'Bitcoin bubble is bursting and will fall a lot further', warn economists

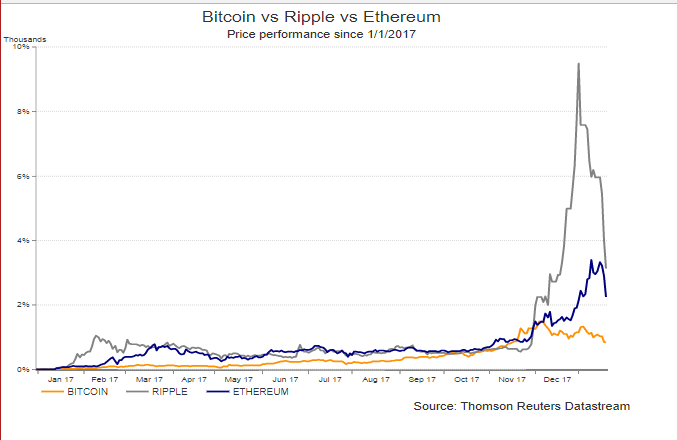

The value of bitcoin has plunged by 40% in a matter of weeks as the worldwide sell-off of cryptocurrencies shows no signs of abating.

Having soared to almost $20,000 (£14,450) in December, bitcoin stood at $11,138 on Thursday morning, after falling as low as $9,200 early in the week, according to tracker site CoinDesk.

The dramatic and volatile trading came after South Korea indicated it was planning to ban bitcoin and other virtual currencies amid fears of fraudulent trading.

MORE: Wow, much hype: dogecoin doubles in value in days to pass $2 billion

That sparked a run on the currencies that has swept the globe, with other leading coins such as ripple and ethereum also plunging in value.

Forbes contributor and market analyst Naeem Aslam said: “Bitcoin is known for its volatility: when goes up, it makes your eyes pop, and when it drops, it makes your jaws drop.”

London-based economists Vicky Redwood and Kerrie Walsh, of Capital Economics, said in a research note they believe the long-term future of bitcoin is bleak – even if the blockchain technology behind it is solid.

“Claims that cryptocurrencies will replace established fiat currencies are rubbish; our view is that bitcoin is a bubble,” they said.

“Indeed, the latest price falls suggest that the bubble is bursting – although with prices still 10 times higher than a year ago, they have a lot further to fall yet.”

MORE: The country that plans to ban bitcoin trading

Bitcoin saw an astounding rise during 2017, up more than 1700% within 12 months.

Such was its rise that some were speculating it could rival traditional currencies such as sterling, the dollar, and the euro.

Stories emerged of car sellers, for example, wanting bitcoin instead of regular, established monies for their vehicles.

With so many virtual currencies now available, JP Morgan noted the total value market is about $770bn.

“Of course, modern paper currencies don’t have any intrinsic value either. But unlike dollars, for example, bitcoin is not backed by a credible authority, such as a central bank or government,” Redwood and Walsh added.

“Most people are buying Bitcoin, not because of a belief in its future as a global currency, but because they expect it to rise in value,” they said.

“Accordingly, it has all the hallmarks of a classic speculative bubble, which we expect to burst. Triggers for the bubble to burst could be a further crackdown by regulators or a major hacking attempt.”

In South Korea, the chief financial regulator told MPs in Seoul on Thursday the government was considering shutting down all local virtual currency exchanges.

MORE: What is Bitcoin, how do you buy it – and is it a safe investment?

“The government is considering both shutting down all local virtual currency exchanges or just the ones who have been violating the law,” said Choi Jong-ku.

Separately, Bank of Korea Governor Lee Ju-yeol told a news conference that “cryptocurrency is not a legal currency and is not being used as such as of now”.

South Korea accounts for about 15% of all bitcoin trading worldwide.

Yahoo Finance

Yahoo Finance