Biogen (BIIB) Initiates Late-Stage Study on Lupus Candidate

Biogen Inc. BIIB announced that it has dosed the first patient in the phase III study — TOPAZ-1 — that will evaluate its humanized IgG1 monoclonal antibody (mAb) candidate, BIIB059, in patients with active systemic lupus erythematosus (SLE). The late-stage study will be conducted across several sites globally and aims to enroll 540 active SLE patients, which will include African-American and Hispanic/Latinx communities.

Active SLE is a chronic autoimmune condition that can affect multiple organ systems and has limited treatment options. The TOPAZ-1 study will evaluate two doses of BIIB059 administered subcutaneously every four weeks and an additional dose at week 2 for reduction in disease activity. The primary endpoint of the study is proportion of patients achieving SLE Responder Index-4 response compared to placebo, following a year of treatment. Please note that the patients will continue to receive their existing lupus treatment during the study period.

The company initiated the late-stage study based on positive results from previously completed phase II LILAC study.

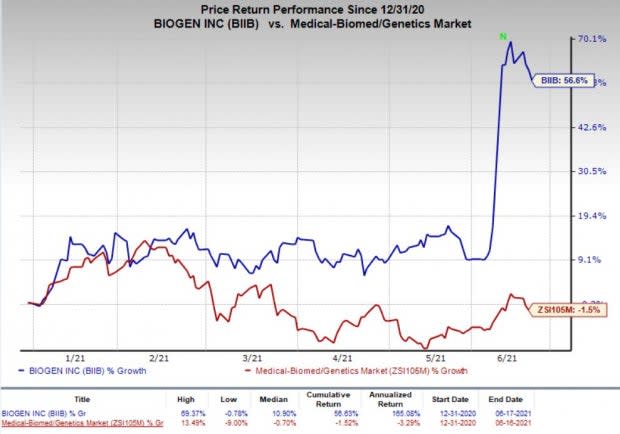

Shares of Biogen have soared 56.6% so far this year against the industry’s decrease of 1.5%.

Image Source: Zacks Investment Research

As per data from LILAC study announced in December 2019, treatment with BIIB059 demonstrated statistically significant reduction of disease activity in patients with cutaneous lupus erythematosus and SLE in the LILAC study. The reduction in disease activity in SLE patients was achieved following 24 weeks of treatment.

Apart from BIIB059, Biogen is also developing another candidate, dapirolizumab pegol, in lupus patients. A phase III study was initiated to evaluate the candidate last year.

Meanwhile, Biogen has been in the news, following the FDA approval to its controversial investigational treatment for Alzheimer’s disease, aducanumab. The drug, to be marketed by the brand name of Aduhelm, has been approved to reduce the accumulation of amyloid beta plaques, a sticky protein, in the brain, which is believed to lead to progression of Alzheimer’s disease. However, an FDA advisory committee had voted against the drug’s approval, citing that clinical data does not provide strong evidence to support the efficacy of the drug.

Biogen Inc. Price

Biogen Inc. price | Biogen Inc. Quote

Zacks Rank & Stocks to Consider

Biogen currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector include Bellerophon Therapeutics BLPH, Repligen Corporation RGEN and BioNTech SE BNTX. While BioNTech sports a Zacks Rank #1 (Strong Buy), Bellerophon and Repligen carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bellerophon’s loss per share estimates have narrowed from $2.75 to $2.69 for 2021 over the past 60 days. The company delivered an earnings surprise of 13.62%, on average, in the last four quarters.

Repligen’s earnings estimates have been revised upward from $1.91 to $2.26 for 2021 over the past 60 days. The company delivered an earnings surprise of 54.69%, on average, in the last four quarters.

BioNTech’s earnings per share estimates have increased from $17.88 to $30.85 for 2021 over the past 60 days. The company delivered an earnings surprise of 70.52%, on average, in the last four quarters.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Repligen Corporation (RGEN) : Free Stock Analysis Report

Bellerophon Therapeutics, Inc. (BLPH) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance