Bitcoin’s Continuing Troubles in 2022 Indicate that a Crypto Winter May be on The Way

What followed, however, was a ‘crypto winter’ punctuated by virtually flat trading until the asset’s third halving event in 2020.

Following its most recent halving, a programmed event that halves the volume of BTC awarded to miners, Bitcoin underwent a blistering rally that saw its 2017 high of $19,834.93 shattered as a value of $69,044.77 was reached in November 2021.

However, following its new all-time high, the world’s most famous cryptocurrency tumbled by ~55% in value over a matter of weeks as complications emerging from record-breaking inflation rate rises began to cause widespread investor sell-offs.

As we can see from the price history of Bitcoin, 2017’s bull run ultimately gave way to around an 18-month period of considerable stagnation before a larger rally in 2020 emerged. With Bitcoin’s next halving event set to take place in 2024, could we be set for a fresh winter period?

Bitcoin’s status as ‘digital gold’ tested

Although it’s fair to say that Bitcoin’s most recent troubles have been influenced by ongoing economic downturns surrounding high inflation rates, geopolitical tensions, and the lingering threat of more complications from the Covid-19 pandemic, the cryptocurrency has so far struggled to maintain its reputation as a decentralized store of wealth.

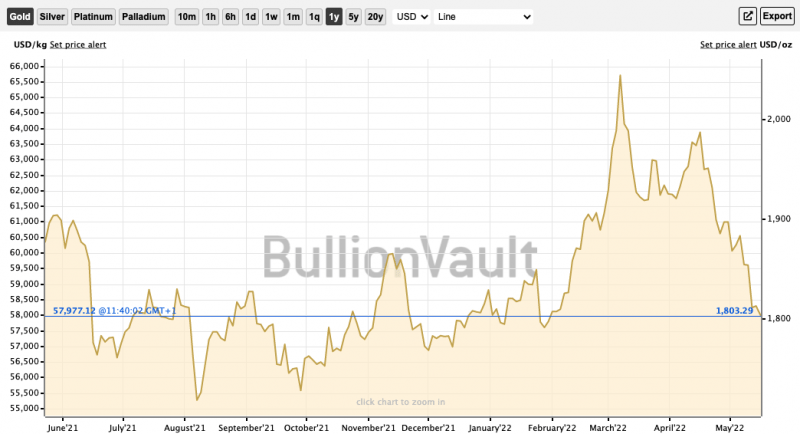

Although Bitcoin has fallen some 55% over the past six months, gold experienced a recent rally as geopolitical tensions surrounding Russia intensified. This may indicate that investors are still unwilling to acknowledge Bitcoin as a safe haven asset.

On paper, Bitcoin’s credentials make it an ideal refuge for investors to store their wealth during times of economic downturns. Because the cryptocurrency is decentralized, it has no physical location and operates externally from stock markets and domestic currencies.

However, the asset’s volatile reputation has meant that investors have been selling up their BTC positions as other markets began to struggle – leaving decentralized crypto markets adversely impacted.

“According to a new survey, in the current environment of high inflation, investors prefer equities over bitcoin,” said Maxim Manturov, head of investment advice at Freedom Finance Europe. “Based on the results of a Bloomberg Markets Live survey of 900 investors, value stocks were found to be the most inflation-proof, garnering 35% of the vote.

The data showed that bitcoin, the largest cryptocurrency by market value, scored a modest 4% of the total, with gold and inflation-linked bonds also lagging far behind the leader.”

“Choosing value stocks over bitcoin is the latest dismissive approach to the idea of cryptocurrency as “digital gold”, a term that suggests bitcoin is a safe haven – akin to the precious yellow metal – in times of high inflation, market turmoil and geopolitical crises.”

Is a crypto winter always a bad thing?

Despite the prospect of another crypto winter like that of 2018 and 2019 still being a very speculative notion, it shouldn’t negatively impact an investor’s decision to buy into cryptocurrencies.

Although its volatility may suggest otherwise, Bitcoin has historically proven itself as a long-term hold for investors who keep their exposure low and embrace the lows as well as the highs. Experts often recommend keeping crypto investments below 5% in their portfolios, and whilst a bearish trend will negatively impact the market, it can present better buying points for new investments.

Vitalik Buterin, best known as the co-founder of Ethereum, mentioned in a Bloomberg interview that crypto winter isn’t always a bad thing for the crypto ecosystem. In fact, Buterin acknowledged that the downturn could even help the cryptocurrency industry progress technological advancements at a better pace.

This counterintuitive move is down to the fact that a lower-priced cryptocurrency has the potential to maintain long-term projects whilst eliminating much of the short-termism of investors and market speculators.

Should Bitcoin’s cyclical halving events pave the way for a fresh bull run in 2024 and 2025, this may well provide enough time for the industry to vastly improve its technology before the next wave of adoption takes place.

With this in mind, the end of crypto winter could see even greater levels of price exploration for the ecosystem’s leading coins. Should the fintech landscape also grow to offer better potential for collaborative projects with crypto in the meantime, it may pave the way for a more sustained bull run in the future.

Although Bitcoin’s recent struggles may be a concern for investors, the future remains bright for the world of cryptocurrencies, and if we’re really on the verge of crypto winter, it may be looked back on as a necessity that paved the way for a stronger ecosystem surrounding digital finance.

This article was originally posted on FX Empire

More From FXEMPIRE:

Unilateral action on Northern Irish Brexit rules is wrong, Sinn Fein tells UK PM

Ukrainian court seizes assets of Russian billionaire Mikhail Fridman – prosecutor general

Russian troops pushed to within 3-4 km of Russian border near Kharkiv- U.S. official

Valneva shares slump after COVID vaccine deal with EU falls apart

Natural Gas Price Forecast – Natural Gas Markets Continue to Rally

BoE faces historic test but not to blame for inflation, Bailey says

Yahoo Finance

Yahoo Finance