Bitcoin (BTC) Falls Back to $30,000 as Regulators Call for Action

Key Insights:

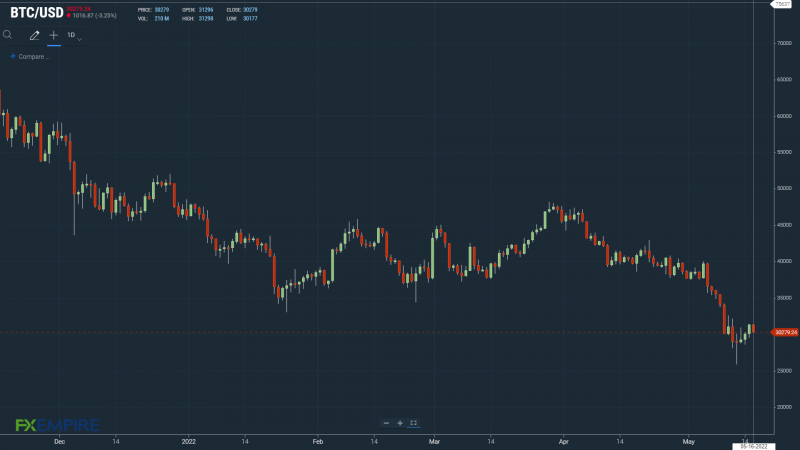

On Sunday, Bitcoin (BTC) rose for a third consecutive day to end the week down 8%. It was a seventh consecutive week in the red.

While the markets moved on from the TerraUSD and Terra LUNA collapse, there was no major breakout, with regulatory uncertainty returning to the market.

Bitcoin (BTC) technical indicators flash red, with bitcoin sitting below the 50-day EMA.

Bitcoin (BTC) rose by 4.15% on Sunday. Following a 2.75% gain on Saturday, bitcoin ended the week down 8% to $31,296.

Investor angst over the TerraUSD (UST) and Terra LUNA eased going into the weekend. Bitcoin tested resistance at the 50-day EMA before a pullback this morning.

While market angst over the Terra collapse eased, increased regulatory chatter is testing investor sentiment.

Regulators React to the UST De-pegging and LUNA Collapse

This week, lawmakers in South Korea talked of the need to expedite the enactment of crypto laws, while looking to consider how other major jurisdictions rollout virtual crypto regulations.

South Korea’s Digital Asset Basic Act is reportedly aimed at protecting investors and is due for enactment next year, with implementation in 2024.

Last week, US Treasury Secretary Janet Yellen and SEC Chair Gary Gensler were vocal on the need for crypto regulations. While Yellen called for crypto regulations, Gensler took the opportunity to, once more, lay claim on the crypto market.

With all eyes on the SEC v Ripple (XRP) case, the issue of whether or not cryptos are securities remains hotly debated.

This Wednesday, the SEC is due to reply to Ripple’s response to the SEC brief attempting to shield William Hinman documents related to a famous 2018 speech.

Hinman said that bitcoin (BTC) and ether (ETH) are not securities in a 2018 speech.

The threat of increased regulatory oversight is just another thing that crypto investors will need to consider.

Other risks include Fed monetary policy and the market fear of a recession that has led to a greater correlation between bitcoin and the NASDAQ.

Bitcoin (BTC) Price Action

At the time of writing, BTC was down 3.25% to $30,279.

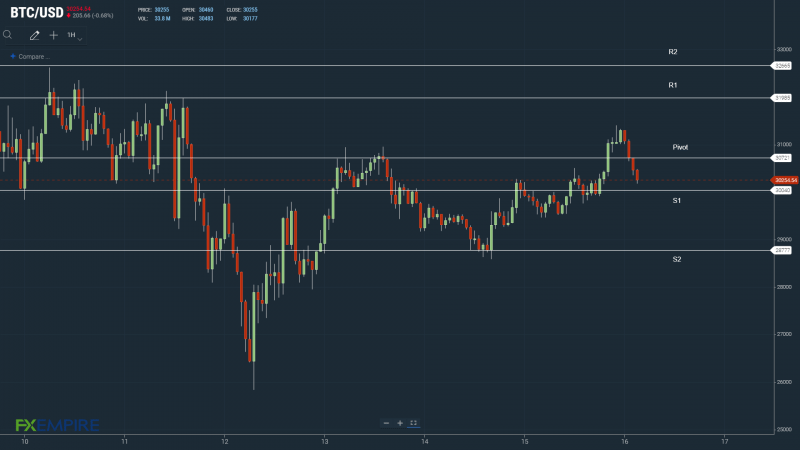

A bullish start to the day saw bitcoin rise to a morning high of $31,298 before falling to a low of $30,177. Resistance at the 50-day EMA pegged bitcoin back this morning.

Technical Indicators

BTC will need to move through the $30,721 pivot to target the First Major Resistance Level at $31,985 and resistance at $32,000.

BTC would need the broader crypto market to support a return to $31,000.

An extended rally would test the Second Major Resistance Level at $32,665 and resistance at $33,000. The Third Major Resistance Level sits at $34,608.

Failure to move through the pivot would test the First Major Support Level at $30,040 and support at $30,000. Barring another extended sell-off, BTC should steer clear of sub-$29,000 levels. The Second Major Support Level sits at $28,777.

Looking at the EMAs and the 4-hourly candlestick chart (below), it is a bearish signal. BTC sits below the 50-day EMA, currently at $31,339. This morning, the 50-day pulled back from the 100-day EMA. The 100-day EMA fell back from the 200-day EMA; BTC negative.

A move through the 50-day EMA would support a run at $35,000.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance