Is Blue Prism Group's (LON:PRSM) Share Price Gain Of 132% Well Earned?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Blue Prism Group plc (LON:PRSM) share price has flown 132% in the last three years. How nice for those who held the stock! It's also up 12% in about a month.

Check out our latest analysis for Blue Prism Group

Blue Prism Group isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Blue Prism Group's revenue trended up 72% each year over three years. That's well above most pre-profit companies. Along the way, the share price gained 32% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. That's not to say we think the share price is too high. In fact, it might be worth keeping an eye on this one.

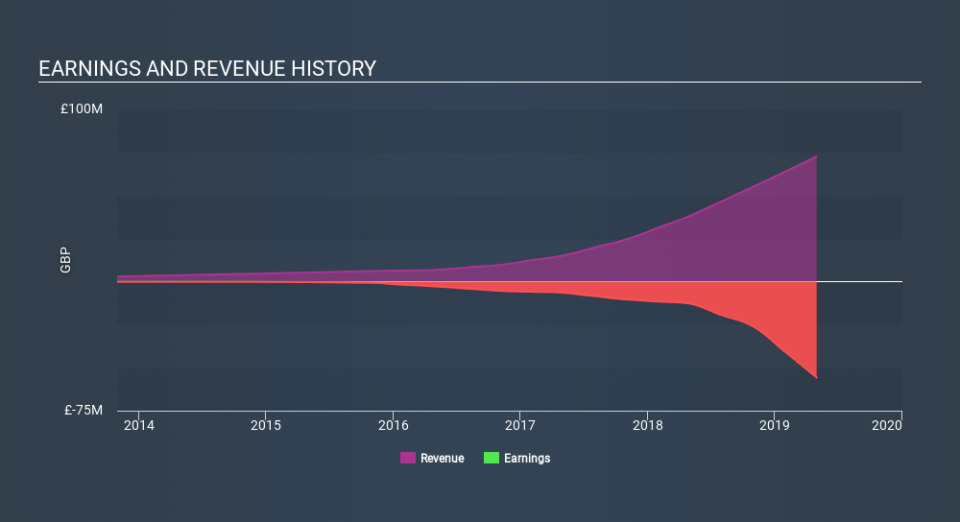

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Blue Prism Group

A Different Perspective

Over the last year, Blue Prism Group shareholders took a loss of 15%. In contrast the market gained about 16%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 32% per year over three years. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. If you would like to research Blue Prism Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance