Blistering report from MPs slams Big Four over 'rotten culture' at Carillion

The Competition and Markets Authority must consider breaking up the so-called Big Four accountancy firms over their involvement in the “rotten corporate culture” at Carillion, MPs have said in a blistering report about the company's collapse.

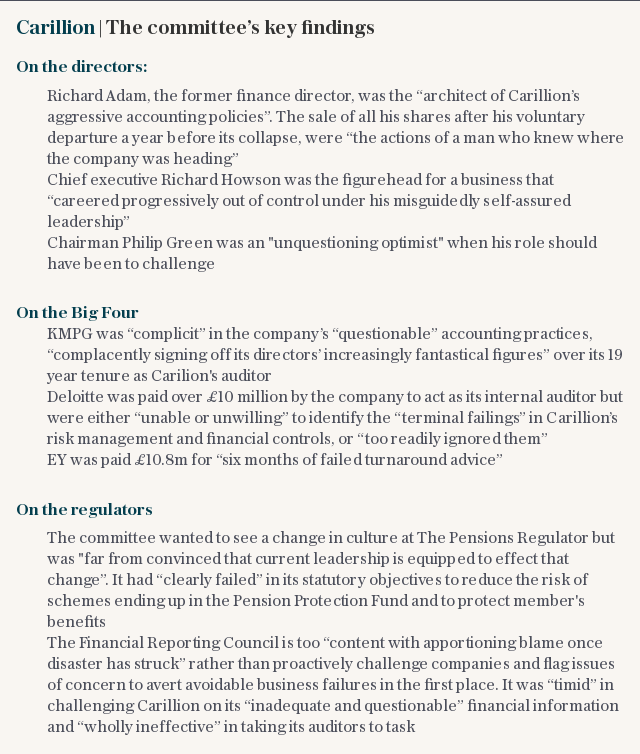

The final report from the select committee investigating Carillion’s failure earlier this year paints a damning picture of “recklessness, hubris and greed” among the company’s senior directors, as they treated smaller companies with contempt and used aggressive accounting techniques to cover the full scale of the business’s problems.

Its collapse exposed the UK audit market as a “cosy club incapable of providing the degree of independent challenge needed,” the report said, adding that Carillion’s auditor KPMG had been complicit in the company’s accounting practices.

KPMG's “long and complacent” tenure of “cursory” audits at Carillion was not an isolated failure, but “symptomatic of a market which works for the members of the oligopoly but fails the wider economy”, the report said.

As a result, the Government should refer the audit market to the CMA with a view to breaking up the four largest firms – Deloitte, KPMG, PwC and EY – or splitting their audit functions from non-audit services.

Carillion’s senior team, who had come under fire from MPs during committee hearings, could now face disqualification if the Insolvency Service finds they breached their duties as directors, the report suggested.

The Institute of Directors suggested that Carillion’s directors could have flouted company law by failing to consider the company’s long term interests.

“The report suggests that Carillion’s directors seemed unfamiliar with their statutory duties and this underlines the need for the professional development of directors in large companies,” Roger Barker, head of corporate governance at the IoD said on Wednesday.

But Richard Adam, one of the company’s former finance directors, hit out at some of the committee’s findings about his particular role in the company.

In a letter to the committee, he said that his evidence had been “mischaracterised” by Robin Ellison, the chairman of the company's pension trustees, who suggested in February that Mr Adam had thought funding the pension scheme was a “waste of money”.

Mr Adam, who is also a non-executive director of Countryside Properties, denied that he had ever held or expressed those views.

MP Frank Field, chair of the committee, said the board of directors were “too busy stuffing their mouths with gold to show any concern for the welfare of their workforce or their pensioners. They rightly face investigation of their fitness to run a company again.”

The committee’s report also took aim at the Government, suggesting that ministers had nurtured a business environment which made a collapse like Carillion’s “almost inevitable”. Both the Financial Reporting Council and The Pensions Regulator were also accused of being too passive and reactive to make effective use of their powers.

Lesley Titcomb, chief executive of The Pensions Regulator, acknowledged that the balance between members of pension schemes and their employers “was not always right”.

But she said the organisation had changed. “We are clearer about what we expect, quicker to intervene and tougher on those who do not act in the interest of members,” she said, adding that TPR was in the process of implementing new regulations.

Philip Green, who was Carillion’s chairman from 2014 until its collapse, said the board had “always sought to make decisions on the best available information and with the best professional advice”, adding that they had “always strived to act in the interests of the company and all its stakeholders”.

Yahoo Finance

Yahoo Finance