Biogen (BIIB) Inks Agreement to Add New Biosimilar Candidate

Biogen Inc BIIB announced that it has signed a commercialization and license agreement with Sweden-based biological drug-maker, Xbrane Biopharma AB, to gain exclusive regulatory, manufacturing, and commercial rights to Xbrane’s pre-clinical biosimilar candidate, Xcimzane.

The monoclonal antibody candidate, Xcimzane references UCB’s UCBJF rheumatoid arthritis drug, Cimzia.

Per the agreement, Biogen will pay $8 million upfront and up to $80 million in potential milestone payments to Xbrane for exclusive global regulatory, manufacturing, and commercial rights to Xcimzane. Biogen will also be the marketing authorization holder following a potential approval to the candidate. Biogen will also pay royalties on potential sales of Xcimzane going forward. While Xbrane will be responsible for the pre-clinical development of Xcimzane, Biogen will undertake remaining development activities as well as associated costs through to an approval for the candidate.

We note that the UCB’s Cimzia is a tumor necrosis factor (“TNF”) blocker approved for several inflammatory indications including Crohn’s disease and psoriatic arthritis. UCB garnered revenues of almost $1 billion in the first half of 2021 from Cimzia sales. The blockbuster inflammatory drug from UCB’s portfolio is set to lose patent protection in the United States in 2024. UCB’s drug lost patent protection in Europe last year.

The agreement with Xbrane should help Biogen boost its biosimilar portfolio going forward with the addition of Xcimzane. Currently, Biogen markets three biosimilar drugs — Flixabi (a biosimilar referencing Remicade), Benepali (a biosimilar referencing Enbrel) and Imraldi (a biosimilar referencing Humira) — primarily in Europe.

The company gained FDA approval for Byooviz, referencing Roche’s RHHBY Lucentis, last year. Biogen may start its commercialization in the second of 2022, per an agreement with Roche. Roche’s branded drug Lucentis generated more than $2 billion in sales in 2021.

Apart from these four biosimilars, Biogen has several biosimilar candidates in its pipeline including SB15, which references Regeneron’s REGN eye drug, Eylea.

Regeneron’s Eylea-referencing candidate is currently in late-stage development. We note that Regeneron generated $5.8 billion from the sale of Eylea in 2021.

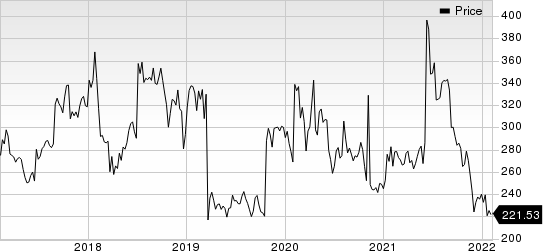

In the past year, Biogen’s shares have declined 17.7% compared with the industry’s decrease of 40.7% in the same time frame.

Image Source: Zacks Investment Research

Biogen’s biosimilar portfolio recorded sales of $831 million in 2021. None of the biosimilar drugs from the company’s portfolio are currently marketed in the United States. Please note that Biogen had a joint venture with Samsung Bioepis for the development and commercialization of its biosimilar drugs. However, Biogen announced an agreement last month to sell its 49.9% equity stake in the joint venture for up to $2.3 billion. Per the terms of the agreement, the companies will continue with their exclusive agreements for the commercialization of Flixabi, Benepali and Imraldi. Biogen will also keep commercial rights for Byooviz and SB15.

Biogen Inc. Price

Biogen Inc. price | Biogen Inc. Quote

Zacks Rank & Stock to Consider

Biogen currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the biotech sector is Vir Biotechnology (VIR), which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Vir Biotechnology’s earnings per share estimates for 2022 have increased from $4.77 to $6.53 in the past 30 days.

Earnings of Vir Biotechnology beat estimates twice in the last four quarters, delivering a surprise of 12.95%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

UCB SA (UCBJF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance