BlackBerry (BB) Swings to Loss in Q2, Revenues Fall Y/Y

BlackBerry Limited BB reported tepid second-quarter fiscal 2023 (ended August 31, 2022) results, with the top line contracting year over year. Nonetheless, accretive design wins and partnerships with major players bode well for the Canada-based company. The sustained demand for IoT products is a significant tailwind.

The company reported an adjusted loss per share of 5 cents compared with the prior-year quarter’s loss of 6 cents per share. The Zacks Consensus Estimate is pegged at a loss of 7 cents per share. Quarterly total revenues declined 4% year over year to $168 million.

Following the earnings announcement, shares of BlackBerry are down significantly in pre-market trading on Sep 28 as investors probably expected a healthy top-line growth.

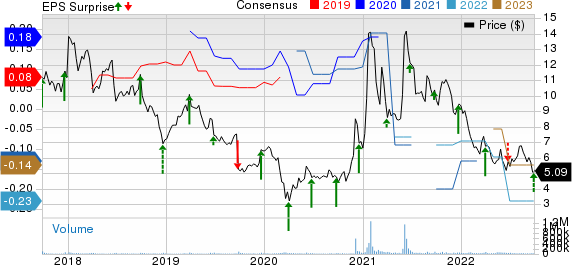

BlackBerry Limited Price, Consensus and EPS Surprise

BlackBerry Limited price-consensus-eps-surprise-chart | BlackBerry Limited Quote

Quarter in Details

Revenues from Cyber Security totaled $111 million, down 7.5% year over year. Revenues from IoT totaled $51 million, up 28% year over year. Licensing and Other contributed $6 million, down from $11 million a year ago.

Software and Services revenue rose 1.3% year over year to $162 million.

In the IoT business unit, the company’s QNX platform secured nine new design wins in Auto and 10 in the General Embedded Market.

In the second quarter, the company announced that its QNX technology and QNX OS for Safety 2.2 will be used by Volkswagen Group's software company CARIAD. Blackberry QNX and OS for Safety 2.2 will be integrated into VW.OS to serve as an efficient source for the development of advanced driver assistance systems and automated driving functions.

Within the auto sector, increasing consolidation of digital cockpits augurs well for BlackBerry. In the reported quarter, the company announced that Hozon’s new energy automobile had selected BlackBerry QNX technology to power its future sedan, the NETA S. The company will leverage BlackBerry QNX Neutrino RTOS and QNX Hypervisor for the vehicle's intelligent technology cockpit.

In the fiscal second quarter, Blackberry partnered with LeapXpert to enable the use of the BlackBerry Dynamics platform on popular messaging applications like WhatsApp, iMessage, WeChat, SMS, Telegram, Signal etc. The collaboration will provide customers with secure storage for important information and data leakage protection. It will also ensure that employee-customer interactions are end-to-end encrypted and captured.

In Cyber Security, the company witnessed solid traction within government and financial services verticals. The continued momentum in BlackBerry’s Cylance product portfolio bodes well for the segment. The segment also delivered double-digit sequential billings growth.

Other Details

Gross profit decreased 5.4% from the year-ago quarter to $106 million. The gross margin contracted 90 basis points (bps) to 63.1%. Non-GAAP gross margin contracted 100 bps to 64%.

Total non-GAAP operating expenses were $129 million. The adjusted operating loss was $22 million compared with an adjusted operating loss of 30 million a year ago. Adjusted EBITDA loss came in at $16 million compared with an adjusted EBITDA loss of $14 reported in the year-ago quarter.

Cash Flow & Liquidity

For the first six months of fiscal 2023, BlackBerry utilized $66 million of net cash in operating activities. As of Aug 31, 2022, BB had $431 million in cash and cash equivalents with $449 million of long-term debentures.

Outlook

For fiscal 2023, BlackBerry expects IoT revenues in the range of $200-$210 million, indicating 12-18% growth year over year. Cyber business billings growth is expected within 8-12% due to increased uptake of security products. For the IoT business, BlackBerry expects strong growth despite the auto industry headwinds.

Zacks Rank & Stocks to Consider

BlackBerry currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Synopsys SNPS, Pure Storage PSTG and Arista Networks ANET. Arista Networks and Pure Storage currently sport a Zacks Rank #1 (Strong Buy), whereas Synopsys presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.84 per share, up 4.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.2%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 3%. Shares of SNPS have increased 1.4% in the past year.

The Zacks Consensus Estimate for PSTG 2022 earnings is pegged at $1.18 per share, rising 24.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 35.5%.

Pure Storage’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 171.8%. Shares of PSTG have increased 2.8% in the past year.

The Zacks Consensus Estimate for Arista Network’s 2022 earnings is pegged at $4.04 per share, increasing 10.1% in the past 60 days. The long-term earnings growth rate is anticipated to be 18.6%.

Arista Network’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.1%. Shares of ANET have increased 28% in the past year

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance