Biogen (BIIB) Lecanemab Gets FDA Priority Tag for Alzheimer's

Biogen BIIB, along with partner Eisai, announced that the FDA has accepted their biologics license application (“BLA”) seeking accelerated approval for its anti-amyloid beta protofibril antibody candidate lecanemab (BAN2401) to treat early Alzheimer’s disease (AD). With the FDA granting priority review to the BLA, a decision is expected on Jan 6, 2023.

The BLA seeks FDA approval for lecanemab to treat mild cognitive impairment due to AD and mild AD with confirmed presence of amyloid pathology in the brain.

The BLA is supported by data from a phase II study (Study 201). Data from the study showed a decline in brain amyloid-beta accumulation, following 18 months of treatment with lecanemab. The study outcomes also demonstrated that treatment with lecanemab resulted in slowing down the disease progression in early AD patients.

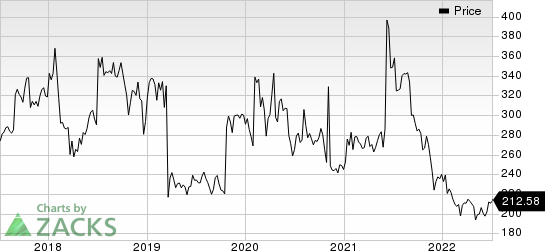

Biogen’s shares have declined 11.4% so far this year in comparison with the industry’s 21.1% decline.

Image Source: Zacks Investment Research

Biogen has developed lecanemab in collaboration with Eisai, with the latter leading the clinical development and regulatory submissions. Eisai initiated a rolling submission of the BLA last September that was completed in May 2022. If approved by the FDA, the drug will be the only anti-amyloid beta antibody that can be used to treat early AD without the need for titration.

A phase III Clarity AD study is evaluating lecanemab in early AD patients. The study has already completed enrollment and will serve as a confirmatory study for lecanemab to seek full approval from the FDA. Data from the study is expected later this year, in the fall season. Based on this data, Eisai also plans to seek marketing approval for lecanemab in Europe by next March.

Biogen is also evaluating the efficacy of treatment with lecanemab in the phase III AHEAD 3-45 study in two groups of participants, one with preclinical AD and elevated amyloid and the other with early preclinical AD and intermediate amyloid.

Some large-cap pharma giants like Roche RHHBY and Eli Lilly LLY are also developing their candidates targeting the AD indication. The Alzheimer’s candidates of these companies — anti-amyloid beta antibodies — are in late-stage development and are expected to be launched in a few months.

Eli Lilly has developed donanemab, an investigational antibody therapy, for AD. LLY's phase II study, TRAILBLAZER-ALZ, investigated the efficacy and safety of donanemab in patients with early, symptomatic AD. Eli Lilly initiated a rolling submission with the FDA last year, seeking approval for donanemab under the accelerated pathway based on data from the TRAILBLAZER-ALZ study.

Roche’s pipeline candidate for AD, gantenerumab, is an anti-amyloid beta antibody developed for subcutaneous administration. The candidate is currently being evaluated in the pivotal phase III GRADUATE 1 and 2 studies. Roche anticipates top-line data from both these studies in fourth-quarter 2022. Last October, Roche announced that the FDA granted Breakthrough Therapy Designation to gantenerumab in AD.

Biogen Inc. Price

Biogen Inc. price | Biogen Inc. Quote

Zacks Rank & Key Pick

Biogen currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Novo Nordisk NVO, which presently holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Estimates for Novo Nordisk’s 2022 bottom line have increased from $3.38 to $3.52 in the past 60 days. Estimates for 2023 have increased from $3.91 to $4.24 in the past 60 days. Share prices of Novo Nordiskhave declined 0.7% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in each of the last four quarters, the average surprise being 7.6%. In the last reported quarter, Novo Nordisk delivered an earnings surprise of 10.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Novo Nordisk AS (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance