Bitcoin/Dollar Hits All-time High, CNH/JPY Eyes Key Resistance

DailyFX.com -

Talking Points:

- Bitcoin against the U.S. Dollar soared to a new all-time high, driven by Japanese purchases.

- The CNH/JPY rose back to below the yearly open range low; Chinese Caixin PMI prints could add momentums.

- Read DailyFX latest trading guides for the outlook of the Japanese Yen in the second quarter.

To receive reports from this analyst,sign up for Renee Mu’ distribution list.

Bitcoin

Bitcoin against the U.S. Dollar set a new all-time high on Tuesday, touching 1481.73. This is mostly driven by the increasing demand in Japan according to bitcoinity.

After the Chinese regulator started to crack down illegal transactions through Chinese Bitcoin trading platforms, the ratio of Bitcoin trading volume in China to the world has dropped to 20% in March from more than 90% previously. Then, Japan, overtaking China, becomes the largest Bitcoin trading country by volume.

From a technical point of view, the BTC/USD is currently right below a key resistance level, the top line of a parallel. Traders will want to be aware of a likely retracement around this level.

BTC/USD 1-day

Prepared by Renee Mu.

CNH/JPY

The offshore Yuan against the Japanese Yen also approaches to a major resistance level. In the mid-March, the pair broke below the open range low of 16.31 and now is back to around this level.

CNH/JPY 1-day

Prepared by Renee Mu.

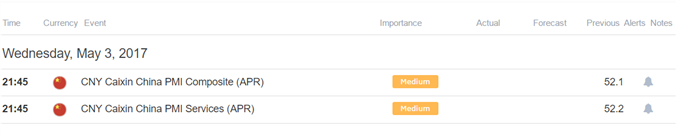

In the coming session, China will release the Caixin PMI prints for April. If those gauges come in to be better than expected, they may add momentum to the CNH/JPY and increase the odds of a breakout.

See the full DailyFX Economic Calendar

Yuan Indexes

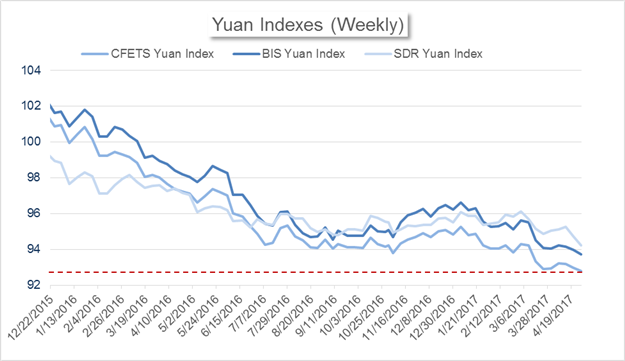

- As of last Friday, the Chinese Yuan (CNY) has been losing to a basket of currencies for the third week, measured by both the CFETS Yuan Index and the BIS Yuan Index; it has been falling for the second week, measured by the SDR Yuan Index. In specific, the primary gauge for Yuan’s value to a basket of currencies, CFETS Yuan Index, has dropped to the lowest level since it was quoted in 2015, to 92.98 last Friday.

Data downloaded from Bloomberg; chart prepared by Renee Mu.

Market News

Sina News: China’s most important online media source, similar to CNN in the US. They also own a Chinese version of Twitter, called Weibo, with around 200 million active usersmonthly.

Chinese steel producers showed improved performance in the first quarter. 33 out of 36 steel companies that have released first-quarter annual reports revealed positive earnings in the first three months. The total profits of these listing steel companies soared to more than 11.0 billion yuan compared to a loss of -4.0 billion yuan in the first quarter last year.

- China’s State-owned Assets Supervision and Administration Commission hosted a conference, requiring steel and coal firms to cut excessive production. The annual target for steel companies in 2017 is to reduce 5.95 million tons of capacity; the target for coal companies is to cut 24.93 million tons of capacity. Amid the pressure on achieving these goals, the profits of Chinese steel and coal producers could drop again.

To receive reports from this analyst,sign up for Renee Mu’ distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance