Bitcoin Cash, Litecoin and Ripple Daily Analysis – 05/08/18

Bitcoin Cash Dives

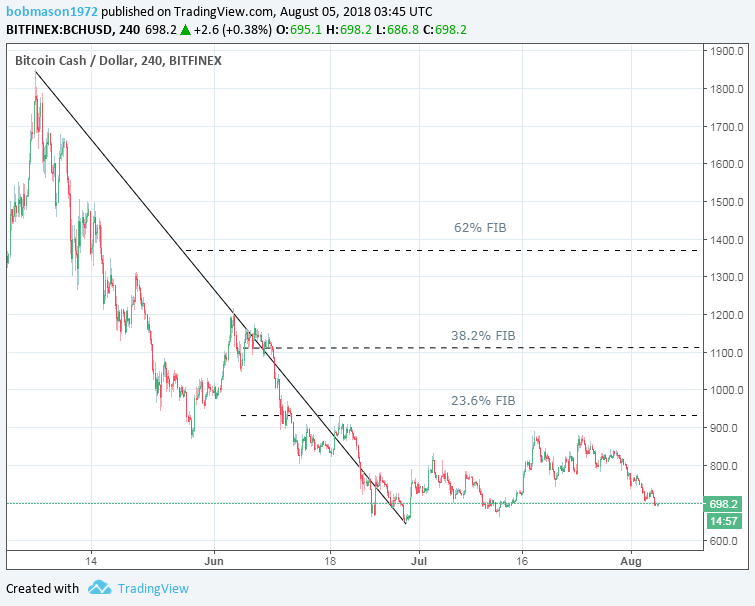

Bitcoin Cash slid by 3.86% on Saturday, following on from five previous consecutive days of losses, to end the day at $696.6.

An early move through the day’s first major resistance level at $736.9 to an intraday high $739 was the only bullish move of the day, with Bitcoin sliding through the first major support level at $706.2 to call on support at the second major support level at $687.9, the day’s sub-$700 end the first since 13th July.

At the time of writing, Bitcoin Cash was up 0.38% to $698.2, recovering from a start of a day fall to a morning low $686.8 that steered clear of the day’s first major support level at $677.4, the Saturday sell-off influencing through the early part of the day.

For the day ahead, a move back through to $700 levels would support a run at the first major resistance level at $727.4, with a move through to $708 signalling a possible late weekend rally.

Failure to break through $700 levels and a run at the first major resistance level could see Bitcoin Cash slide through the first major support level at $677.4, though we would expect Bitcoin Cash to find support at current levels to avoid another major sell-off in the day.

Get Into Bitcoin Cash Trading Today

Litecoin Tanks

Litecoin fell by 5.89% on Saturday, more than reversing Friday’s 1.73% gain, to end the day at $73.03.

Tracking the broader market, Litecoin moved through to an early intraday high $78 before falling into the hands of the bulls and sliding through the first major support level at $75.77 and second major support level at $73.98 to a late afternoon intraday low $72.32.

At the time of writing, Litecoin was up 0.55% to $73.44, with Saturday’s sell-off continuing into the early hours, Litecoin falling to an early morning low $72.41 before recovering to $73 levels, the early morning moves leaving the major support and resistance levels untested.

For the day ahead, a move through to $74.45 would support a run at the first major resistance level at $76.58, though we would expect any rebound to limit Litecoin to $75 levels on the day, sentiment towards the week ahead an influence.

Failure to move through $74.45 would likely see Litecoin reverse early gains, with a fall back through the morning low $72.41 bringing the first major support level at $70.90 into play before any recovery, sub-$70 levels on the cards should sentiment continue to deteriorate through the day.

Buy & Sell Cryptocurrency Instantly

Ripple Back in the Pack

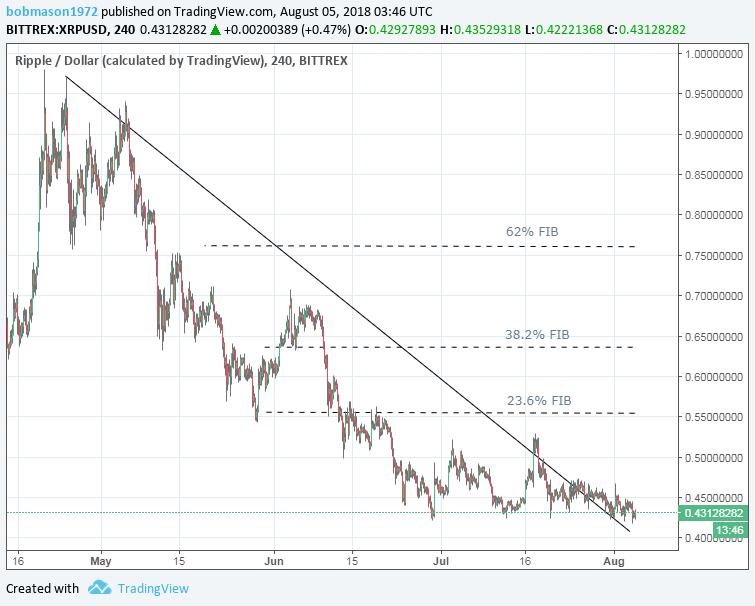

Ripple’s XRP fell by 2.8% on Saturday, reversing 2.34% gain, to end the day at $0.42928, Ripple’s XRP ending the day at sub-$0.43 levels for the first time since before the famous December rally.

A start of a day intraday high $0.44473 came up short of the first major support level at $0.4507, with the broad based market sell-off seeing Ripple’s XRP tumble to an intraday low and new swing lo $0.42202 before steadying through the afternoon.

The day’s slide reaffirmed the extended bearish trend, with Ripple’s XRP having last hit $0.50 levels back on 19th July.

At the time of writing, Ripple’s XRP was up 0.47% to $0.43128, recovering from a start of a day fall to a morning low $0.42484, Ripple’s XRP managing to hold above the first major support level at $0.4193 early on.

For the day ahead, breaking back through an early morning $0.43455 high would support a run at $0.44 levels to bring the first major resistance level at $0.442 into play, though sentiment will need to materially improve for Ripple’s XRP to break through to $0.44 levels on the day.

Failure to break back through to $0.44 levels could see Ripple’s XRP pullback through the morning low $0.42484 and lead Ripple’s XRP to sub-$0.42 levels to test the day’s first major support level at $0.4193, though we would expect Ripple’s XRP to hold on to $0.42 levels in a sell-off before any recovery.

Buy & Sell Cryptocurrency Instantly

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance