Black Hills' (BKH) Unit Gets Rate Hike Approval in Arkansas

Black Hills Corporation BKH recently announced that its natural gas unit, Black Hills Energy, received approval from the Arkansas Public Service Commission for new rates, which will be implemented from mid-October 2022. The rate hike approval from the commission will allow the company to recover more than $220 million of investments made since 2018 in its 7,200-mile natural gas infrastructure system.

The new approval rate will generate an estimated $8.8 million of new annual revenues and a return on equity of 9.6%. The funds coming in from the rate hike will assist Black Hills in achieving its Net Zero emissions target by 2035 for its natural gas distribution system.

Rate hikes increase the monthly utility bills of customers, but we all need a reliable 24X7 energy supply, so strengthening and expansion of infrastructure is quite essential. Domestic-focused, capital-intensive and regulated utilities need rate hikes at regular intervals to continue with infrastructure upgrades and recoup investments made to provide quality services to their customers.

Utilities Invest in Infrastructure

The ongoing hike in interest rates is hurting utilities by increasing the cost of financing and planned budget for projects. Amid such a backdrop, few utilities in the same industry having well-chalked-out investment plans for strengthening their services are NextEra Energy NEE, Alliant Energy LNT and Exelon Corporation EXC.

NextEra Energy aims to invest $85-$95 billion from 2022 through 2025 to strengthen its infrastructure. Courtesy of persistent renewable asset additions to its generation portfolio and execution across all business segments, NEE expects to witness a CAGR of more than 10% for earnings per share through 2025 from the 2021 adjusted EPS of $2.55. The long-term (three to five years) earnings growth of NextEra is currently pegged at 9.66%. It currently has a Zacks Rank #2 (Buy).

Alliant Energy announced plans to invest substantially over the next four years to strengthen the electric and gas distribution networks as well as add natural gas and renewable assets to the generation portfolio. LNT has plans to strengthen electric and natural gas distribution systems and make regular investments to boost infrastructure. It plans to invest $6.1 billion between 2022 and 2025. After the planned expenditure, the company plans to follow it up with an investment of $7-$9 billion for 2026-2030. The long-term earnings growth of Alliant Energy is currently pegged at 6.16%. The company currently has a Zacks Rank #2.

Exelon plans to invest nearly $29 billion during the 2022-2025 period in regulated utility operations for grid modernization and to increase the resilience of its infrastructure to benefit customers. Such systematic investments are going to boost the long-term earnings of the company. The current dividend yield of the company is 3.6% and its long-term earnings growth is pegged at 7.11%. Exelon currently has a Zacks Rank #3 (Hold).

Price Performance and Zacks Rank

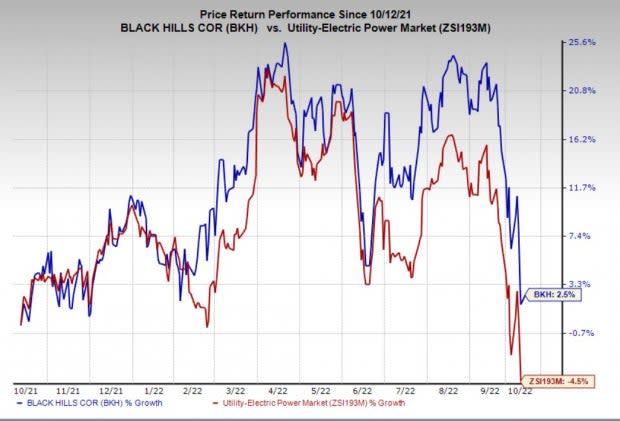

Black Hills has gained 2.5% against the Zacks Utility - Electric Power industry’s decline of 4.5% in the past 12 months.

Image Source: Zacks Investment Research

Black Hills currently has a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Black Hills Corporation (BKH) : Free Stock Analysis Report

Alliant Energy Corporation (LNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance