Bitcoin Hits $66K as Soft Inflation Data Sparks Crypto Rally

BTC climbed to its highest price since April 24, while Solana's SOL and NEAR led crypto gains.

Bitcoin could target the $84,000 level with altcoins performing well, Swissblock said.

Crypto markets rallied on Wednesday as softer-than-expected U.S. inflation data jolted digital assets from their stupor.

Bitcoin {{BTC}} surged past $66,000 for the first time since April 24, and was recently up more than 7% over the past 24 hours. Ether {{ETH}} changed hands near $3,000 but underperformed with a 4% advance during the same period.

Solana {{SOL}} and near {{NEAR}} led gains among crypto majors with 8% and 12% jumps, respectively, and the broader market benchmark CoinDesk 20 Index (CD20) was up 6%.

The rally occurred as April U.S. Consumer Price Index (CPI) figures edged lower from March, coupled with a slightly sluggish retail sales report. The data came as a relief for investors fearing that reaccelerating inflation and a red-hot economy might force the Federal Reserve to walk back its dovish pivot and even consider interest rate hikes.

"Investors consider this as a bullish regime shift, as it marks the first decrease in CPI inflation over the last three months," Bitfinex analysts said in a market update. This, together with the Federal Reserve previously announcing its intention to taper the central bank's balance sheet run-off, "is seen as a favorable print for risk assets," Bitfinex added.

Looking at traditional markets, U.S. equities also climbed during the day, with the S&P 500 index gaining more than 1% and hitting a fresh all-time high, underscoring the return of risk appetite.

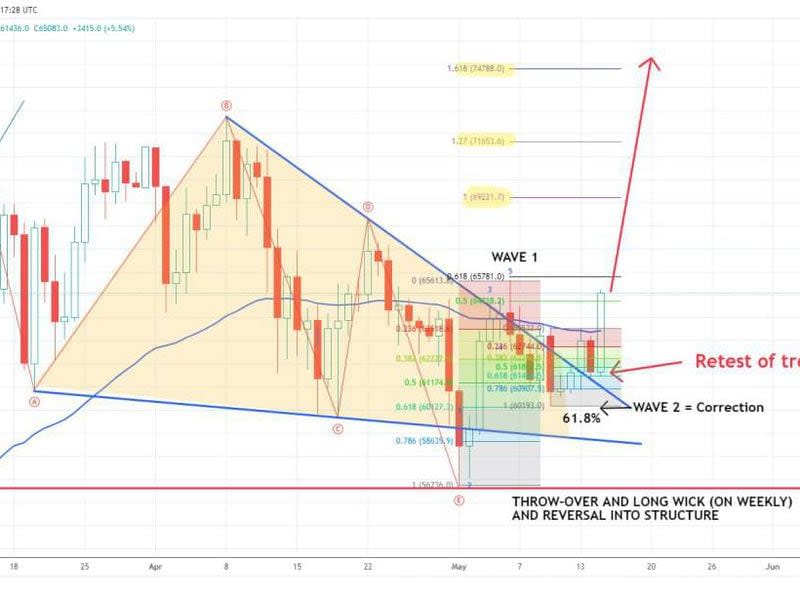

Today's bitcoin surge also marked a break-out from a downtrend that capped prices for the last few weeks, Swissblock analysts said in a Telegram update.

"BTC [is] finally making the bigger move," Swissblock said. "We have been waiting for the trigger for the release of a larger structure since March high. Today we got that," referring to the CPI and retail sales numbers.

The analytics firm said the breakout opens the way for BTC to rally $69,000 first, then later potentially towards new all-time highs targeting the $84,000 price level. During the next leg up, "altcoins will follow strongly," the report added.

Yahoo Finance

Yahoo Finance