Bitcoin Back on the Defensive as Moderna CEO Warns of Reduced Vaccine Efficacy, Exchange Inflows Eyed

The financial market sentiment flipped back to risk-off on Tuesday after drugmaker Moderna’s CEO warned of a material drop in vaccine effectiveness against the new found COVID-19 variant, Omicron.

Bitcoin slipped 2.5%, hitting lows of under $56,000, while the futures tied to the S&P 500 declined by 1.2%. The Aussie dollar-U.S. dollar (AUD/USD) exchange rate fell to a 12-month low of 0.7092, and the yield on the U.S. 10-year Treasury note penetrated Friday’s low of 1.47% as government bonds drew safe-haven demand.

Stéphane Bancel, the CEO of Moderna, told Financial Times that current vaccines will likely be much less effective against the new variant. Bancel added that pharmaceutical companies could take months to produce vaccines at scale to counter Omicron.

Bancel’s comments renewed concerns regarding the pandemic’s trajectory, torpedoing recovery in risk assets. The buoyant mood returned to crypto and equity markets on Monday after reports stated that Omicron patients in South Africa had extremely mild symptoms. Also, U.S. President Joe Biden said the new variant is a “cause for concern” and “not a cause for panic,” ruling out economically painful lockdown restrictions. Bitcoin crashed nearly 9% to $53,600 on Friday after the World Health Organization (WHO) deemed Omicorn a variant of concern.

There is consensus in the market that policymakers would provide unlimited support to asset prices if the situation worsens, leading to lockdowns. However, that would push governments and central banks in a tough spot. With inflation already running hotter than expected globally, lockdowns and more stimulus could lead to stagflation, a period characterized by low growth and elevated price pressures. While bitcoin is widely perceived as a store of value asset, it remains vulnerable to weakness in growth-sensitive assets like stocks.

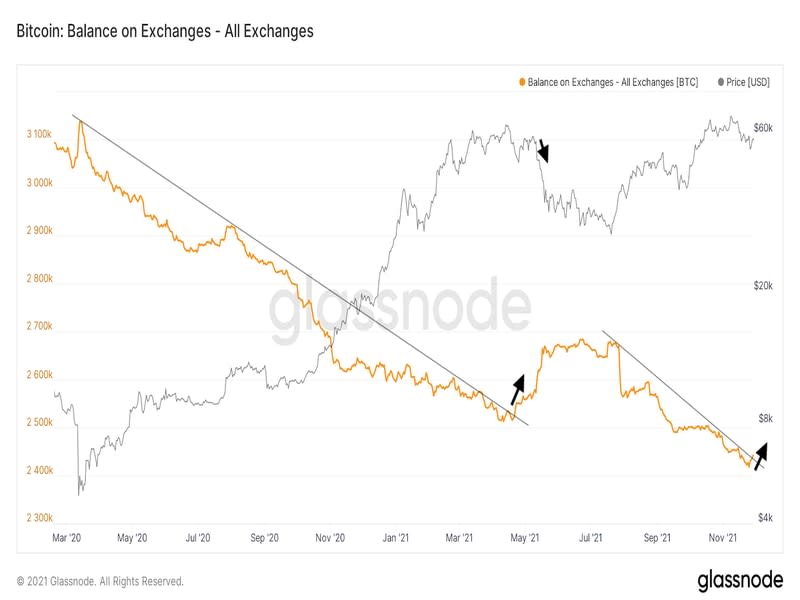

Some crypto investors seem worried about prospects of an extended price drop and appear to be transferring coins to exchanges. Data tracked by Glassnode shows centralized exchanges have received more than 24,950 BTC in the past four days, as evident from the pickup in the number of coins held in exchange addresses. Investors typically move coins to exchanges when intending to liquidate their holdings.

While the latest uptick in the exchange balances is hardly substantial, a continued rise might signal a deeper drawdown. Bitcoin fell sharply in May after the number of exchange balances violated the year-long downtrend.

Yahoo Finance

Yahoo Finance