Biotech Stock Roundup: REGN Down on Eylea Data, CINC Surges on AZN Offer & More

The biotech sector was in focus with key pipeline and regulatory updates. Among these, Regeneron (REGN) was down on disappointing updates on Eylea.

Recap of the Week’s Most Important Stories:

Regeneron Gives Eylea Update: Regeneron Pharmaceuticals, Inc. REGN announced that its lead drug Eylea sales were negatively impacted by a short-term shift to off-label use of Avastin (bevacizumab). On a preliminary basis, sales of Eylea in the fourth quarter came in at $1.5 billion, down 3% year over year. For 2022, sales on a preliminary basis were $6.26 billion, up 8% year over year.

Per Regeneron, sales in the fourth quarter were also affected by the temporary closing of a fund that provides patient co-pay assistance. Avastin is approved for the treatment of metastatic colorectal cancer (mCRC) but is used to treat age-related macular degeneration (AMD) on an off-label basis. Eylea, approved for various ophthalmology indications, has been a consistent performer, and a slowdown in sales will adversely impact the top line.

Regeneron also announced that the Dermatologic and Ophthalmic Drugs Advisory Committee (“DODAC”) of the FDA met to discuss the proposed use of Eylea injection as a treatment for preterm infants with retinopathy of prematurity (ROP). The DODAC provided advice to the FDA on appropriate communication and labeling of Eylea as a treatment for ROP in preterm infants. Regeneron is in alignment with the outcome of the discussion. The DODAC’s guidance will now be considered by the FDA in its review of the supplemental biologics license application (sBLA) for EYLEA in ROP, which was previously accepted for Priority Review and assigned a target action date of Feb 11, 2023.

Regeneron currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here

CinCor Up on AstraZeneca Deal: Shares of CinCor Pharma, Inc. CINC surged after the company entered into a definitive agreement with pharma giant AstraZeneca AZN whereby the latter will acquire the former. AstraZeneca will buy all of CinCor’s shares for a price of $26.00 per share in cash at closing plus a non-tradable contingent value right of $10.00 per share in cash payable upon a specified regulatory submission of a baxdrostat product. The upfront cash portion of the consideration represents a transaction value of approximately $1.3 billion. The offer price represents a 121% premium over CinCor’s closing market price on Jan 6, 2023. Investors were upbeat about the premium offered, and shares surged on the same. The acquisition is expected to close in the first quarter of 2023. Lead asset, baxdrostat, a highly selective, oral small molecule inhibitor of aldosterone synthase, is in clinical development for treating hypertension and primary aldosteronism.

Updates From Moderna: Moderna MRNA announced updates on its pipeline development and outlook for 2023. The company expects to record around $18.4 billion as preliminary revenues from product sales in 2022, generated entirely from its COVID-19 vaccines. The company expects to incur around $3.3 billion in R&D expenses for 2022. Management expects to close the year with cash and cash equivalents of around $18.0 billion. Moderna expects to record a minimum of around $5.0 billion from COVID-19 vaccine sales in 2023, based on confirmed advance purchase agreements and contract deferrals. Management is also focused on shifting the supply of its COVID-19 vaccines from government contracting to commercial distribution. MRNA also announced plans to increase investment in R&D expenses. It expects to spend around $4.5 billion in 2023.

With regards to mRNA-1010, management expects to report data from the immunogenicity study evaluating the influenza vaccine in adults in first-quarter 2023 while the data from the efficacy study evaluating the vaccine in older adults is expected later this year during the winter season. Moderna also announced the advancement of two new candidates to clinical-stage development. These include mRNA-0184, its heart failure treatment candidate, which is being evaluated in a phase Ib study in patients with stable heart failure. Another candidate is VX-522, an investigational mRNA-based therapy for cystic fibrosis (CF), which is being developed in collaboration with Vertex Pharmaceuticals.

Editas Down on Layoffs: Editas Medicine EDIT announced that it will reduce its headcount by approximately 20%, which is expected to extend the company’s cash runway into 2025. As part of the portfolio reprioritization, Editas will shift all its resources toward EDIT-301, the company’s lead clinical program. The candidate is being developed for the treatment of severe sickle cell disease and transfusion-dependent beta thalassemia.

EDIT has decided to discontinue all its investments in its previously lead pipeline candidate, EDIT-101, which is developed for treating Leber congenital amaurosis type 10 (LCA10), a rare genetic illness that causes blindness. The company also decided to discontinue its investments in other pipeline candidates, EDIT-103 for rhodopsin-associated autosomal dominant retinitis pigmentosa and EDIT-202 for solid tumors.

Editas Medicine will continue advancing its cellular therapy assets through partnerships, including continued development of alpha-beta T-cell medicines with Bristol-Myers Squibb and gamma-delta T-cell medicines with Immatics N.V.

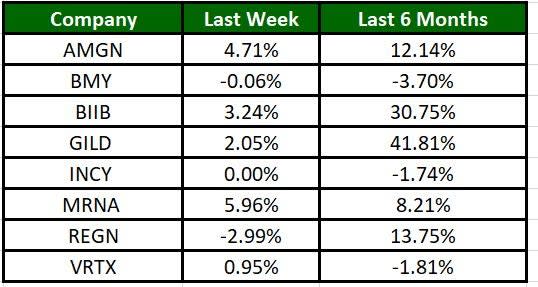

Performance

The Nasdaq Biotechnology Index has gained 2.23% in the past five trading sessions. Among the biotech giants, Moderna has jumped 5.96% during the period. Over the past six months, shares of Gilead have soared 41.81%. (See the last biotech stock roundup here: Biotech Stock Roundup: GERN Surges on Study Data, PHAT, VERA Offer Updates & More)

Image Source: Zacks Investment Research

What's Next in Biotech?

Stay tuned for other updates.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Regeneron Pharmaceuticals, Inc. (REGN) : Free Stock Analysis Report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

Editas Medicine, Inc. (EDIT) : Free Stock Analysis Report

CinCor Pharma, Inc. (CINC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance