Bitcoin Set to Become More Dominant Even as BTC Stares at First Monthly Loss Since August

Bitcoin is about to snap a seven-month winning streak due to several factors, including a slowdown in demand for spot ETFs.

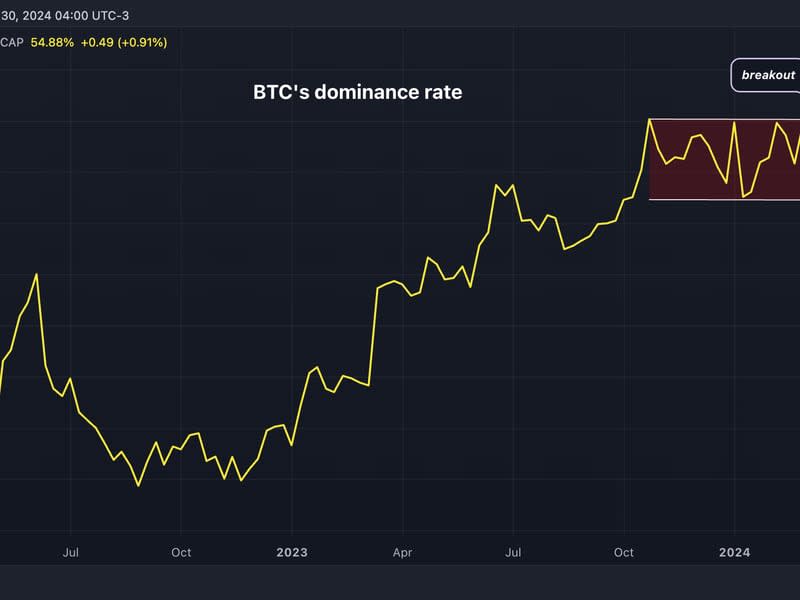

According to Fairlead Strategies, Bitcoin’s dominance rate has risen past a critical level, signaling further upside.

Bitcoin {{BTC}} appears on track to end a seven-month winning streak. Still, the largest token by market value is likely to become more dominant in the crypto market, according to one analyst.

As of the time of writing, bitcoin changed hands at $63,200, representing an 11% monthly loss, the first since August 2023, according to data source CoinDesk and TradingView. The CoinDesk 20 Index, a measure of the most liquid digital assets, traded nearly 20% lower for the month at 2,185 points.

A bevy of factors like the dwindling probability of the Fed rate cuts, reduced demand for the U.S.-based spot bitcoin exchange-traded funds (ETFs) and broad-based risk aversion in financial markets have taken the wind out of the bitcoin bull run this month. Meanwhile, a continued expansion of prominent stablecoins has been a supportive factor.

Analysts are now closely watching Wednesday’s quarterly refunding statement by the U.S. Treasury. According to Singapore-based QCP Capital, a higher issuance of short-term bills could free up liquidity, supporting risk assets.

“The upcoming Quarterly Refunding Announcement (QRA) on May 1 could also see higher issuances of short-term U.S. bills. This will drain the RRP, which currently has USD 400 billion, and also increase liquidity,” QCP said in a market note.

The U.S. Treasury said on Monday it plans to borrow more in the April to June quarter. Higher-than-expected borrowing means more bond supply, higher yields or risk-free rates and less reason to invest in risky assets.

The Treasury also said it expects to maintain a balance of $850 billion in its Treasury General Account by the end of September, slightly higher than the $750 billion expected.

That 850bln planned TGA number for end of Sept '24 has got to have the "Yellen will do whatever it takes to juice assets" crowd a little shaken right now.

— Bob Elliott (@BobEUnlimited) April 29, 2024

BTC to become more dominant

Bitcoin’s dominance rate, or the share in the crypto market, recently rose to a three-year high of 57%, breaking higher from a six-month consolidation pattern.

The breakout means bitcoin could continue to outshine alternative cryptocurrencies (altcoins) in the coming months.

“It [the dominance rate] recently had a breakout favoring bitcoin over altcoins in the intermediate-term, which is in line with the weekly RRG [relative rotation graph] where most altcoins point lower,” Fairlead Strategies said in a note to clients Monday.

“The breakout in the index marks a continuation of a long-term turnaround phase, which has reversed much of the altcoin gains made in early 2021,” Fairlead Strategies added.

Yahoo Finance

Yahoo Finance