BitMEX CEO defends the billion-dollar crypto exchange: 'We don’t trade against customers'

The CEO of one of the world’s biggest crypto exchanges has defended his company from online criticism in an exclusive interview with Yahoo Finance UK.

Arthur Hayes, the CEO and co-founder of BitMEX, told Yahoo Finance UK that his platform doesn’t offer “special access to anyone,” doesn’t trade against its customers, and doesn’t make money when customer trades are liquidated.

Hayes was responding to charges levelled by an anonymous blogger in a widely read post on Medium last month.

BitMEX: The billion-dollar bitcoin futures exchange

BitMEX is a peer-to-peer bitcoin futures trading platform that allows retail investors to take positions against one another on the future price of bitcoin. Founded in 2014, BitMEX has grown to be one of the biggest exchanges in the crypto space with daily volumes of $8bn on its best ever day earlier this year.

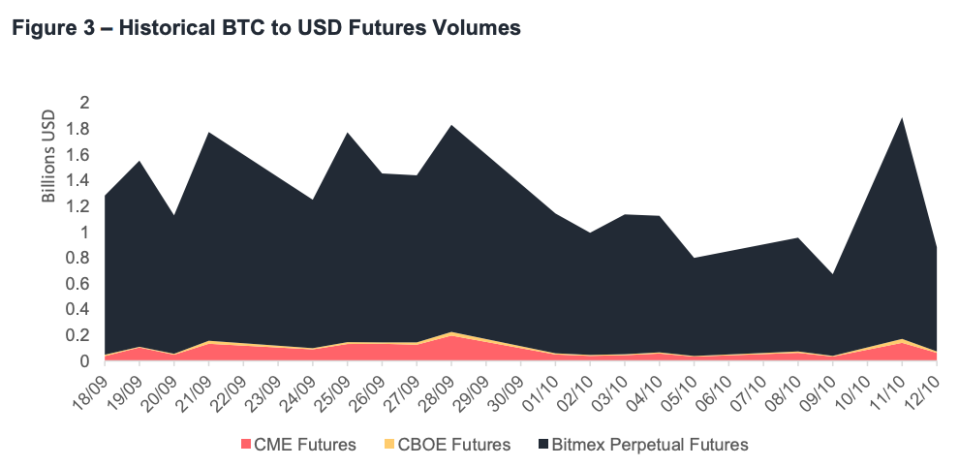

BitMEX dominates the bitcoin futures market, far outstripping volumes of products offered by mainstream exchange operators CBOE and CME. BitMEX and Japanese rival BitflyerFX account for about a quarter of all crypto exchange volume, according to a recent report from CryptoCompare.

As the exchange has grown, it has attracted greater scrutiny from members of the crypto community. This is not uncommon — the crypto sector has little to no official regulation and so investors and users publicly scrutinise everything from specific coins to exchanges and digital wallet providers.

BitMEX was the subject of a 3,000 word blog on Medium last month that attacked the company as “opaque” due to its regulatory structure. BitMEX is officially registered and regulated in the Seychelles but has offices in Hong Kong. The blog also alleged that BitMEX has “a hard time acting ethically once it gets in their way of making more money.”

The author, blogging via anonymous account ‘Hasu’ and claiming to be an independent cryptocurrency researcher, made three key allegations:

BitMEX secretly trades against its customers through a market making desk that was only recently disclosed.

The company “weaponises” frequent server issues by offering preferential access to certain traders once servers are back online.

BitMEX makes money when it liquidates client positions and puts excess margin in its insurance fund.

For each point, the blog gave little evidence but said the claims were based on suspicions of customers.

The blog received 4,500 reactions and 22 comments on Medium. It was also published on Medium’s blog channel The Startup, which has over 380,000 subscribers.

Arthur Hayes, the former Deutsche Bank and Citi trader who is the CEO and co-founder of BitMEX, spoke to Yahoo Finance UK at a recent event in London to address the allegations.

‘We don’t trade against our customers’

On the first point, Hayes said BitMEX has a market making desk but it does not trade against clients and exists only to bring liquidity to the market.

BitMEX’s market makers provide liquidity to the market by posting bid and sell orders. They get both sides of the order and make money through the spread of prices between the two.

Hayes said: “They are a customer too. It is treated like any other account.”

Hasu said the BitMEX customers they spoke to suspected the market making desk is given priority access to the exchange and also given privileged information on client orders that would allow them to take profitable positions in the market.

Hayes denied this outright. He said the market making desk is “completely secluded from the rest of the employees” and has “no special access.”

“They have the same trading rights as any other regular trader, they can’t see the liquidation prices of any of our customers. We don’t trade against our customers,” he said.

“It’s actually pretty bad business model and introduces a lot of risk into what is right now a riskless business model, BitMEX. We match trades, that’s it, we have no risk. Trading against our clients is nonsensical.”

‘We don’t offer any sort of special access to anyone’

Hayes had a similar response to the claim that BitMEX “weaponises” server issues.

The platform frequently receives more orders than its servers can handle. When this happens, BitMEX temporarily closes to new orders or position changes. Hasu said traders they spoke to are suspicious that certain customers are given priority access to the market during these server issues, effectively creating an unfair playing field.

“We don’t offer any sort of special access to anyone,” Hayes said. “Everyone has the same connection, unlike most other exchanges which will sell colocation or other perks to larger and more well-heeled traders.

“Fairness is one of our guiding principles as a company. Many clients, larger traders, ask us for a special API, or can we colocate somewhere, or can we get a special order type so we can bypass the queue and we’ll pay for it or when there’s a time of system overload can we get priority access? The answer to that is always no. It’s the same access for everyone, even if it means we give up potential revenue.”

Hayes said the “biggest priority of our company right now” was dealing with the ongoing server issues.

“This summer we did a 10x increase in the amount of orders we could process. That was basically going through the code and removing dead wood. We’ve gotten rid of the easy things. Now we’re working on actually the root cause of the problem.”

Insurance fund is ‘purely a function of the market’

The final allegation concerns liquidations. BitMEX permits leveraged trading, meaning customers can trade using more money than they deposit. Leverage is up to 100x, meaning if you deposit 1 bitcoin, you can place trades worth 100 bitcoin. Leveraged trades allow for outsized profits relative to stakes but also mean traders can lose far more than they deposit.

If the market moves against a trader’s position, BitMEX will ask them to deposit more money to support their position or it will close the order and take the margin that has been put up. The exact mechanics of how trades are liquidated are explained on its website but what’s important to know is that sometimes some of the margin from a closed order can be left over.

Any leftover margin is placed in BitMEX’s insurance fund, which currently has 14,000 bitcoin in it. This fund is meant to cover any positions that can’t be met by the market at times of exceptional volatility. For example, if bitcoin moves 20% in a few minutes, BitMEX may not have time to close out the contract in time and the winning side may find they get less bitcoin than they expected. In these cases, the insurance fund kicks in to fill the shortfall.

The bitcoin fund is worth close to £69m ($89m) by Friday’s prices and Hasu said the fund is “bigger than necessary.” The blogger claimed it appears to make BitMEX money as the company views it as an asset on its balance sheet.

Hayes insisted that BitMEX doesn’t “make money when people get liquidated.” He added that the size of the insurance fund is “purely a function of the market.”

He said the company is reluctant to reduce the size of the insurance fund because of past experience. The last time the fund was used was when the SEC denied an application for a bitcoin ETF in 2017.

“The price dropped about 30% in about five minutes and we actually emptied our entire insurance fund and we still had to close out traders who were short, had the correct position, but they didn’t get the full benefit,” Hayes said.

“A lot of people have forgotten about that but it was actually very traumatic for a lot of clients who put on a position, expected a certain amount of profit, we weren’t able to live with that. Those were the contract terms, no one was slighted in any way, but it still leaves a bad taste in the mount of clients.”

He also said the current low volatility in the cryptocurrency market could last for as long as 18 months.

Yahoo Finance

Yahoo Finance