BlackBerry (BB) QNX Solutions Continue to Gain Traction

BlackBerry BB has announced that its QNX technology and QNX OS for Safety 2.2 will be used by Volkswagen Group's software company — CARIAD.

CARIAD is part of Volkswagen Group's NEW AUTO strategy. According to company reports, CARIAD’s objective is to create a single software platform by 2025 that comprises of VW.OS, the Volkswagen Cloud VW.AC and a scalable, unified end-to-end electronic architecture.

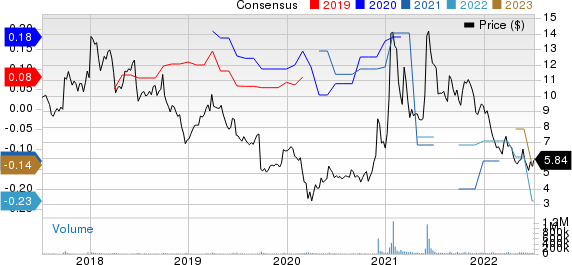

BlackBerry Limited Price and Consensus

BlackBerry Limited price-consensus-chart | BlackBerry Limited Quote

Volkswagen Group's NEW AUTO strategy was developed to tap the growing demand for electric vehicles and reduce the company’s carbon footprint per car.

Blackberry QNX and OS for Safety 2.2 will be integrated into VW.OS to serve as an efficient source for the development of advanced driver assistance systems and automated driving functions.

QNX will also provide Volkswagen with safety and professional engineering services for solution validation, system-level integration and performance optimization.

BlackBerry QNX is the market leader for safety-certified embedded software in the automotive sector. It is now installed in more than 215 million vehicles, reflecting a year-over-year surge of 20 million, per independent research firm — Strategy Analytics.

The company witnessed a rise in QNX installations for the seventh consecutive year, marking a significant improvement in its business roadmap. QNX installation increased from 16 million in 2013 to more than 215 million in 2022.

Prior to this, BlackBerry QNX was selected by BDStar Intelligent & Connected Vehicle Technology Co (“BICV”). It will power BICV’s intelligent cockpit for the new Renault Jiangling Electric Vehicle named “Yi”.

The company provides intelligent security software and services to enterprises and governments worldwide.

However, BlackBerry has to invest heavily in research and development activities to introduce new products and fend off competition, which takes a heavy toll on its profitability. The global chip shortage faced by the auto industry due to supply chain troubles is a concern for this Zacks Rank #4 (Sell) stock.

Shares of BlackBerry have lost 49.5% in the past year compared with the industry’s fall of 13.9%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are Aspen Technology AZPN, Synopsys SNPS and Broadcom AVGO, each sporting a Zacks Rank #1 (Strong Buy).You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.50 per share, increasing 1.5% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.4%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 29.8% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.47 per share, rising 7.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 10.7% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.03 per share, up 3.8% in the past 60 days. AVGO’s long-term earnings growth rate is pegged at 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have gained 2.8% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance