BIM Software Global Market Report 2022: Continuously Increasing Functionality and New Features Boosting Adoption

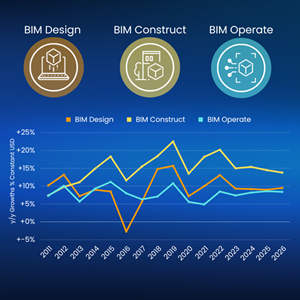

BIM Design, Construct, and Operate Markets: YoY Growth

Dublin, Nov. 14, 2022 (GLOBE NEWSWIRE) -- The "BIM Software Market Report - Market Drivers, Trends, Share, Size, Growth, Opportunity and Forecast 2022-2026" report has been added to ResearchAndMarkets.com's offering.

The latest forecast is that BIM will continue with double-digit growth of CAGR of 11.2% (2021-2026) to reach a global market size of $25.1 billion by 2026. The market is resilient against economic downturns, but this varies by product, country, and industry.

BIM software growth potential based on relevant employment trends remains positive. With a proliferation of roles employed in the construction industry, the potential opportunity for growth is clear for BIM providers to deliver engineering and project management tools that will drive productivity improvements in the sector. It should be noted that AEC Design software growth continues to outpace construction GDP growth, which shows that improved functionality and new features are leading to ever-higher software spending per user.

Significantly, all key providers have established Design offerings, but their Construct software is increasingly growing within their software mix. Autodesk is the most significant player in the BIM Design space and generates more revenue than the other top four providers combined. Bentley offers the most complete Operate package. Importantly, it is in the tail of the market where we see the largest presence here, typically made up of much smaller providers in this relatively unsaturated BIM segment.

AMER region remains the largest BIM software market, closely followed by EMEA in 2021. However, by 2026 the disparity between the two regions has widened. While AMER displays double-digit growth, EMEA must settle for high single-digit growth from 2024 onwards. APAC remains the smallest segment to 2026. However, it is catching the competition.

This focused report is intended to provide a high-level assessment of one of the most attractive, fast-developing segments of the Engineering Software market where opportunities for lucrative growth via new market development, potential acquisition, and partnering are becoming a characteristic of the segment.

Report Objectives

BIM software market overview for better plans & strategies and to align internal resources, capabilities, and product planning.

Potential software users' analysis for establishing addressable market perspective.

Understand BIM software market competitive landscape.

Capture the main trends and market drivers.

Forecast market growth by segment, region, and key players to derive targets for sales and marketing initiatives.

Create a starting point for detailed investigations of one or more market segments or country markets.

Understand the impact of currency fluctuation on the technical software markets.

Key Topics Covered:

About the analyst

Report objectives

Source

Scope

BIM Design phase

BIM Construct phase

BIM Operate phase

The analyst's provider/product software coverage

Geographic coverage

Executive summary

Global BIM software market overview

Global BIM Software market size and growth

BIM software market SWOT Analysis

BIM software market drivers

Currency effect - BIM software revenue growths by currency

Conflict in Ukraine and its impact on the BIM software market

Economic influences on the BIM software market

AEC industry spend intensity and market size

Potential software users / BIM related employment

Worldwide AEC employment breakdown

Construction industry employment

Construction industry employment in US, Germany, France, UK, China and India

Architecture & Engineering services employment

Architecture & Engineering services employment in US, Germany, France, UK, China and India

Software revenue by region EMEA, APAC, AMER

Single year vs. 5-year outlook by selected regions

AMER, EMEA, APAC regions revenue, revenue growth and CAGR

BIM software market share by top 3 countries in EMEA, APAC, AMER

Market performance by BIM Design, Construct and Operate phases

Global BIM software revenue by BIM phase in 2021

Global BIM software revenue growth by BIM phase

Design, Construct and Operate phases revenue and CAGR

Top 5 players and their revenue by BIM phase

Global BIM Design software revenue and growth by segment

Competitive landscape

Key market players and the rest of the market revenues in BIM Construct, Design and Operate

BIM software players market share in 2021

Key market players and the rest of the market revenues growths

Autodesk BIM software market size, share and growth forecast

Bentley BIM software market size, share and growth forecast

Hexagon BIM software market size, share and growth forecast

Nemetschek BIM software market size, share and growth forecast

Trimble BIM software market size, share and growth forecast

Mergers & Acquisitions (M&A) in 2021

BIM Observatory

Methodology

Policies & options

Companies Mentioned

Assetworks

Autodesk

Autodesk?

Bentley

Hexagon

MRI

Nemetschek

Newforma

Planon

Procore

SpaceIQ

thinkproject

Trimble

For more information about this report visit https://www.researchandmarkets.com/r/jpgo7r

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance