Bitcoin Price Rally Stalls as Whales Take Profits: CryptoQuant

Join the most important conversation in crypto and web3! Secure your seat today

Bitcoin (BTC) has rallied more than 17% in the past two weeks, displaying resilience amid regulatory headwinds and suggesting the asset could be in the early stages of a bull market.

The price briefly crossed $29,000 on Thursday before retracting to trade around $28,500. Major tokens such as ether (ETH) and XRP fell over 24 hours, pausing a multiday rally.

On-chain data suggests some traders and whales – a colloquial term for holders of large amounts of tokens – are taking profits after weeks of gains, which may fuel a decline in the coming days.

“On-chain data shows three conditions that are worth noting in the context of bitcoin's current rally,” analytics firm CryptoQuant said in a note shared with CoinDesk.

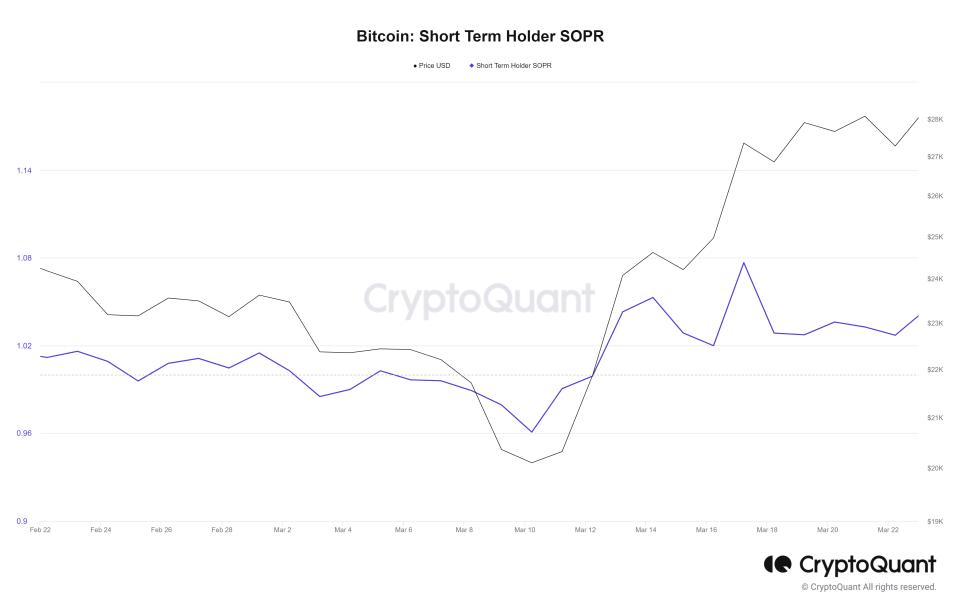

“Short-term holders are taking profits at the highest profit margin in more than a year. There’s a recent increase in spending activity in large bitcoin holders (whales) and a slight decrease in their holdings. And price valuation momentum is increasing to overvaluation territory,” the note said.

Data from CryptoQuant's Short Term Output Profit Ratio tool, which calculates the ratio of price received/price paid for assets held between one hour and 155 days, spiked above 1 in the past week, indicating investors were probably selling token holdings at a profit.

Data tracking whale wallets showed over 320,000 bitcoin were moved, or spent, by large entities in the past week.

Nevertheless, the firm said bitcoin remains “well inside a bull market,” suggesting any short-term decline is not indicative of a widespread drop.

Yahoo Finance

Yahoo Finance