukraine, which Versano said has also hurt demand. “The war in Russia, you know, it’s obviously chased out a lot of the Russian population here and they were, they were spenders,” Varsano said.

Other clients have also been hit by the tightening of ‘non-dom’ tax rules, he added, which the government pledged to phase out entirely in the Spring Budget.

“Sometimes people have a home here or some kids in school, they can’t come here for more than 90 days, and so they come in for a couple of days, and they leave.”

“London is still an incredible financial hub in the world. There’s no question about it,” Varsano insisted. “It’s just the head people, the CEOs, the shareholders are not allowed to stay here for tax reasons.”

“London is still an incredible financial hub in the world, there’s no question about it… it’s just the head people, the CEOs, the shareholders are not allowed to stay here for tax reasons.”

Steve Varsano, The Jet Business

City bigwigs ignore environmental concerns

Whatever proponents say about their importance for efficiency, the industry, and business executives that use them, can’t escape the fact that flying by private aircraft is terrible for the environment.

Each jet is up to 14 times more polluting per passenger than commercial planes and 50 times more polluting than trains, according to the campaign group Transport and Environment. Moreover, around 40 per cent of private flights are empty as the jets must be flown to the correct pick-up locations.

Private jet use has become something of a PR nightmare for politicians, celebrities and corporate bigwigs in the UK, hence the desire for discretion.

Prime Minister Rishi Sunak courted controversy in April last year after it emerged the Indian entrepreneur and Conservative party donor Akhil Tripathi funded his private jet travel to various Tory events, worth £38,500.

Aston Martin’s chief executive, Amedeo Felisa, faced scrutiny earlier this month after it emerged he was handed £1.3m to commute weekly from Italy to the Midlands by private jet.

City A.M. revealed last week that two private jets owned by Asda’s billionaire Issa brothers, bought using loans from their petrol forecourt empire EG Group, had flown nearly 1,000 times over two and a half years.

Varsano admitted the “bad press… definitely gets absorbed by aircraft owners and users and, yes, it probably has some effect on sales.”

However, the statistics show, for now at least, that private jet passenger numbers are still up and politicians and the business elite have shown little sign of stopping anytime soon.

City A.M. is publishing a number of articles on private jet use in the City over the coming weeks. Read more about where Mohsin and Zuber Issa’s private jets have been flying and why a top private jet dealer thinks London’s ultra-rich have left since Brexit.

Additional reporting and data analysis from Elliot Gulliver-Needham.

Yahoo Finance

Yahoo Finance