Bitcoin Tech Analysis – Recap and Mid-Morning Review – 21/08/19

Bitcoin saw red on Tuesday, falling by 1.33%. Partially reversing Monday’s 5.9% rally, Bitcoin closed out the day at $10,792.1.

A spillover from a late Monday rally led to an early morning intraday high $10,993 before Bitcoin hit reverse.

Selling pressure at $11,000 left Bitcoin short of the first major resistance level at $11,174.67.

The reversal through the morning saw Bitcoin fall to an early afternoon intraday low $10,584.

Bitcoin managed to hold above the first major support level at $10,490.67 to bounce back to $10,800 levels late on.

Unable to move back into positive territory, Bitcoin slipped back to $10,700 levels in the final hour.

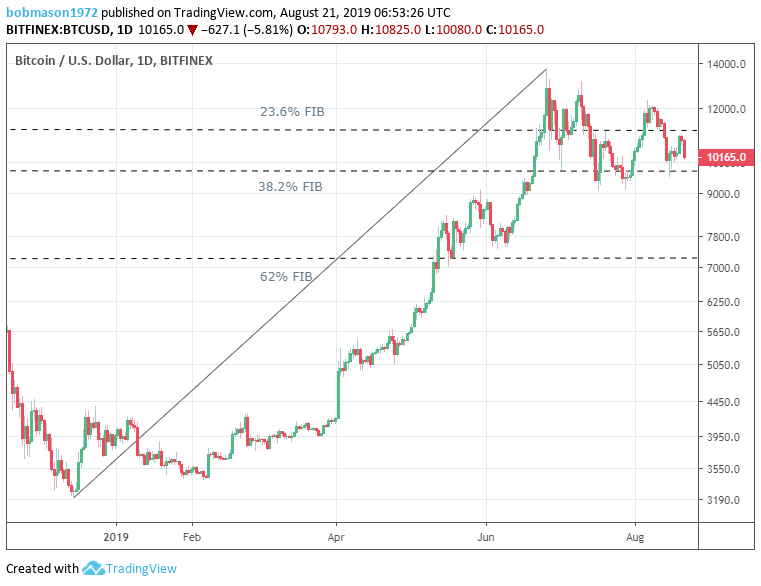

The extended bullish trend, formed at 15th December’s swing lo $3,215.2, remained firmly intact. In spite of a pullback from a June swing hi $13,764, Bitcoin continued to steer well clear of the 60.2% FIB of $7,245.

Of greater significance was a rebound through the 38.2% FIB of $9,734 to bring the 23.6% FIB of $11,275 back in to play.

This Morning

At the time of writing, Bitcoin was down by 5.81% to $10,165. A particularly bearish morning saw Bitcoin tumble from a start of a day high $10,825 to a mid-morning low $10,080.

Falling well short of the first major resistance level at $10,995.4, Bitcoin slid through the first major resistance level at $10,586.40 and second major resistance level at $10,380.7.

For the Day Ahead

A move back through the second major support level at $10,380.7 to $10,400 levels would signal a rebound.

Bitcoin would need the support of the broader market, however, to break back through to $10,300 levels.

Barring broad-based crypto rebound, Bitcoin would likely fail to move back through the first major support level at $10,586.4.

Failure to move back through the second major support level at $10,380.70 could see Bitcoin take another hit.

A fall back through the morning low $10,080 would bring the sub-$10,000 levels and the third major support level at $9,971.7 into play.

We would expect Bitcoin to steer clear of the 38.2% FIB of $9,734, however, in the event of an extended sell-off.

Looking at the Technical Indicators

Major Support Level: $10,586.4

Major Resistance Level: $10,995.4

23.6% FIB Retracement Level: $11,275

38.2% FIB Retracement Level: $9,734

62% FIB Retracement Level: $7,245

Click here to start trading

The article was written by Bharat Gohri, Chief Market Analyst at easyMarkets

This article was originally posted on FX Empire

More From FXEMPIRE:

Crude Oil Price Update – Strengthens Over $56.95, Weakens Under $55.72

U.S. Dollar Index Futures (DX) Technical Analysis – August 21, 2019 Forecast

Bitcoin Tech Analysis – Recap and Mid-Morning Review – 21/08/19

Asian Stocks Lower as Investors Keep US-China Trade Deal Optimism in Check

Oil Price Fundamental Daily Forecast – EIA Report Forecast Calls for 1.4 Million Barrel Draw

Yahoo Finance

Yahoo Finance