Bitcoin crash shows Asia's enormous influence on cryptocurrencies

Too often over the past couple of years, whenever the price of bitcoin sank, even by 5%, mainstream media would rush to call it a “crash.” Given the volatility of bitcoin, the price would frequently regain its losses within a day or two, making the alarmist headlines look silly.

But this time, it’s a bona fide crash.

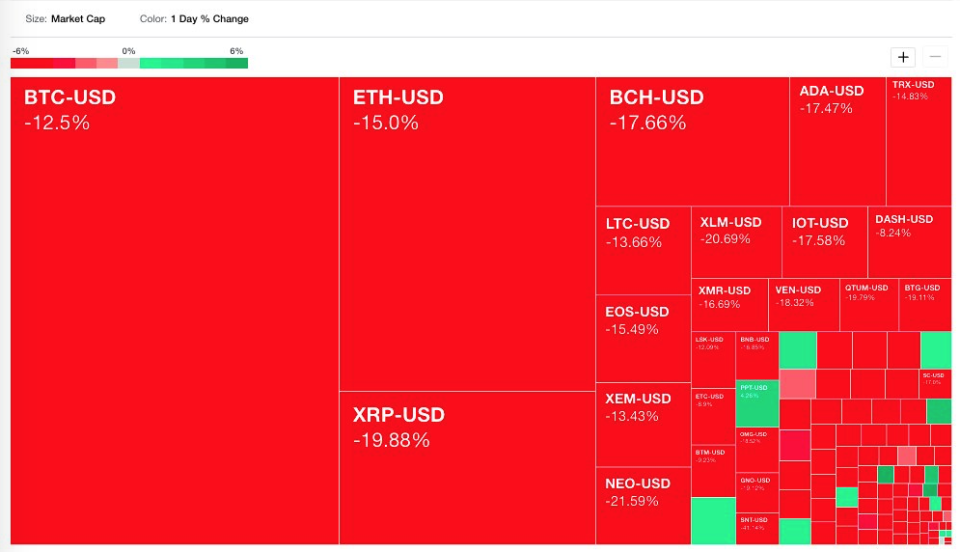

The entire cryptocurrency market was seeing deep red on Tuesday morning, with most of the top coins down by more than 15%, and they were still plunging Wednesday afternoon. Bitcoin fell below $10,000 for the first time since before Thanksgiving, and is down nearly 50% in the past month; ether, the token of the Ethereum blockchain, fell below $1,000; and XRP, the token of the Ripple payment network, erased $32 billion of its market cap in a few hours.

So, what happened? Bad news out of China and South Korea.

China: cracking down on crypto

Just a few months ago, China was the world’s largest market for bitcoin trading activity. Then came bad news, followed by more bad news.

In September, China banned initial coin offerings (ICOs), a red-hot but risky new method for cryptocurrency startups to raise money in a token sale. Two weeks later, Chinese government officials shut down local bitcoin exchanges like OKcoin and Huobi, at that time two of the largest exchanges in the world.

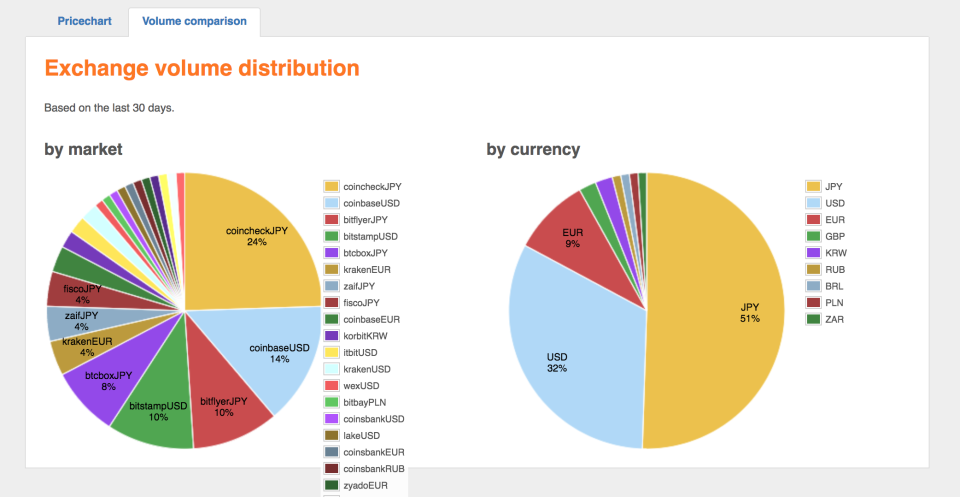

Those moves were enough to make Japan the new No. 1 bitcoin market by trading volume on exchanges (three of the top five global exchanges are in Japan), and the Japanese yen the No. 1 currency used to buy bitcoin (by a healthy margin over USD). Take a look at the below charts for a visual.

This week, the news out of China got worse. According to reports from Chinese media, officials there want to crack down on bitcoin mining (the vast majority of the world’s bitcoin mining happens in large mining pools in China) and block local internet access to international cryptocurrency exchanges.

In other words: China’s government already killed Chinese bitcoin exchanges, but now it wants to stop Chinese consumers from buying on foreign exchanges, too.

South Korea: mixed signals

Last week, a South Korean official said that the country is preparing a bill to ban bitcoin trading. The major coins plummeted.

“There are great concerns regarding virtual currencies and the justice ministry is basically preparing a bill to ban cryptocurrency trading through exchanges,” Justice Minister Park Sang-ki said at a press conference, according to Reuters.

But within a few hours, South Korean President Moon Jae-in appeared to pull back on Park Sang-ki’s claim, saying the ban is “not a finalized decision and will be finalized through discussion and a coordination process with each government ministry.” Coins rallied on the news.

But a few days later, it remains unclear what actions South Korea is going to take. And any uncertainty from South Korea, one of the three biggest global markets for bitcoin trading activity, isn’t good for investor sentiment. It didn’t help when a third South Korean official said on a radio interview this week that the bitcoin ban is still under consideration.

Add that lack of clarity to the news out of China, and you have a mountain of anxiety still driving the entire coin market down further.

Remember also that the price of bitcoin or other cryptocurrencies is all about sentiment. Bad news leads to bad headlines, which foments negative sentiment. But the true bitcoin believers are all likely holding their coins, and there’s nothing to stop sentiment from turning around in the next few days, and that would buoy prices.

So: Where’s the bottom?

—

Daniel Roberts covers bitcoin and blockchain at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

The latest cryptocurrency rout is about more than South Korea

Yahoo Finance

Yahoo Finance