Bitcoin news – live: Crypto prices collapse with Tether latest ‘stablecoin’ to suffer

Bitcoin is teetering on the precipice of an abyss, according to some crypto market analysts, with its price hitting its lowest level since July 2021.

The cryptocurrency has lost more than 50 per cent of its value over the last six months amid a market-wide downturn that has wiped more than $1.5 trillion from the overall crypto market.

Since first rising above this price at the start of 2021, BTC has never fallen below it for any significant amount of time, meaning it will be in unchartered territory if the sell-off continues.

There is widespread fear in the market on Thursday, after the Terra (LUNA) cryptocurrency fell by more than 99 per cent, dropping below $1 on Wednesday having peaked close to $120 last month.

The crash has pushed another stablecoin, Tether, below its dollar peg hitting as a low of 95 cents.

You can follow all the latest news, analysis and expert price predictions for bitcoin, as well as other leading cryptocurrencies like Ethereum (ETH), Solana (SOL) and Cardano (ADA), right here.

Key points

Bitcoin price crash caused by ‘wider adversity'

Bitcoin market enters ‘extreme fear'

Crypto market metrics ‘incredibly bullish’ despite price crash

Terra Luna misses out

08:02 , Andrew Griffin

The crypto market might be making an attempt to recover this morning. But that doesn’t apply to Terra Luna, the so-called stablecoin that was at the centre of the meltdown.

That’s supposed to be pegged to the dollar, so that it is always worth $1. This morning, it is worth $0.00005583.

And what’s more, it’s not really moving from that price – in part because the instability means that the technology underpinning it has been broken, and exchanges have stopped allowing it to be traded.

Stablecoins: What are Terra and Tether, and how did they help cause new crypto meltdown?

07:50 , Jon Sharman

So-called stablecoins have led the cryptocurrency market to melt down in a moment of significant instability, writes Andrew Griffin.

The cryptocurrencies are intended to be a particularly reliable way of investing in digital money, and are marketed as being a way around the significant volatility in other, better known names such as bitcoin.

For some, that volatility is a fun or valuable thing about cryptocurrencies, as people look to make money by trading them. But it is also means that they are a dangerous store of value, and are impractical to use in actual transactions.

How ‘stablecoins’ helped cause the new crypto meltdown

Bitcoin crash costs El Salvador enough for next bond payment

07:31 , Jon Sharman

ICYMI: Bloomberg reports that the cash-strapped country’s Bitcoin holdings are down around $40m, with it owing $38.25m on its foreign debt on 15 June on notes maturing in 2035.

The country became the first to make it legal tender last September and the government spent around $105m on Bitcoin, before the 40 per cent fall in its value, reports the news organisation.

Coinbase warns customers they could lose their crypto if the company goes bankrupt

06:57 , Graeme Massie

ICYMI: Coinbase has warned users that their cryptocurrency could be at risk if the exchange ever went bankrupt.

“Because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors”, the warning states.

This is a statement Coinbase needed to make because of a requirement made by the US Securities and Exchange Commission, which said these disclosures are necessary so customers are informed about their investments.

Founder and chief executive of Coinbase Brian Armstrong took to Twitter to reassure customers that the company was not at risk of bankruptcy.

“Your funds are safe at Coinbase, just as they’ve always been”, he wrote.

Experts warn about ‘crypto rug pull'

06:03 , Graeme Massie

ICYMI: Here’s a warning, from Associated Press, about the “crypto rug pull” and how it could lead to yet more pain in the cryptocurrency markets:

A new type of scam has emerged in the hype-filled world of cryptocurrency: the “rug pull.”

The scam, which gets its name from the expression “pulling the rug out,” involves a developer attracting investors to a new cryptocurrency project, then pulling out before the project is built, leaving investors with a worthless currency. It’s part of a long history of investment schemes.

“This isn’t a crypto-only phenomenon. This is a people phenomenon. Crypto is just the latest way to do it,” says Adam Blumberg, a Houston-based certified financial planner who specializes in digital assets. But cryptocurrencies have particular risks due to loose regulations for fundraising and their emphasis on decentralization.

Cryptocurrency projects often use “smart contracts,” agreements that are governed by computer software, not the legal system. This setup can be a benefit when it reduces transaction costs, but it also leaves little recourse if things don’t work out.

Rug pulls have been particularly common in decentralized finance, or DeFi, projects that aim to disrupt services such as banking and insurance. NFTs, or non-fungible tokens, that provide digital ownership of art and other content, have also been involved in rug pulls.

Investors can protect themselves by choosing established cryptocurrency projects, making sure the code of any new project has been reviewed and verifying the developers’ identities.

Rug pulls are most common with new projects that haven’t gotten the same scrutiny as more established cryptocurrencies.

Bitcoin has its risks, but countless people worldwide have used it and reviewed its inner workings, which are readily available online. Newer projects don’t have such a track record, which means there may be vulnerabilities that make it possible for their organizers to siphon value away from investors and keep it for themselves.

If you’re struggling to break through the hype, one way to find established projects is to look at centralized exchanges such as Binance, Coinbase and FTX. While the presence of a cryptocurrency on a large exchange is by no means a guarantee of its quality or investment potential, these businesses often will review assets before listing them for sale.

The trade-off of investing primarily in more established assets: While cryptocurrency, in general, has seen periods of rapid price appreciation, the highest rewards may come from new projects where the risk is also higher.

These are often listed on “decentralized exchanges,” which don’t rely on any centralized authority that would prevent unproven projects from joining.

Rex Hygate, founder of DeFiSafety, a company that reviews projects in the field, says scammers can prey on the fear of missing out that’s generated by rare but true stories of mind-blowing returns. “It is seductive. People have made a lot of money. That is a fact,” Hygate says.

“The hope is real, albeit small, (and) therefore criminal organizations in an organized and regular manner are making these rug pulls.”

The fate of any investment in cryptocurrency or blockchain projects rests on the integrity of the project’s computer code. You may not be a computer programmer, but you should at least understand how a product works before investing in it.

One way to evaluate a potential investment without going under the hood yourself is to see if it’s been audited by a professional organization that is respected in the industry. Projects that have gotten good marks from auditors will often promote the results themselves.

Some of the biggest red flags in the cryptocurrency world come down to human factors.

While it’s not unheard of for people to use pseudonyms in cryptocurrency, reputable developers often have websites and references that can establish their credentials.

But even if you do your homework, there’s no guarantee of success. For example, the founder of Rugdoc.io, a service that reviews new projects, says she wound up getting scammed herself on an NFT that was supposed to be a ticket for an event.

Diversification is as important in cryptocurrency as anywhere else in finance. Projects can fail due to technical glitches or business blunders, even without malicious intent.

“Assume whatever you’re investing in is going to have a problem,” says Leah, the Rugdoc.io founder, who asked that her full name not be used to protect her identity from scammers seeking retribution. “If you plan for failure, if it doesn’t fail you’re going to have a very good day. And if it fails, you’re probably not going to be ruined.”

Bitcoin, altcoins gain after crash

05:17 , Vishwam Sankaran

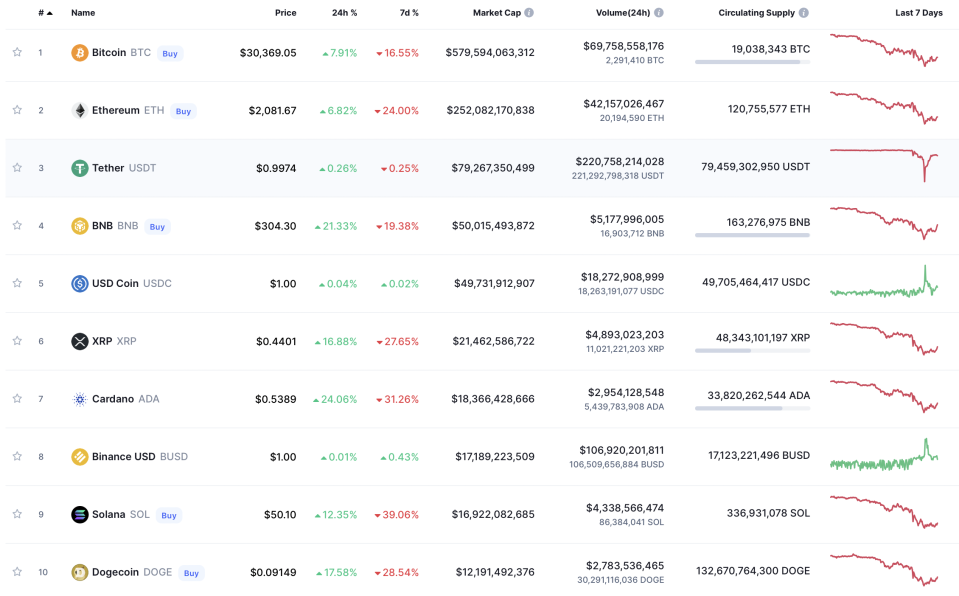

After hitting a low close to $25,000 on Thursday – Bitcoin’s lowest level since late December 2020 – the leading cryptocurrency has surged by about 8 per cent in the last 24 hours and is currently priced at over $30,000.

However, it is still down by about 17 per cent compared to its value a week earlier.

Meanwhile, ethereum has grown by over 6 per cent in the last day. But it is still down by 24 per cent compared to last week.

In the last 24 hours, cardano has surged by over 20 per cent while solana and dogecoin have grown by over 10 to 15 per cent.

The global crypto market has grown by about 6 per cent in the last 24 hours and is valued at $1.3 trillion, which is still nearly less than half of its value last November.

How bad is Bitcoin mining for the environment really?

05:07 , Graeme Massie

ICYMI: In little over a decade, Bitcoin has risen from a fringe technology popular with cryptographers, to the world's ninth most valuable asset by market cap.

The cryptocurrency's dramatic ascent has created millionaires, reimagined money and launched a multi-billion dollar industry inspired by its revolutionary decentralised technology.

But it has also brought with it some unwanted side effects, writes Anthony Cuthbertson.

How bad is Bitcoin for the environment really?

‘I lost my life savings’: Terra Luna cryptocurrency collapses 98% overnight

04:05 , Graeme Massie

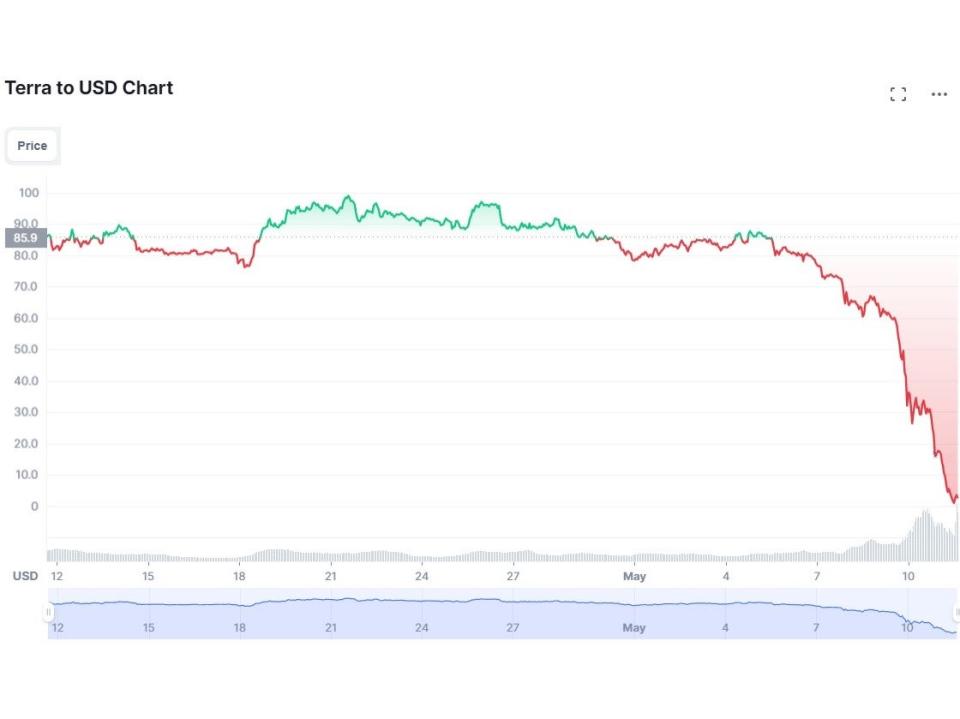

ICYMI: The price of the Terra (LUNA) cryptocurrency has fallen by more than 99 per cent, wiping out the fortunes of crypto investors, writes Anthony Cuthbertson.

Terra, which ranked among the top 10 most valuable cryptocurrencies, dropped below $1 on Wednesday, having peaked close to $120 last month.

The majority of the losses were realised overnight, with a 98 per cent price fall in the space of just 24 hours.

‘Life savings’ evaporate as major cryptocurrency collapses 98%

03:15 , Graeme Massie

ICYMI: “Cryptocurrency has always seemed to me like one of those financial manias that sometimes grip the world – like Wall Street in the 1920s, or the dot com boom that collapsed in 2000”, writes Independent columnist Sean O’Grady.

“If cryptocurrencies collapse and fail, this is because the collective of people who use them and create them have failed to find a way of making them stable and reliable, ie useful, besides being a vehicle for speculation. Then again, usefulness probably isn’t the point of cryptocurrencies. Their point is that they have no point. I hope that helps”.

Stablecoins: What are Terra and Tether, and how did they help cause new crypto meltdown?

02:10 , Graeme Massie

ICYMI: So-called stablecoins have led the cryptocurrency market to melt down in a moment of significant instability.

The cryptocurrencies are intended to be a particularly reliable way of investing in digital money, and are marketed as being a way around the significant volatility in other, better known names such as bitcoin.

Andrew Griffin has the details.

How ‘stablecoins’ helped cause the new crypto meltdown

Terraform labs halts activity on Terra blockchain

01:05 , Graeme Massie

ICYMI: Terraform Labs says it has halted activity on its Terra blockchain after its TerraUSD and Luna tokens collapsed, according to Bloomberg.

“The Terra blockchain was officially halted at a block height of 7603700,” Terraform Labs tweeted on Thursday.

“Terra validators have decided to halt the Terra chain to prevent governance attacks following severe $LUNA inflation and a significantly reduced cost of attack.”

Luna fell in value to almost zero cents, while TerraUSD, which is also known as UST, fell to around 36 cents.

The Terra blockchain was officially halted at a block height of 7603700.https://t.co/squ5MZ5VDK

Terra validators have decided to halt the Terra chain to prevent governance attacks following severe $LUNA inflation and a significantly reduced cost of attack.— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) May 12, 2022

Chelsea launch crypto partnership – as market collapses

Thursday 12 May 2022 18:01 , Graeme Massie

ICYMI: Chelsea Football Club have announced a new sponsorship agreement with the owners of digital asset platform WhaleFin. The Premier League side will display the logo of the exchange on the sleeves of both men’s and women’s shirts from next season.

Chelsea say their partnership with Amber Group will see them “collaborate on a range of partnership activities which will focus on growing the WhaleFin brand globally”, while highlighting WhaleFin as “an all-in-one platform that serves as a gateway to crypto finance”.

The Blues join a rising number of top-flight clubs in England who have branched out into the world of digital assets and cryptocurrency, after Liverpool launched a range of NFTs last month and Arsenal last year saw their fan token adverts banned for taking advantage of consumers’ inexperience in cryptoassets.

Watford carry the Dogecoin logo as their own shirt sleeve sponsor, while governing body Uefa recently launched a much-criticised partnership with fan token company Socios.com.

Thursday 12 May 2022 17:30 , Adam Smith

One user said the millions they had invested in the Luna cryptocurrency were now worthless.

“My 2.8 million dollars is literally worth $1000”, they tweeted, adding “Man bought the dip and lost:

My 2.8 million dollars is literally worth $1000

HAHAHAHAHAAHAHAHAHAHAHAHAHAHAHHAHAHAHAHAHAHAHAHA. Yeah I’m packing this in 😂😂😂😂 pic.twitter.com/qeiVN5yG2w— KSICRYPTO (@ksicrypto) May 12, 2022

Thursday 12 May 2022 17:15 , Adam Smith

“The extreme volatility that we’ve witnessed across the cryptocurrency market over the past 24 hours is demonstrable of just how nascent the technology is. The capitulation of Terra Luna and the issues that we see with Terra’s dollar-pegged algorithmic stablecoin UST are part of the growing pains of a space where innovation charts a course at a frenetic pace”, Bitfinex Market Analysts told The Independent.

The real story of the day is the relatively strong performance of the three leading cryptocurrencies, bitcoin, Ethereum and Tether tokens (USDt). The trinity stands strong, demonstrating the strength and resilience of a digital token ecosystem that will define this entire decade.”

Thursday 12 May 2022 16:48 , Adam Smith

Binance has announced warning measures against the Luna cryptocurrency.

“Due to the existing tick-size constraints of the LUNAUSDT perpetual contracts, Binance Futures will take the following precautionary measures”, the company wrote in a blog post.

“Should the price of the LUNAUSDT contracts go below 0.005 USDT, Binance shall proceed to delist the contracts. Any further information including the delisting time will be announced accordingly.”

Thursday 12 May 2022 16:15 , Adam Smith

Many people are criticising celebrities like Larry David and Matt Damon for appearing in ads promoting crypto without properly explaining the risks.

Did Matt Damon insist on getting paid for his crypto ad in rock solid crypto, or obsolete dollars?

— Hex Morgan MD (@sammideedub) May 11, 2022

“History is filled with ‘almosts,’” Mr Damon said as he breezes past a Christopher Columbus-like figure.

“With those who almost adventured, who almost achieved, but ultimately for them it proved to be too much. Then, there are others – the ones who embrace the moment and commit.”

Thursday 12 May 2022 16:00 , Adam Smith

In a Twitter Space voice chat, Paolo Ardoino, Tether’s chief technology officer reportedly said that Tether holds the majority of its reserves in United States Treasuries.

Thursday 12 May 2022 15:38 , Adam Smith

Tether, another stablecoin, dropped to a low of 95 cents by early Thursday morning.

As the largest stablecoin, it is a foundational part of the cryptocurrency ecosystem. It is the first time it has dropped below $1 in two years.

Like all stablecoins, it is supposed to maintain its price to fiat currency. One tether should always equal $1.

“The lack of transparency provided by Tether on the quality of commercial paper they hold to back the peg made it the obvious next target,” BCB Group’s Usher told Reuters

“However, Tether is a very different animal to Terra, with a more proven ecosystem and I have far more confidence that when volatility subsides it can regain its peg and stability,”

Thursday 12 May 2022 15:15 , Adam Smith

Eight days prior to the crash, Do Kwon said: “95% [of coins] are going to die, but there’s also entertainment in watching [them] die too.”

In an interview 9 days ago, $UST & $LUNA Founder Do Kwon said "95% [of coins] are going to die, but there's also entertainment in watching [them] die too."

Today, his coin is down 99%. pic.twitter.com/UXoHCr2L1G— Watcher.Guru (@WatcherGuru) May 12, 2022

Luna founder called people poor before his coin dropped 99.99 per cent

Thursday 12 May 2022 14:47 , Adam Smith

Do Kwon, the founder of the Luna cryptocurrency, has a history of mocking people for not investing in his coin.

Here’s a thread of founder of $LUNA, Do Kwon, calling people poor.

His coin is down 99.99% since last month’s high.https://t.co/0lA4JMczvQ pic.twitter.com/o6cnI1auYL— unusual_whales (@unusual_whales) May 12, 2022

Luna has recently dropped nearly the entirity of its value, dropping below $1 on Wednesday having peaked close to $120 last month

Thursday 12 May 2022 14:30 , Adam Smith

“Five years ago, people who were in crypto were crypto people,” said Mike Boroughs, a founder of the blockchain investment fund Fortis Digital. “Now you’ve got guys who are across the whole span of risk assets. So when they’re getting hit over there, it’s impacting their psychology.”

Bitcoin is just like any other tech investment

Thursday 12 May 2022 13:50 , Adam Smith

In the wake of cryptocurrencies’ falling price, traders are increasingly treating them like just another speculative tech investment, the New York Times reports.

“It delegitimizes the argument that Bitcoin is like gold,” said Vetle Lunde, an analyst for Arcane. “Evidence points in favor of Bitcoin just being a risk asset.”

Thursday 12 May 2022 13:30 , Adam Smith

Cryptocurrency exchange Binance has warned that its network is “experiencing slowness and congestion, which is intermittently causing a high volume of pending Terra network withdrawal transactions”.

It continued: “ We are continuously monitoring the network status and working to provide Binance users with the best possible experience. Please note there may be periods where $LUNA network withdrawals are temporarily suspended due to the network congestion”.

We are continuously monitoring the network status and working to provide Binance users with the best possible experience.

Please note there may be periods where $LUNA network withdrawals are temporarily suspended due to the network congestion.— Binance (@binance) May 12, 2022

Ethereum leads the collapse

Thursday 12 May 2022 13:13 , Andrew Griffin

Here’s our latest wrap on what is happening in cryptocurrencies. In short: a lot of bad.

Those same negative fortunes are being seen across tech stocks, too. As such, cryptocurrency seems to be suffering both from new poor sentiment about digital coins in general, but also a worrying economic picture.

You can read the full story here.

Thursday 12 May 2022 12:19 , Adam Smith

$1mil in $LUNA 3 days ago would be worth $1,746 right now

This is one of the craziest things I've ever witnessed...— TraderKøz (@TraderKoz) May 12, 2022

Crash continues as ethereum and others plunge

Thursday 12 May 2022 08:49 , Andrew Griffin

The crash is continuing. Ethereum is the worst hit – but far from the only digital coin to see dramatic drops this morning.

Terra LUNA price crash destroys crypto fortunes

Wednesday 11 May 2022 19:05 , Anthony Cuthbertson

Suicide hotline numbers have been pinned to the top of the popular sub-Reddit for the Terra (LUNA) cryptocurrency, after 98 per cent of its value was wiped virtually overnight.

Members of the forum are reporting losing their life savings, while some retain a sliver of hope that the project can be rescued.

“I should’ve cashed out when it was $100, then I would have been up $25,000,” wrote Reddit user No-Forever.

Another member wrote: “I lost over $450,000, I cannot pay the bank.”

Until recently LUNA was among the top 10 most valuable cryptocurrencies in the world, with advocates claiming that its potential to transform Web3 could see its value climb even higher.

You can read the full story here:

‘Life savings’ evaporate as major cryptocurrency collapses 98%

Bitcoin price briefly dips below $30,000

Wednesday 11 May 2022 14:58 , Anthony Cuthbertson

After hovering above the $30k mark for most of the past couple of days, bitcoin took another very brief dip below the price point before almost immediately returning back above.

This happened a few times last July, as bitcoin managed to resist the downward momentum and find a strong support level between $28k - $32k. It’s still very precarious for the cryptocurrency, as it continues to teeter above the unknown.

Since rising above $30,000 at the start of 2021, bitcoin has never fallen below it for any significant period of time - though it has bounced off it a few times. The coming hours and days could prove critical as to whether this trend can continue.

‘Stable’ coin UST pegged to dollar now worth $0.33

Wednesday 11 May 2022 13:57 , Anthony Cuthbertson

Terra’s UST stablecoin, which is meant to be pegged to the price of the US dollar, is now worth less than a third of that, sending shockwaves through the decentralised finance (DeFi) industry and the broader crypto space.

The Luna Foundation Guard (LFG) is now seeking to raise $1 billion in order to rescue UST and get it back on parity with the dollar.

According to Terraform Labs founder Do Kwon, LFG is “close to announcing a recovery plan for UST”, though its a complex task for a token controlled by AI algorithms.

The price of Terra (LUNA) has also collapsed, falling by more than 97 per cent over the last 24 hours, according to CoinMarketCap’s price index.

Bitcoin whales hits 18-month low

Wednesday 11 May 2022 12:43 , Anthony Cuthbertson

The number of large holders of bitcoin, known as whales, has reached its lowest level since November 2020.

The trend was spotted by crypto commentator Lark Davis, who shared a graph showing the number of bitcoin whales tracked through data from on-chain analytics firm Glassnode.

The drop in the number of whales shows how severe this latest sell-off has been, but is also a good sign that the cryptocurrency is being more evenly distributed among investors and not being hoarded by a small group.

Number of #bitcoin whales just hit an 18 month low! pic.twitter.com/8DhiyvstmC

— Lark Davis (@TheCryptoLark) May 11, 2022

Bitcoin’s price crash explained

Wednesday 11 May 2022 11:22 , Anthony Cuthbertson

What caused bitcoin’s price crash and where does it go from here? These are the questions we asked crypto market analysts and experts in order to help decipher what exactly is going on.

The downturn has coincided with a major slump for tech stocks, with some saying cryptocurrencies have become more synced up with traditional markets as they become more accessible to both retail and institutional investors. Others warn that holding the $30k level could be critical for bitcoin’s short- to medium-term prospects.

You can read the full story here:

Why did bitcoin’s price crash and where does it go from here?

Bitcoin price collapse plan for MicroStrategy

Tuesday 10 May 2022 18:39 , Anthony Cuthbertson

MicroStrategy, the world’s biggest corporate investor in bitcoin with holdings of roughly $4 billion at current rates, has so far refused to sell any of its crypto stockpile.

Some of that stash was acquired through bank loans that used the firm’s existing holdings as collatoral, which could lead to complications if the price falls considerably further.

CEO Michael Saylor has shared what the plan is if bitcoin completely implodes, claiming that even if the cryptocurrency’s price falls below $3,562 - 90 per cent down on today’s prices - the company could still survive.

MicroStrategy has a $205M term loan and needs to maintain $410M as collateral. $MSTR has 115,109 BTC that it can pledge. If the price of #BTC falls below $3,562 the company could post some other collateral. See slides 11-12 in Q1 2022 presentation. #HODLhttps://t.co/9WHsIB6Usx

— Michael Saylor⚡️ (@saylor) May 10, 2022

Bitcoin price enjoys moment of calm

Tuesday 10 May 2022 16:23 , Anthony Cuthbertson

There has already been $1.1 billion liquidations of leading cryptocurrencies over the last 24 hours, according to data from Blockworks, but the mass sell-off appears to have subsided.

Bitcoin has so far managed to hold above the $30k level, but only just. After climbing above $32,000, it has since slid back down to $31,000 in the last hour.

When compared to the volatility of recent days, today has so far been relatively calm. But is there more storm still to come?

Bitcoin price crash: ‘When in doubt, zoom out’

Tuesday 10 May 2022 13:17 , Anthony Cuthbertson

A popular adage from veteran bitcoin investors during price crashes is “when in doubt, zoom in out.”

Looking at the bigger picture shows that bitcoin is up 250 per cent from May 2020, up 35 per cent since May 2018 and up more than 6,000 per cent since May 2016.

Zooming out even further, a decade ago one bitcoin was worth just $5. That marks an astonishing 600,000 per cent price gain.

Bitcoin HODLer wakes up from an 8 year-old coma.

"Is bitcoin still in a bear market?"

"Yes sir, still dumping from its ATH."

"How bad is it, did we go below $300 per coin?"

"No sir, it's hovering above the $30.000 mark" pic.twitter.com/l6OMmUtSXY— Vlad "BTCTKVR.com" Costea ⚡️ (@TheVladCostea) May 10, 2022

Bitcoin City

Tuesday 10 May 2022 12:08 , Anthony Cuthbertson

The scale model of El Salvador’s as-yet unbuilt Bitcoin City, which was shared by President Nayib Bukele overnight, has given some insight into the mega project.

There’s a lot of trees, a lot of landmarks, and even a “beautiful lookout in the volcano”. That volcano is going to be used to not only power the city with geothermal energy, but also provide the energy to mine bitcoin.

The circular city will slope up the side of the Conchagua volcano on the Gulf of Fonseca in the south-east of the Central American country, with construction expected to begin later this year.

You can read the full story here:

Bitcoin City: El Salvador president unveils layout of ‘crypto utopia’

Bitcoin price $10k away from MicroStrategy margin call

Tuesday 10 May 2022 10:22 , Anthony Cuthbertson

MicroStrategy, the world’s biggest corporate investor in cryptocurrency, revealed earlier this month that it faces a margin call for its $205 million bitcoin-collateralised loan with Silvergate Bank if bitcoin drops to $21,000. We are now just $10,000 away from that point.

If it is hit, MicroStrategy CFO Phong Le expained during the company’s first-quarter earning calls that it would use some of its uncollatoralised BTC holdings to pay it. Either way, it would be a disaster for CEO and co-founder Michael Saylor, who has pledged his reputation on the belief that bitcoin’s price will go up in the long term.

Here’s what he said during the earnings call:

We took out the loan at a 2 per cent LTV; the margin call occurs at 50 per cent LTV. So essentially, bitcoin needs to cut in half, or around $21,000, before we’d have a margin call.

As you can see, we mentioned previously we have quite a bit of uncollateralized bitcoin. So we have more that we could contribute in the case that we have a lot of downward volatility. But again, we’re talking about $21,000 before we get to a point where there needs to be more margin or more collateral contributors. So I think we’re in a pretty comfortable place where we are right now.

Phong Le, CFO of MicroStrategy

Bitcoin price crash sees market plunge deeper into ‘extreme fear'

Tuesday 10 May 2022 09:17 , Anthony Cuthbertson

The Crypto Fear & Greed Index has fallen even further overnight, dropping from 11 to 10.

The market indicator – which analyses data from cryptocurrency exchanges, Google Trends, social media posts and price volatility – is used to measure current market sentiment. For some investors, the metric is also used as a gauge for whether to buy or sell, with ‘extreme fear’ seen as a strong buy signal and ‘extreme greed’ as a signal to sell.

The last time the index was this low was on 8 January, 202, and it has only ever fallen lower four times since it was first established in February 2018. The lowest it has ever fallen is 5, which happened in August 2019, when bitcoin was trading below $10,000.

Bitcoin Fear and Greed Index is 10. Extreme Fear

Current price: $29,913 pic.twitter.com/JZFFK2esWY— Bitcoin Fear and Greed Index (@BitcoinFear) May 10, 2022

Bitcoin price retests $30,000

Tuesday 10 May 2022 08:07 , Anthony Cuthbertson

This is the third time over the last 12 months – and the first time since last July – that the price of bitcoin has tested the $30,000 level.

Both previous times that BTC fell this low, it managed to use the price point as a platform to bounce back up. Should the downward momentum continue, however, then bitcoin will enter unchartered territory, having never fallen below $30,000 for any sustained amount of time since first rising above it.

In the time it took me to put this chart together, bitcoin already appears to be back on the ascendency, rising above $32,000. Let’s see if it can hold.

Bitcoin City in El Salvador ‘coming along beautifully'

Tuesday 10 May 2022 06:55 , Anthony Cuthbertson

The latest bitcoin price crash doesn’t seem to have deterred El Salvador’s plans to build Bitcoin City, set to be built in the shadow of a volcano in the Central American country.

El Salvador President Nayib Bukele revealed images of a model of the futuristic city, with construction expected to begin later this year.

#Bitcoin City is coming along beautifully ❤️ pic.twitter.com/A6ay8aAREW

— Nayib Bukele (@nayibbukele) May 9, 2022

Announcing the new city last year, President Bukele said residents would pay no income tax and geothermal energy from the volcano will be used to mine bitcoin.

You can read more about Bitcoin City here:

El Salvador to build crypto-fuelled ‘Bitcoin City’

Bitcoin price recovers after dip below $30,000

Tuesday 10 May 2022 06:21 , Anthony Cuthbertson

The price of bitcoin briefly fell below $30,000 overnight, reaching as low as $29,944 before immediately returning above the key resistance level.

The cryptocurrency is once again trading above $31,000, though there appears to be some resistance going in the other direction at $32,000.

The last time bitcoin tested $30,000 back in July 2021, it actually fell even lower before staging a dramatic comeback that saw it rise more than $10,000 over the course of a week.

At such a precarious level, whatever happens today could have major implications for BTC’s future trajectory.

Bitcoin price bounces back

Monday 9 May 2022 21:21 , Anthony Cuthbertson

Bitcoin just shot up by more than $1,000, marking its biggest bounce back throughout the decline of the last 24 hours.

After falling to a low of $30,516 on CoinMarketCap’s price index, BTC returned almost immediately above $31,000 before continuing its surge back above $31,000.

It is only a modest recovery considering all the losses today, but it signals that the expected resistance at the $30,000 level may well be as strong as many had hoped.

El Salvador buys the dip

Monday 9 May 2022 20:40 , Anthony Cuthbertson

El Salvador President Nayib Bukele has just tweeted that his government just “bought the dip”.

The world’s first country to adopt bitcoin as a legal form of tender bought 500 coins at an average USD price of ~$30,744 ($15,372,000), Bukele revealed, marking his country’s 10th purchase of the cryptocurrency.

It is the lowest price El Salvador has ever paid for bitcoin, as well as the most bitcoins ever bought in one go, having never purchased more than 420 at once.

El Salvador just bought the dip! 🇸🇻

500 coins at an average USD price of ~$30,744 🥳#Bitcoin— Nayib Bukele (@nayibbukele) May 9, 2022

Bitcoin price tests $31,000

Monday 9 May 2022 19:12 , Anthony Cuthbertson

Bitcoin is getting closer to its next major level of resistance, falling below $32,000 to just $31,277, according to CoinMarketCap’s price index.

Since first breaking above $30,000 at the start of last year, this level has proved a firm platform from which bitcoin has bounced back from. After a flash crash took it briefly below it in July, bitcoin went on a record-breaking price rally that took it to a new all-time high of close to $69,000 in the space of just four months.

A move of less than 5 per cent would take bitcoin back to this level, which is relatively minor by bitcoin’s notoriously volatile standards - it is down 8 per cent just today. If it fails to hold that level, bitcoin will be in unchartered territory, with no historic levels of support for quite a way down. The coming hours and days could prove crucial in determining bitcoin’s longer term trajectory.

Bitcoin ‘will crash below $10k'

Monday 9 May 2022 18:13 , Anthony Cuthbertson

Prominent bitcoin skeptic Peter Schiff believes the current price slide may be far from over.

Having dipped below $33,000, the American stock broker tweeted that the “next stop is $30k”. He added: “If that level fails look out below. Bitcoin will crash below $10k.”

It is not the first time Schiff has predicted a near-absolute capitulation for bitcoin, with his proclamations often coming near the bottom of a cycle. This has led some to use his bearish comments as a buy-signal, with one Redditor writing in response to his comments that it was the “positive signal” they had been waiting for to buy more bitcoin.

Noted bitcoin advocate and investor Anthony Pompliano mocked Schiff’s prediction with his own tweet.

“If a nuclear attack happens, we all may die,” he wrote. “If we don’t die, an asteroid may hit the Earth and kill us. If we don’t die from that, another pandemic could take us out. And if none of that gets us, we just have to wait long enough and then we’ll die for sure.”

MicroStrategy boss responds to bitcoin price crash

Monday 9 May 2022 16:21 , Anthony Cuthbertson

MicroStrategy CEO Michael Saylor, who heads the world’s largest corporate investor in bitcoin, has joked that the latest price crash has caused him to lose his job at the software firm.

The company holds more than 120,000 BTC, worth roughly $4 billion at today’s prices, bit despite the dip, Saylor is unlikely to sell any time soon.

He is a vocal advocate for holding the cryptocurrency for the long term. MicroStrategy also acquired its holdings at an average price of just over $30,000 per bitcoin, so technically the company hasn’t actually lost money on its investment.

Monday morning is time to get back to work. #Bitcoin pic.twitter.com/JlufLXRT9W

— Michael Saylor⚡️ (@saylor) May 9, 2022

Bitcoin’s yearly price lows offer perspective

Monday 9 May 2022 15:07 , Anthony Cuthbertson

There seem to be certain recurring themes of bitcoin price crashes - which come around not infrequently - as people try to calm their fellow investors.

One popular chart that is shared encourages people to not look at all-time highs, but rather yearly lows. This shows the progress bitcoin has made over the last decade, with annual price bottoms rising from $4 in 2012 to $25,000 in 2021.

Bitcoin price crash doesn’t deter long-term holders

Monday 9 May 2022 14:51 , Anthony Cuthbertson

Despite bitcoin’s recent price slide, some crypto market analysts are remaining positive about the overall outlook for the cryptocurrency.

One metric that investors can take encouragement from is that long-term holders of bitcoin do not appear to be selling their crypto stash. Marcus Sotiriou, an analyst at the UK-based digital asset broker GlobalBlock, claims that this on-chain metric means bitcoin remains “incredibly bullish”, and suggests a bounce back at the key support level of around $30,000.

Here are his full comments:

Technically, bitcoin’s structure is bearish as lower-lows and lower-highs persist, but bitcoin is now approaching the bottom of the 16-month range. The region near the low of the range, from $28-32k, could be a good region to add to long term holdings from a risk-reward perspective.

On-chain metrics remain incredibly bullish, as the percentage of bitcoin which has not moved in a year is now at an all-time high. Every time a macro bottom has formed in the market previously when this has happened, it has marked a bottom in the crypto market. This shows that the proportion of bitcoin holders who are long-term HODLers is increasing, which is positive as it shows that short-term holders are selling to those with long-term conviction.

Marcus Sotiriou, GlobalBlock

Bitcoin market enters ‘extreme fear'

Monday 9 May 2022 14:27 , Anthony Cuthbertson

The latest Crypto Fear & Greed Index shows that the bitcoin market is at just 11 - deep into the “extreme fear” territory.

The index compiles data from crypto exchanges with daily online trends to analyse general market sentiment.

It is currently at the lowest level it has been at all year, which some analysts use as a measure to suggest that bitcoin is currently oversold.

Bitcoin Fear and Greed Index is 11 — Extreme Fear

Current price: $34,041 pic.twitter.com/PQK3x6YMok— Bitcoin Fear and Greed Index (@BitcoinFear) May 9, 2022

Bitcoin price crash caused by ‘wider adversity'

Monday 9 May 2022 13:22 , Anthony Cuthbertson

Crypto market analysts have offered us their insights into what is behind the latest price crash for bitcoin.

“The market is caught in the wider adversity of investment markets that are battling to decide where confortable levels are in the wake of interest rate hikes designed to quell soaring inflation around the Western world,” says Simon Peters, from the online trading platform eToro. “The concern now for cryptoasset investors is when the slide will end.”

You can read the full story here.

Bitcoin price crashes to 2022 low amid crypto market collapse

Hello and welcome...

Monday 9 May 2022 13:00 , Anthony Cuthbertson

to The Independent’s live coverage of the crypto market.

Several days of tumbling prices has seen bitcoin fall to a 2022 low on Monday, leaving traders and investors wondering when the sell-off will come to an end.

We’ll have all the latest news, analysis and expert price predictions for bitcoin and the rest of the cryptocurrency market right here.

Yahoo Finance

Yahoo Finance